Discover the Secrets of Using Stochastic RSI in Trading!

Jakarta, Pintu News – The use of indicators in technical analysis is key to identifying potential trading opportunities. One indicator that is often overlooked but has great potential is the Stochastic RSI (StochRSI). This indicator is a development of the Relative Strength Index (RSI) that is more sensitive and provides trading signals more frequently.

Definition of Stochastic RSI

Stochastic RSI is a technical analysis tool that measures the level of buy or sell saturation of an asset by applying a stochastic oscillator formula to the RSI values. StochRSI values range from zero to one, or zero to 100 depending on the charting platform used.

The formula used in calculating StochRSI is (RSI – min[RSI]) / (max[RSI] – min[RSI]), where RSI is the current RSI reading, min[RSI] is the lowest RSI reading during a specific period, and max[RSI] is the highest RSI reading during the same period.

The StochRSI provides a faster and more sensitive overview than the regular RSI. This makes the StochRSI particularly useful in volatile markets, where asset prices change rapidly. However, due to its highly sensitive nature, the StochRSI can also produce false signals that traders should be wary of.

Also Read: Ethereum (ETH) Price Predicted to Surge to $15,000, What’s Driving This Increase?

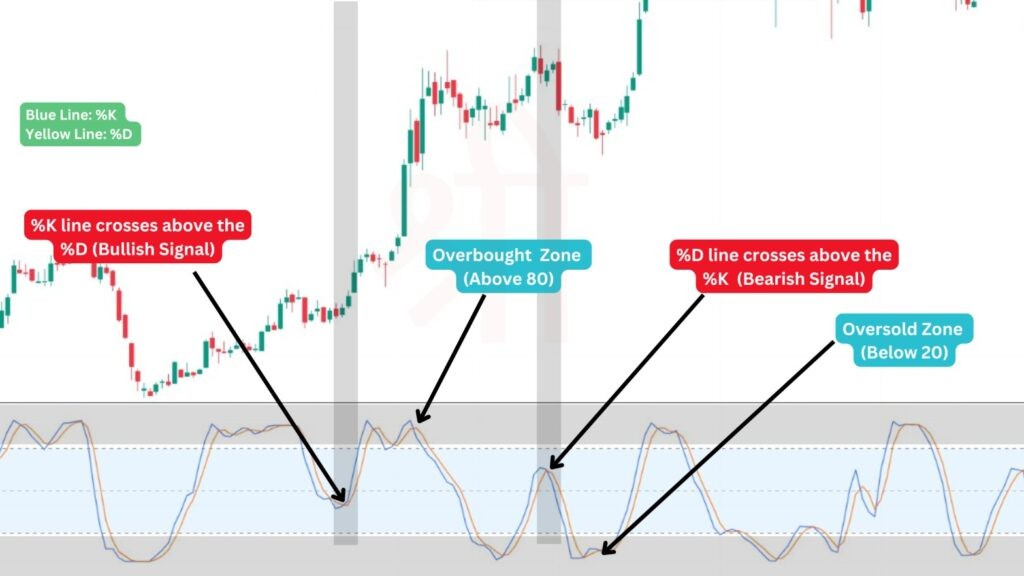

Understanding Signals from Stochastic RSI

The StochRSI gives an indication that an asset may be overbought when the value exceeds 0.70 and oversold when the value falls below 0.30. This indicates that the RSI value is at the upper or lower end of a predetermined range, which could be a signal for traders to consider a price reversal.

For example, if the StochRSI shows a value below 0.30, this could be an indication that the asset’s price will soon rise. It is important for traders to understand that signals from the StochRSI should be confirmed with other indicators or with additional technical analysis. Using StochRSI in conjunction with other indicators such as Moving Average or MACD can help in reducing the risk of false signals and increasing the accuracy of price predictions.

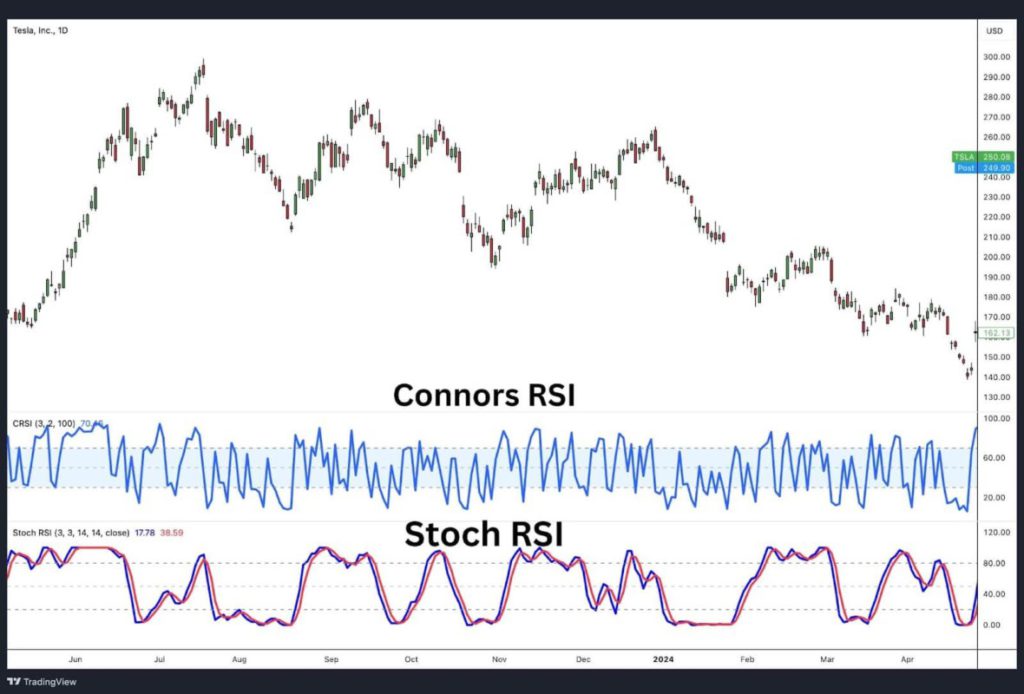

Comparison of Stochastic RSI and Ordinary RSI

While both use RSI data, the StochRSI and the regular RSI have fundamental differences in their speed and sensitivity. The StochRSI reacts faster to price changes as it is the second derivative of the price, while the RSI is slower and more stable as it is only the first derivative of the price.

The StochRSI’s high speed makes it ideal for fast-changing markets, but it is also more prone to volatility and signal overload. To combat this volatility, some traders use a moving average of the StochRSI values to dampen fluctuations and get a clearer picture of market trends.

This helps in making more informed trading decisions and reduces the risk of losing investments due to overreaction to short-term price movements.

Conclusion

The Stochastic RSI is a very useful tool in technical analysis, especially for identifying overbought and oversold conditions faster than the regular RSI.

By understanding how the StochRSI works and its limitations, traders can utilize it to improve their trading strategies, especially in combination with other indicators. However, it is important to always be aware of potential false signals and use additional analysis for confirmation.

Also Read: Dogecoin is the only meme coin in the top 25 – is it the king of meme coins?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Investopedia. StochRSI. Accessed on August 20, 2025