3 US Economic Events Shaping the Crypto Market This Week

Jakarta, Pintu News – The crypto market started the week on a downward note, sending Bitcoin back to the $115,000 range, while Ethereum moved around the $4,300 level.

Whether this decline will continue or is just a temporary correction, will most likely be influenced by some important economic data from the US released this week.

Notably, Bitcoin shows high sensitivity to US economic indicators, so this week’s data will be crucial for its move towards new highs.

FOMC Meeting Notes are the Highlight of the Week

The FOMC (Federal Open Market Committee) meeting notes from the July meeting are expected to be one of the most important US economic events this week.

Read also: Bitcoin Holds Around $115K on August 19: Is Further Decline on the Horizon?

Scheduled for release on Wednesday, this document could potentially provide clues regarding the Federal Reserve’s (Fed) monetary policy decisions, which have a significant impact on global financial markets, including crypto.

More specifically, the FOMC meeting notes revealed discussions regarding possible interest rate changes. Higher interest rates typically strengthen the US dollar and increase borrowing costs, so investors tend to reduce allocations to riskier assets like Bitcoin.

Conversely, hints of low interest rates or dovish policies could boost crypto prices, as investors seek higher yields in speculative assets.

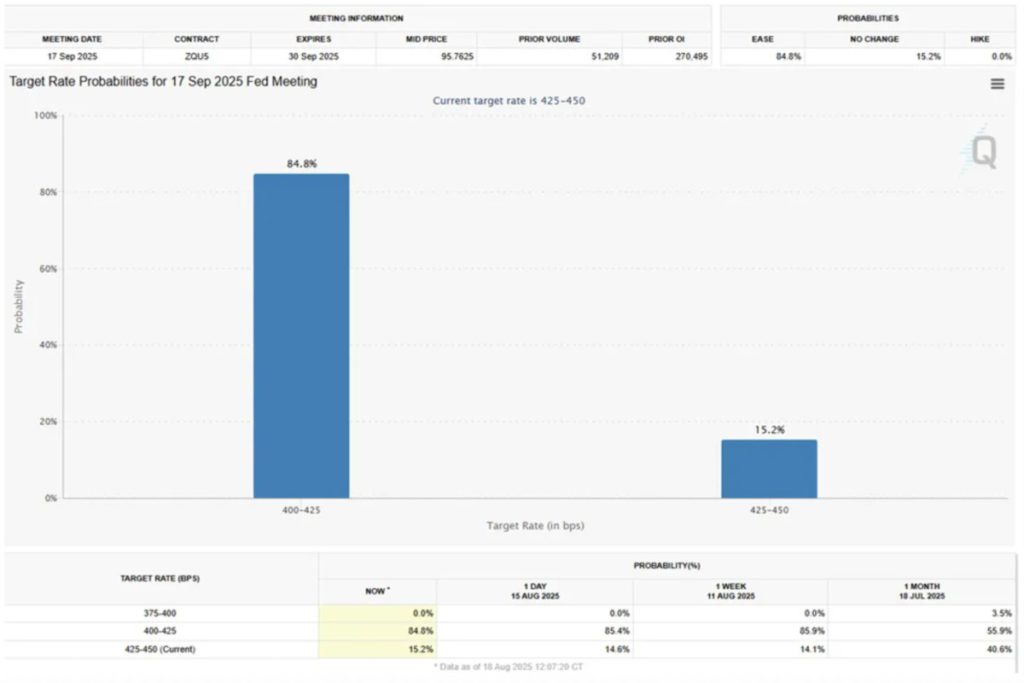

According to the CME FedWatch Tool, market participants expect there to be an 84.8% chance that the Fed will cut rates to 4.00-4.25% at its September 17 meeting, while there is only a 15.2% chance that rates will be maintained at 4.25-4.50%.

This expectation comes after reports showed inflation in the US remained high, rising 2.7% on an annualized basis in July.

In addition, the FOMC meeting notes are also important to show the individual views of policymakers after the 9-2 vote that decided to keep interest rates unchanged.

As such, the meeting notes could reveal how much the committee differed in opinion regarding the possibility of an interest rate cut in the US.

Initial Jobless Claims Number in the Spotlight of Crypto Market

This week, the next US economic indicator that could potentially impact crypto is initial jobless claims, as labor market data is increasingly becoming an important macro factor for Bitcoin.

This data, released every Thursday, shows the number of US citizens applying for unemployment insurance for the first time.

For the week ending on August 9, initial jobless claims stood at 224,000, slightly down from 226,000 in the previous week. This figure was even below economists’ forecasts, which predicted up to 229,000.

According to a MarketWatch survey, economists expected last week’s initial jobless claims to reach 224,000, the same as the previous week. Overall, initial jobless claims have shown a steady trend over the past few weeks.

This stable but slightly elevated jobless claims figure indicates a cooling of the labor market, potentially strengthening expectations of a rate cut by the Fed and supporting Bitcoin’s upside momentum.

Read also: Whale Moves 3 Trillion SHIB from Coinbase, Shiba Inu Ready to Expand to Base and Solana!

Fed’s Jackson Hole Meeting in the Spotlight this Week

One of the key US economic events this week is the Jackson Hole Symposium, which will be held on Friday, August 22. Fed Chairman, Jerome Powell, is scheduled to deliver the keynote speech at 10:00 ET.

According to CryptoData’s popular account on X, the event “features dozens of central bankers, policymakers, academics, and economists from around the world. Jerome Powell’s speech on August 22 at 10am EST will provide important insight into a potential rate cut next month.”

The Jackson Hole Symposium is known to create a ‘seek and destroy’ trading environment, where price movements can be highly volatile and surprise traders.

Powell’s comments hold great influence as his previous speeches at Jackson Hole have often altered market expectations regarding interest rates and economic growth. The impact can extend to the stock, bond and crypto markets, making it an important moment for investors and traders.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. US Economic Events Crypto This Week. Accessed on August 19, 2025