Crypto Market Correction, Bitcoin Price Plunges to $115,000: What Happened?

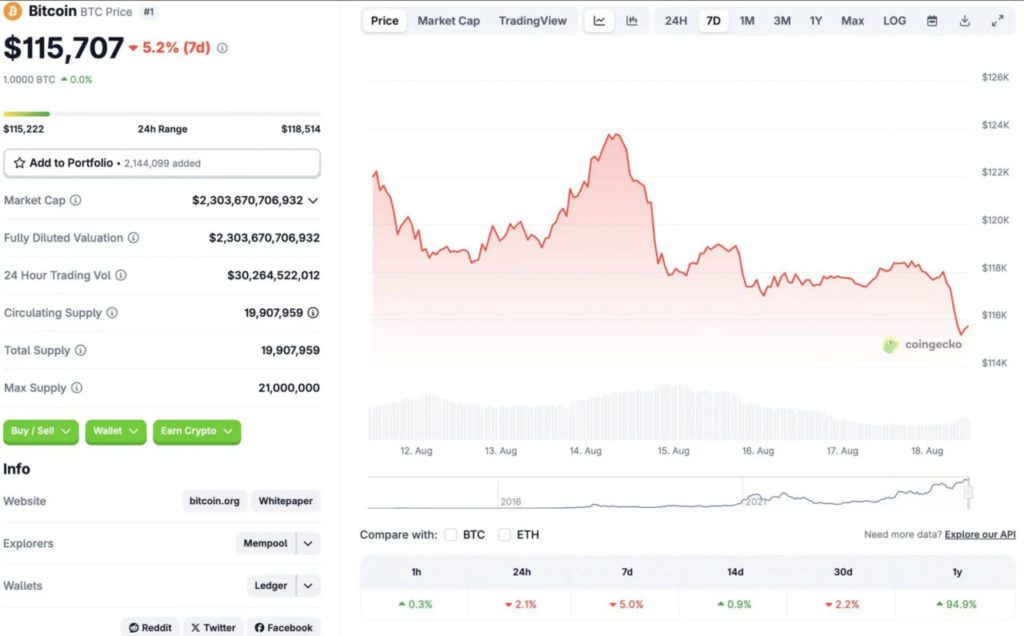

Jakarta, Pintu News – The crypto market has experienced another sharp correction after its recent rally. Data from CoinGecko shows that Bitcoin has dropped to a price level of $115,000.

The asset fell 2.1% in the daily chart, 5% in the weekly chart, and 2.2% over the last month. Despite this, Bitcoin (BTC) still registered gains in the 14-day and yearly charts, with gains of 0.9% and 94.9% respectively. This article will discuss the causes of the current crypto market correction.

Main Causes of Market Correction

The market correction started on August 14, after the US Bureau of Labor Statistics announced higher-than-expected producer price index (PPI) figures. The PPI rose by 0.9% on month, while the Dow Jones had expected a rise of only 0.2%. This figure measures the prices of final demand goods and services and the increase was the biggest jump since June 2022.

The rise in PPI may have led investors to avoid risky markets, such as crypto. The rise in PPI came right after better-than-expected consumer price index (CPI) figures. The low CPI numbers had previously pushed the crypto market into a surge. Bitcoin (BTC) reached a new record high of $124,128 on August 14. However, the PPI data released later caused the market to lose its momentum significantly.

Also Read: CHILLGUY Price Prediction 2025-2030: Meme Coin Viral TikTok, Is it Still Worth Buying?

Impact of Federal Reserve Policy

The Federal Reserve will meet in Jackson Hole at the end of this month. During the meeting, the Federal Reserve is likely to discuss the US monetary policy stance. High PPI figures could be a source of concern. However, low CPI figures may provide some cushion.

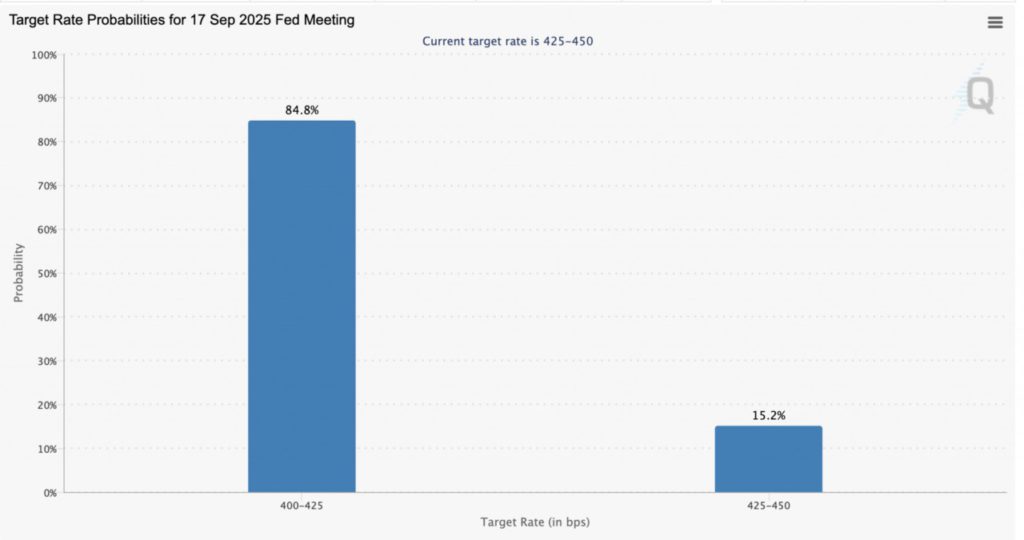

According to the CME Fedwatch tool, there is an 84.8% probability that the Federal Reserve will cut interest rates by 25 basis points next month. This rate cut could give the market another boost.

This Federal Reserve meeting is highly anticipated by market participants as it will provide further clues regarding the future direction of monetary policy. The decision on interest rates is very important as it can affect the US dollar exchange rate and indirectly affect the crypto market.

Future Prospects of the Crypto Market

Although the crypto market is currently experiencing a correction, the long-term outlook still shows positive potential. Bitcoin’s (BTC) annual increase of almost 95% shows that interest in crypto is still very strong. In addition, a potential interest rate cut by the Federal Reserve could be a positive catalyst for the market.

Investors are expected to remain vigilant against market volatility that could occur at any time. Given that the dynamics of the crypto market are highly influenced by various external factors, it is important for investors to continue to monitor global economic developments and monetary policies from the world’s major central banks.

Conclusion

In the face of crypto market fluctuations, a deep understanding of the economic factors that influence them is key. Despite the uncertainties, opportunities in the crypto market are still wide open for those who understand how to navigate through the market turmoil.

Also Read: Worldcoin (WLD) Price Prediction 2025-2031: Bullish Potential or Just Hype?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Watcher Guru. Cryptocurrency Market Crash: Bitcoin at $115k, What’s Going On. Accessed on August 19, 2025