Pi Network Rises 3% Today – Will the Rally Last or Fade?

Jakarta, Pintu News – Pi Network’s PI token has seen a 15% surge in the past week, driven by growing optimism in the overall crypto market.

However, this upward trend is now entering a crucial phase. The PI token is facing strong selling pressure around the $0.40 price, a level that previously served as support but has now turned into resistance.

If it is unable to break this level, a potential correction could occur in the near future.

Pi Network Price Rises 3.5% in 24 Hours

On August 14, 2025, the price of Pi Network was recorded at $0.4057, having risen 3.5% in the last 24 hours. If converted to the current rupiah ($1 = IDR 16,120), then 1 Pi Network is IDR 6,539.

Read also: Can Pi Network Bounce Back from Its Decline?

In the last 24-hour period, the lowest price was recorded at $0.3887, while the highest price touched $0.4057, showing a fairly stable positive trend.

In terms of market capitalization, PI is now worth $3,177,019,225, with a fully diluted valuation of $4,887,648,467. Trading volume in the last 24 hours also showed high activity with a value of $81,126,444.

PI Price Stuck Below $0.40, Bearish Pressure Still Dominant

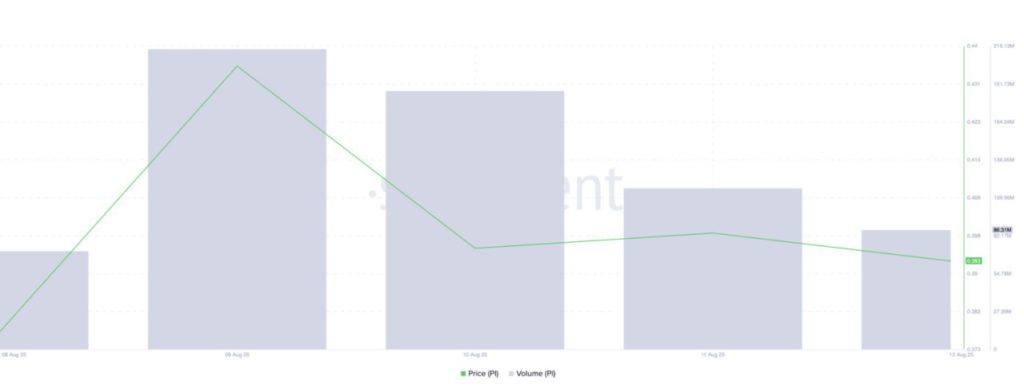

Based on the PI/USD daily chart (Aug 13), it can be seen that in the past week, PI has twice failed to break the resistance limit at $0.40.

On each attempt, PI prices briefly surpassed this threshold, but strong selling pressure soon pushed prices back down below $0.40 before the daily close. This pattern reflects the still solid strength of the resistance, as well as the tight grip of the sellers in that price area.

Although PI prices recorded a 2% increase on August 13, in line with the general strengthening of the crypto market, the 26% drop in trading volume raises a cautionary signal.

This drop in volume created a negative divergence to PI’s price movement, which could be an indication of a potential correction in the near term.

In technical analysis, a condition where prices are rising but volumes are falling is often interpreted as weakening buying interest. This divergence suggests that PI’s price rally may not be supported by strong market forces, and could reverse course when daily demand begins to weaken.

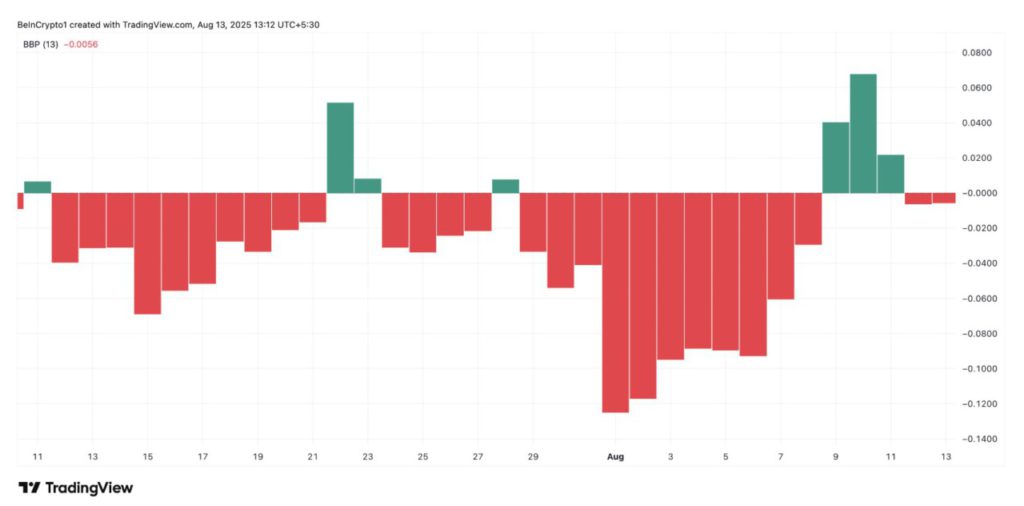

Furthermore, the Elder-Ray Index indicator on the daily chart is also showing the same signal – bearish sentiment. In the last two trading sessions, this indicator has registered negative values, and is currently at -0.0056, indicating that selling pressure is still ruling the spot PI market.

For the record, the Elder-Ray Index is a technical analysis tool that measures the balance between buying and selling pressure by comparing price movements against a short-term moving average.

Read also: Dogecoin Surges 6% Today (Aug 14): Is $1 Within Reach for DOGE?

Negative values indicate that selling forces dominate, confirming market control by the bearish side.

PI Price Direction: Falling to $0.32 or Climbing to $0.46?

If PI again fails to close the daily price convincingly above the $0.40 level, there is a high probability that the token will repeat the decline until it hits its low again at $0.32.

On the contrary, if it is able to break and hold above the resistance, PI has the opportunity to pave the way for a stronger price recovery, with a potential increase towards the $0.46 level in the upcoming trading sessions.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. PI Price Hits Brick Wall at $0.40 as Bears Gain Ground – What’s Next? Accessed on August 14, 2025