Bitcoin price slips due to US inflation? PPI Report shows ETH and SOL in the spotlight!

Jakarta, Pintu News – US inflation data may have been the “brake” on crypto markets this week, but that doesn’t mean all opportunities were lost. Ethereum and Solana showed that crypto assets with strong fundamentals can still grow even in uncertain market conditions.

For investors who are ready with a medium to long-term strategy, this kind of correction could be the best moment to start organizing a crypto portfolio more intelligently.

1. Hot Inflation in the US Pressures Bitcoin Price

The crypto market was shaken again after the latest inflation data from the United States, specifically the Producer Price Index (PPI), came in higher than expected. The hot producer inflation numbers fueled concerns that the Fed will delay interest rate cuts.

In response, investors shunned risky assets like crypto, and the price of Bitcoin immediately slipped from its highs last week. This correction reflects how sensitive the crypto market is to monetary policy and macroeconomic data.

Also Read: 5 Native Tokens with the Best Performance According to Birdeye Data

2. Why PPI Data Affects Crypto So Much?

The Producer Price Index (PPI) is a leading indicator of inflationary pressures at the producer level. If the figure is higher than expected, it means that production costs are rising and potentially squeezing company margins – which can then lead to consumer inflation (CPI).

In the context of the crypto market, high PPI data usually reduces investors’ appetite for speculative assets. They tend to prefer safer instruments such as bonds or money market instruments that provide fixed returns, compared to Bitcoin, which is now behaving more like a “risk-on” asset.

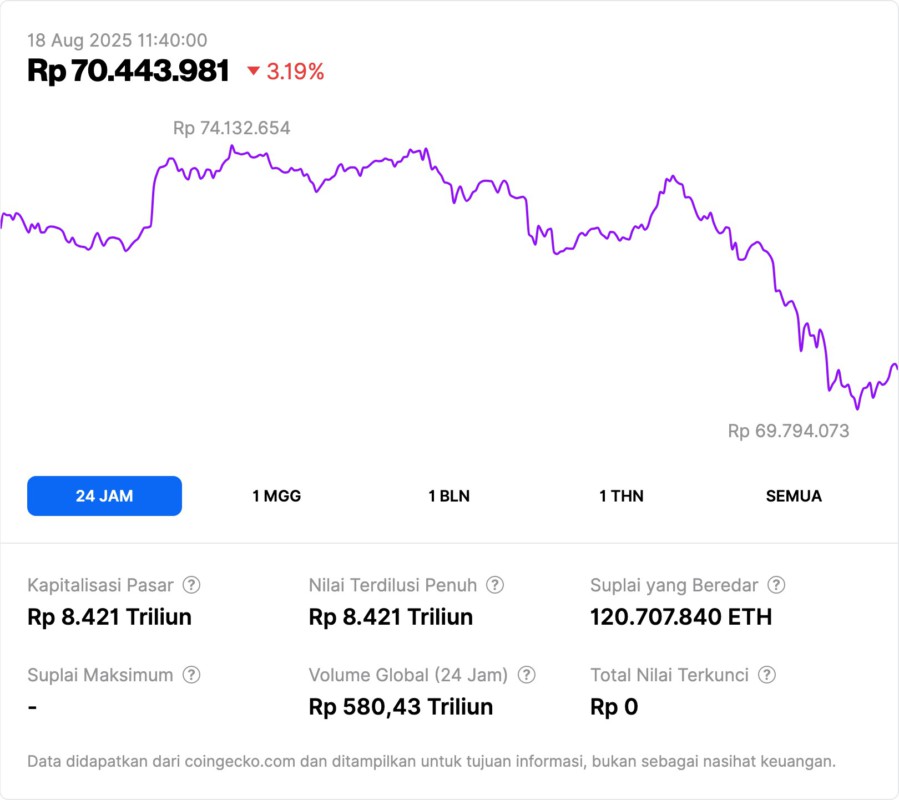

3. Ethereum (ETH): Institutional Investor Favorite

Amid the market correction, Ethereum continues to show strong appeal as the institutional crypto asset of choice. The inflow of funds through Ethereum ETFs and the addition of ETH to corporate balance sheets show long-term confidence in the network.

Besides being used in DeFi, NFTs, and enterprise applications, Ethereum also continues to develop technology through proof-of-stake models and scaling solutions such as rollups. With the current price of ETH approaching $4,457, analysts see this as a potential accumulation point for serious investors.

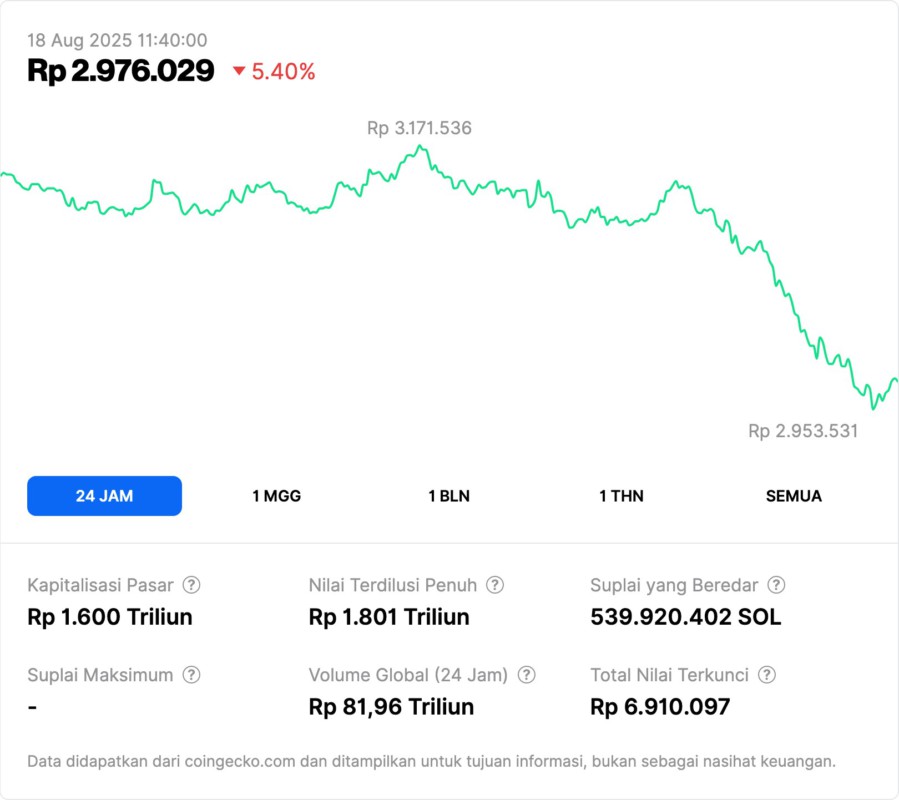

4. Solana (SOL): A Fast and Cheap Alternative

Solana continues to strengthen its position as a serious competitor to Ethereum when it comes to speed and scalability. The blockchain is capable of handling thousands of transactions per second at low fees, making it a favorite in the gaming sector, DEX, and other high-performance applications.

Solana’s developer ecosystem is also growing rapidly, and its current token price of around $190.33 (IDR 3,075,844) is seen as a golden opportunity before the next potential bull run.

5. Bitcoin Correction Could Be an Opportunity in Altcoins

While Bitcoin’s price correction may seem negative on the surface, many analysts see it as a healthy rotation of capital into quality altcoins. Ethereum and Solana being two of the few major crypto assets that offer a combination of real utility and institutional adoption.

With the crypto market maturing and market capitalization approaching $4 trillion, the shift in focus from Bitcoin to altcoins could mark a new phase in the next crypto bull cycle ahead of 2025.

Also Read: 7 Ethereum (ETH) Developments to Anticipate in 2025

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Alexander Zdravkov. Bitcoin Price Dips on Hot Inflation Data – Analysts Highlight Ethereum, Solana & MAGACOIN FINANCE as the Best Altcoins to Buy Now. Accessed August 18, 2025.