Crypto Market Turmoil Based on Crypto PPI: Trump, Inflation Data, & Giant Ethereum Buyouts!

Jakarta, Pintu News – This week served as a reminder that crypto markets can be very dynamic and sensitive to global events, whether political, economic or technological. Despite the pressures, positive developments in terms of regulation and institutional adoption have been counterbalance.

Bitcoin and Ethereum are still showing technical strength, while altcoins and presale tokens offer more room for growth. Investors are advised to remain vigilant, but also not to miss opportunities amid market uncertainty.

1. Bitcoin and Ethereum Approach Records, Then Plummet Sharply

The cryptocurrency market opened the week with high optimism after Bitcoin reached its all-time high price (ATH ) of $124,000. Ethereum also flew close to its ATH, only 3% away.

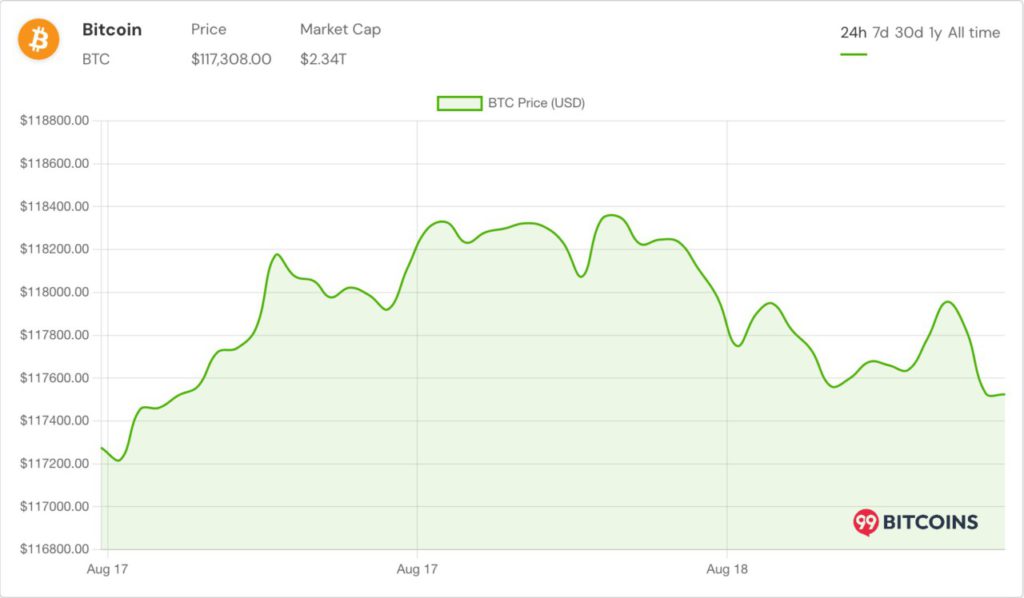

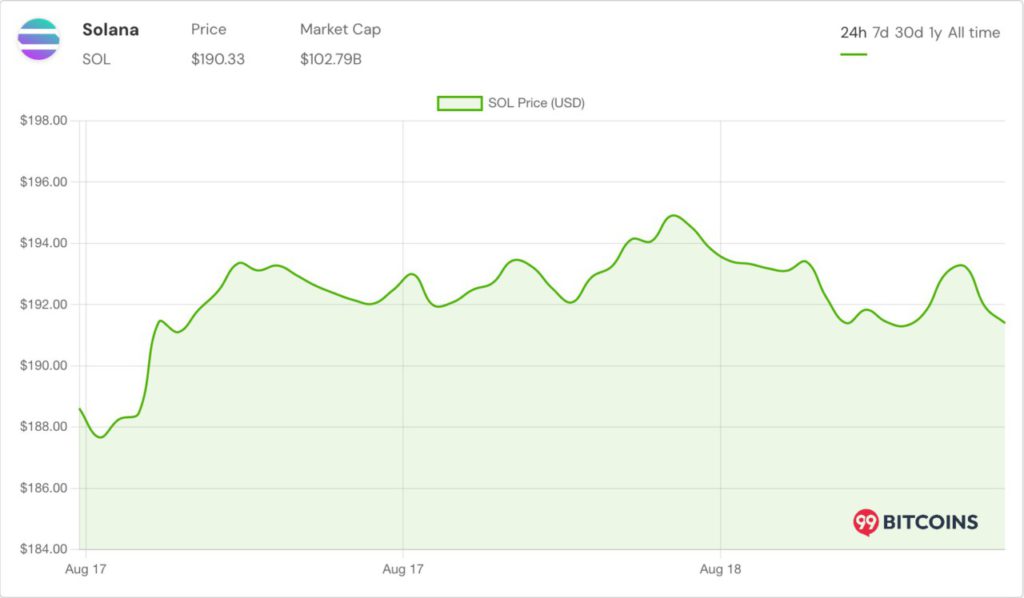

But before long, the entire market experienced a significant correction. BTC fell to $117,308 (Rp1.896 billion), ETH to $4,457 (Rp720 million), and most altcoins fell by 5-6%, triggered by geopolitical pressures and inflationary sentiment.

Also Read: 5 Native Tokens with the Best Performance According to Birdeye Data

2. Trump-Putin meeting leads to no peace, geopolitics shocks markets

The turmoil started with President Donald Trump and Vladimir Putin meeting in Alaska. Hopes for peace in the Ukraine conflict were dashed, and markets reacted negatively. These tensions derailed a potential crypto market rally that had strengthened earlier in the week.

The situation also worsened global sentiment towards risky assets, including cryptocurrencies. Diplomatic uncertainty made investors turn to safer assets.

3. US Inflation Surges: 3.3% PPI Triggers IDR16.1 Trillion Crypto Liquidation

US Producer Price Index (PPI) data surged to 3.3%, well above expectations of 2.5%. This figure sparked fears of inflation and dampened hopes of an interest rate cut by the Fed.

As a result, there was a massive liquidation of $1 billion or around Rp16.1 trillion in the crypto market. Short-term investors opted out to avoid further losses.

4. Cyberattacks & Ethereum Sell-Off Add Pressure

A cyberattack by a North Korean group against several crypto platforms caused losses of around $200 million (Rp3.2 trillion). This hit privacy coins like Monero (XMR) hard, which fell by up to 10%.

On the other hand, the Ethereum Foundation reportedly sold 2,795 ETH, despite large fund flows into the Ethereum ETF. This is a mixed signal that leaves investors confused, although ETH still maintains support at $4,500.

5. Positive News: Trump Buys Crypto, Coinbase Acquires Deribit

The positive side came from Trump’s move through wallet World Liberty Financial , which bought $18.6 million (IDR300 billion) in WBTC and ETH – reflecting the US president’s support for digital assets.

Last but not least, Coinbase announced its $60 billion acquisition of Deribit. This prompted a 27% surge in the price of XRP , amid market euphoria towards institutional adoption.

Also Read: 7 Ethereum (ETH) Developments to Anticipate in 2025

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Akiyama Felix. Trump Crypto Saga: PPI Data, Geopolitical Stalls, Institutional Plays, And Finding The Best Crypto To Buy. Accessed August 18, 2025.