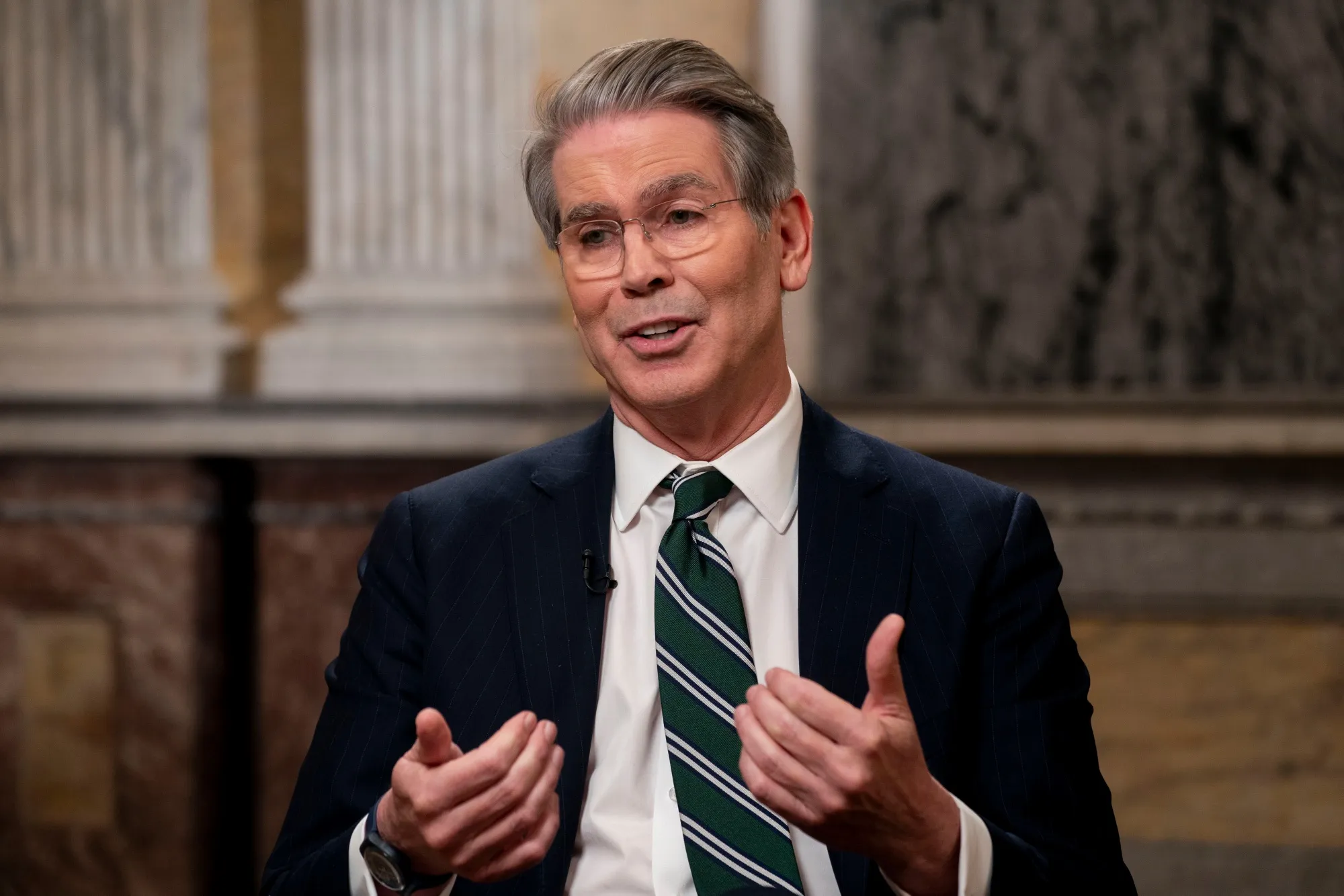

Scott Bessent Proposes 50 BPS Rate Cut by the Fed in September 2025!

Jakarta, Pintu News – Scott Bessent, US Secretary of the Treasury, suggested that the Federal Reserve consider a larger interest rate cut at its September meeting.

Check out the full information in this article!

Proposed Interest Rate Cut Based on Inflation Data

According to a report from Bloomberg, Bessent revealed that the central bank should be open to a 50 basis points rate cut after taking no action at the last policy meeting. This comment came after July’s inflation data which he deemed “exceptional”.

The latest consumer price index data showed an increase of 0.2% from the previous month. Core inflation, which excludes food and energy, rose by 0.3%, in line with economists’ expectations. Although the cost of services increased, goods prices were more restrained despite the tariff hikes recently imposed by President Donald Trump.

Read also: Circle Develops Arc Layer-1 to Strengthen Enterprise-Scale Stablecoin Finance

Optimism on Fed Board Candidates

Bessent also expressed optimism that Stephen Miran, Trump’s nominee for the vacant seat on the Fed board, would be confirmed before the September 16-17 policy meeting. Currently, Miran serves as the head of the White House Council of Economic Advisers.

If approved, Miran would fill the role until January, and Bessent noted that Miran could potentially stay longer. In addition to discussing interest rate cuts, the Secretary of the Treasury also addressed the search for a new Federal Reserve chairman, given that Jerome Powell’s term will end in May.

Read also: Grayscale Goes a Step Further with the Launch of Trust DEEP and WAL in the Sui Ecosystem

Criticism of Fed Policy and Its Impact

Trump has repeatedly criticized Powell for not making a rate cut this year. In addition, Fed officials have asked for more evidence on the inflationary impact of rising rates.

Bessent’s comments suggest that the administration favors faster and more substantial rate cuts to support economic growth. This push for a half-point cut comes as economic policymakers consider how to balance inflation control with maintaining momentum in the economy.

Conclusion

The upcoming September meeting will be closely watched to see if the Fed will follow Bessent’s recommendation on cutting interest rates. This looser monetary policy is expected to provide impetus for more stable economic growth amid global uncertainties.

This decision will not only affect financial markets, but also have long-term implications for US and global economic policy. Thus, the Fed’s move this September is crucial in determining the future direction of the economy.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. Fed Should Consider 50 BPS Rate Cut, Scott Bessent Says. Accessed on August 14, 2025

- Featured Image: Generated by AI