5 Ways Traders Discover Crypto ‘Hidden Gems’

Jakarta, Pintu News – Finding cryptocurrencies that have great growth potential, or what is often referred to as “hidden gems”, is one of the main challenges for traders.

With many new tokens being launched every day, traders need to have the right strategy to sort out the projects that are worth paying attention to.

In this article, we will discuss 5 ways commonly used by traders to find crypto “hidden gems” according to a survey by Loke Choon Khei and Choo Yuan Jie from Coingecko.

1. Relying on the Power of Memes: Virality

One way for traders to find cryptos with potential is to pay attention to the “virality” of memes in the market. Many new tokens, especially memecoins, often start their journey by going viral on social media.

Viral memes usually get a lot of attention on platforms like TikTok, Twitter, and Discord. Traders pay attention to how often the meme is talked about, as this could indicate how quickly the token gains attention in the market.

The less attention the meme receives, the more likely traders are to spot opportunities early.

2. Paying Attention to Where the Token is Registered

The location where the token is listed is also an important indicator in assessing the token’s potential.

Tokens that are newly listed on platforms like Pump.fun are likely to be in their early stages, while tokens that are already listed on major exchanges are often in the later stages of their popularity.

Therefore, changes in a token’s listing status on major exchanges can be a clue as to how popular it is in the market.

Read also: 5 Phases of Altcoin Season

3. Tracking Token Activity: Age and Market Capitalization

After choosing a theme or meme to watch, traders tend to analyze the token’s activity, including the token’s lifespan, market capitalization, as well as the movement of whales (large holders of the token).

Traders also pay attention to endorsements from crypto influencers or key opinion leaders (KOLs), which can signal whether the token has entered a more advanced stage of growth or is just starting to develop.

4. Using On-Chain and Off-Chain Information Sources

Traders use two main types of information sources: on-chain and off-chain. On-chain refers to data recorded directly on the blockchain, such as tokenomics analysis and whale movements. Tools like GeckoTerminal and block explorers are used to analyze this data.

Off-chain sources include those from social media platforms such as Twitter and Telegram, where traders often share analysis and information on new tokens. Both types of sources help traders sift through relevant information and decide if the token has potential.

Also read: MicroStrategy’s Bitcoin Purchase Timeline: From 2020 to 2025

5. Selecting Information Based on Reliability and Authenticity

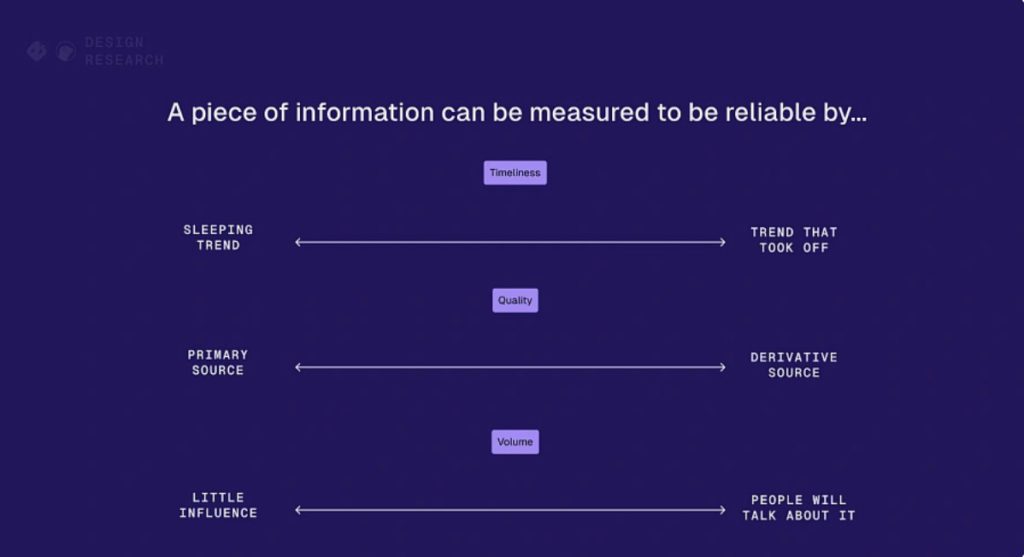

Traders also assess the reliability of the information they come across, especially when dealing with highly speculative memecoins.

Many traders prefer information that comes from lesser-known sources, as lesser-known sources tend to offer earlier opportunities.

The authenticity of the information is also an important factor, as more authentic information usually comes earlier before the token gains great attention from the public.

Conclusion

Finding crypto “hidden gems” requires a careful approach and observation of various factors, such as meme virality, token listing places, market activity, and on-chain and off-chain information sources.

Using this information, traders can gain deeper insights into the growth potential of emerging tokens.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinGecko. How Do Traders Discover New Memecoins Early?. Accessed August 16, 2025.

- Featured Image: Generated by AI