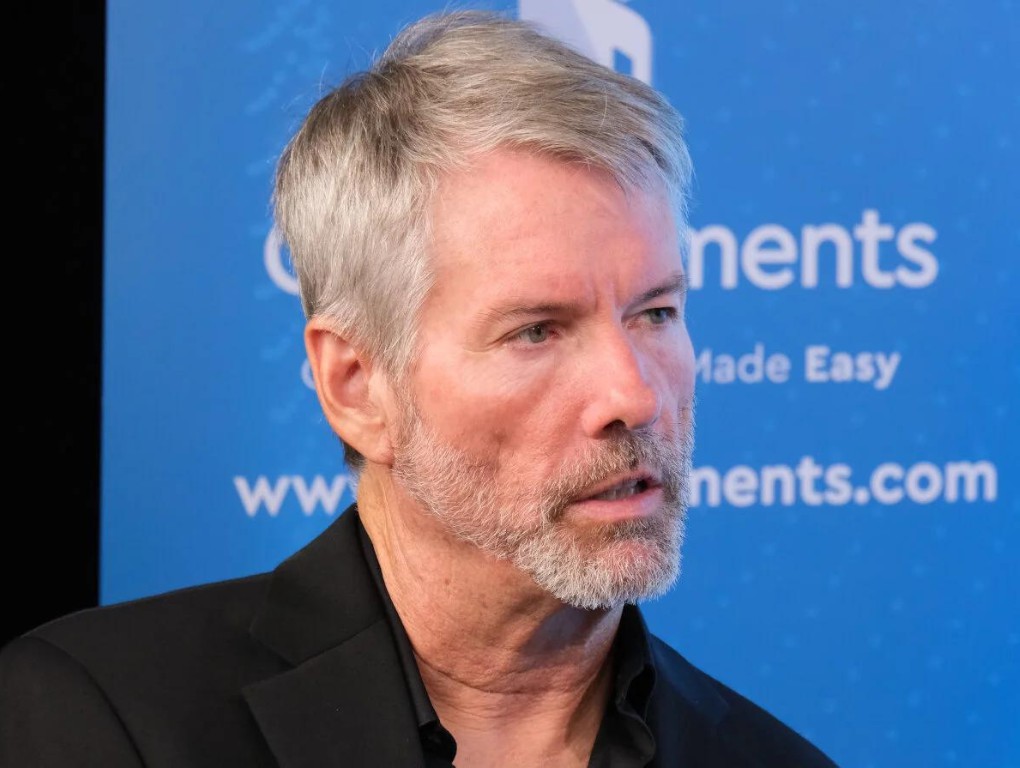

Michael Saylor Relaxes Stock Sale Rules — What Does This Mean for Bitcoin?

Jakarta, Pintu News – Michael Saylor, CEO of Strategy Inc, has made significant changes to his company’s share sale policy. This change was made to adapt to market fluctuations that affect the company’s big plans in Bitcoin investment.

Check out the full information in this article!

Introduction of New Share Sale Rules

Strategy Inc. initially committed to slowing down the sale of common stock and focusing more on perpetual preferred stock. However, recently, the company announced that it would keep selling shares even if the share price was below the previously set level.

This decision was made to help stabilize the company’s finances. Michael Saylor has long used a margin called “mNAV premium” to raise funds at a high price and buy Bitcoin (BTC) at a cheaper price.

This rule change gives Strategy Inc. more flexibility to acquire funds when necessary. Brian Dobson, managing director at Clear Street, stated that this policy change allows the company to be more opportunistic in its Bitcoin (BTC) purchases.

Also read: Volkswagen Singapore Now Accepts Crypto Payments, How is the Process?

Bitcoin Purchasing Slows

Although Strategy Inc. continues to make purchases of Bitcoin (BTC), there has been a decline in the number of purchases. In the week ending August 17, the company reported the purchase of 430 Bitcoin (BTC) worth $51.4 million, a decrease from the previous purchase.

Currently, Strategy Inc. owns around $72 billion in Bitcoin (BTC), but the pace of purchases has decreased significantly. This decline comes amidst Strategy’s stock not performing as well as Bitcoin (BTC) itself.

Since November 20, the company’s stock has fallen by 22%, while Bitcoin (BTC) has risen by 23% over the same period. This suggests an imbalance between the value of the company’s shares and the value of the Bitcoin (BTC) they hold.

Read also: Crypto ETF Decision Delayed by SEC, What’s the Impact?

Market Response and Future Strategy

The strategy adjustment by Michael Saylor has received responses from various parties, including from short seller Jim Chanos who criticized the decrease in Bitcoin (BTC) purchases and the adjustment of mNAV rules.

Although Strategy Inc. has not provided further comment, this change in strategy indicates the company’s response to intensifying competition and the need for strategic adaptation.

With new competitors and funds vying for investors, Michael Saylor seems to be looking for new ways to keep buying Bitcoin (BTC) and pushing his vision. This shows that the company is not only focused on short-term growth but also on long-term sustainability in the cryptocurrency ecosystem.

Conclusion

The change in strategy by Michael Saylor and Strategy Inc. demonstrates the complex dynamics of managing a large investment in Bitcoin (BTC). With market conditions constantly changing, strategic adaptation is key to ensuring the company’s sustainability and growth in this highly volatile industry.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto Times. Michael Saylor Eases Stock Sale Rules as Bitcoin Premium Shrinks. Accessed on August 20, 2025

- Featured Image: Decrypt