Ethereum Price Drops to $4,100 Today as Whales Begin Offloading Assets

Jakarta, Pintu News – In recent months, the distribution of Ethereum supply has undergone significant changes regarding how a large amount of ETH is owned by various wallets.

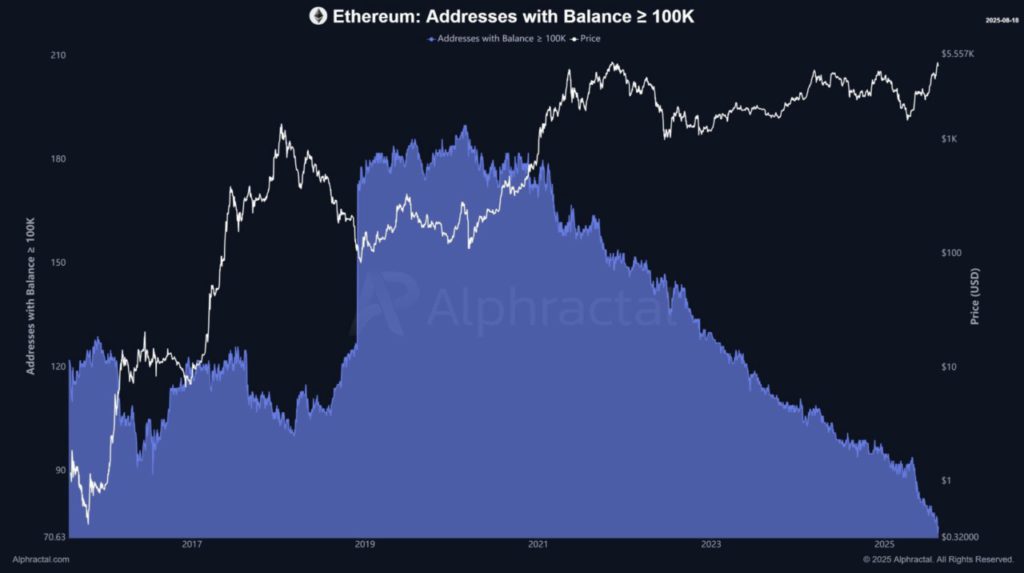

In particular, the number of addresses holding more than 100,000 ETH – the so-called “whales” – has decreased considerably. Interestingly, this trend hasn’t raised any major concerns among Ethereum investors or analysts.

Then, how is the current ETH price movement?

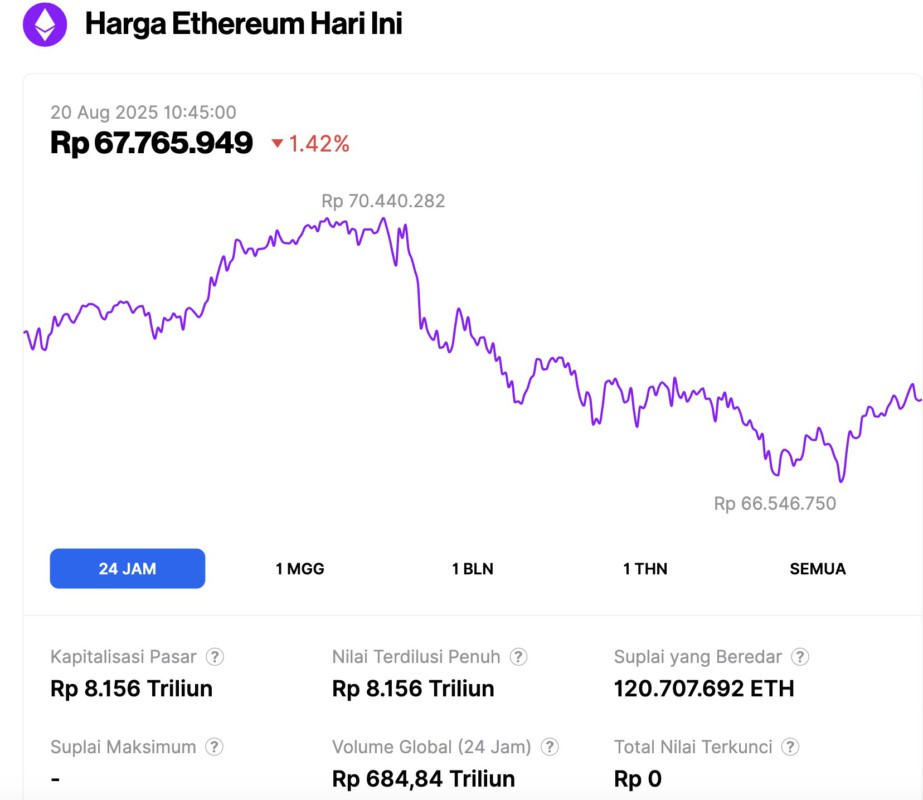

Ethereum Price Drops 1.42% in 24 Hours

As of August 20, 2025, Ethereum was trading at approximately $4,139, or around IDR 67,765,949 — marking a 1.42% drop over the past 24 hours. During this period, ETH hit a low of IDR 66,546,740 and climbed as high as IDR 70,440,282.

At the time of writing, Ethereum’s market capitalization is estimated at IDR 8,156 trillion, while its daily trading volume has risen by 10% to reach IDR 684.84 trillion in the last 24 hours.

Read also: Bitcoin Plunges to $113K on August 20, 2025, but Analysts Stay Optimistic About a Rebound

Ethereum’s Whale Decline and the Rise of the Sharks

Recent data shows that the number of addresses holding more than 100,000 ETH is decreasing, even though the price of ETH continues to rise.

According to Alphractal, the number of “whale” addresses dropped from over 200 in 2020 to around 70 in 2025 – the lowest level in almost a decade.

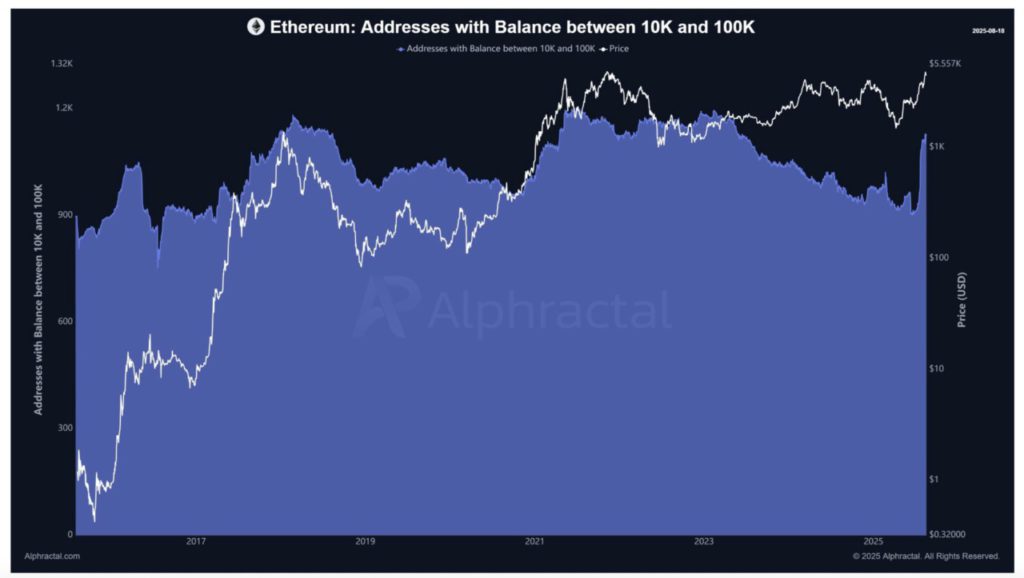

Usually, selling by whales is considered a bearish signal. However, looking at the number of “shark” wallets holding between 10,000 to 100,000 ETH gives a more complete picture.

In August, the number of shark wallets increased from around 900 to over 1,000. This growth comes amid a wave of Ethereum accumulation, driven by the strategic reserves of publicly traded companies.

Joe Wedson: Whale Decline Doesn’t Affect ETH Price

Joao Wedson, founder of Alphractal, explained that the decrease in the number of whales holding more than 100,000 ETH did not have a significant impact on the price.

Instead, mid-scale addresses – the so-called “sharks” – are the main force to watch.

“But before dismissing this as a bearish signal, remember: the same is true for Bitcoin. Historical on-chain data shows that the real holders often have fewer coins, while the real price drivers are the mid-sized players – the ‘sharks’,” Wedson said.

It should be noted that large wallets are often owned by exchanges or early adopters, and some of them may lose access due to long periods of inactivity or security issues.

Over the past month, ETH accumulators have moved supply to a new generation of sharks. Their buying activity indicates a stronger belief in Ethereum’s long-term value.

Read also: Crypto Trader Turns $125K into $43 Million, Walks Away with $7 Million Profit After Market Dip!

Ethereum Accumulation and Owner Structure Changes

ETH strategic reserve data shows that Ethereum companies and ETFs have accumulated 10.2 million ETH, worth about $39.48 billion. This accumulation trend has been increasing since July.

The results are clearly visible in the changing structure of Ethereum owners. According to CryptoQuant data, while the number of large investor wallets continues to reach new records, the number of retail wallets has been consistently decreasing.

Retail investors appear to be exiting Ethereum, while institutions continue to add to their holdings.

IT Tech analysts noted, “Three things are visible from the chart: Retail wallets fell to 8.5 million ETH – the lowest level in years. Large holders rose to 19.1 million ETH, an all-time record high. Prices haven’t followed suit, but the shift in ownership is very clear. Who will be proven right this cycle – retail or whale?”

Combining Wedson’s and IT Tech’s observations, institutional demand for ETH looks like a black hole, drawing supply from both exchange wallets and retail investors.

This increased demand has the potential to make Ethereum a more mature asset. However, it also poses a challenge for the network to maintain sustainable long-term value growth.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Whales Are Selling in August. Accessed on August 20, 2025