Pi Coin Price Prediction: Can Pi Network Reach $0.50 Along with Mainnet Migration?

Jakarta, Pintu News – On August 18, the price of Pi Coin was briefly trading at $0.3592, down 7.33% in the last 24 hours, with a market capitalization of $2.81 billion at the time of writing.

However, trading activity surged, with daily volume up 142% to $68.61 million. This shows increased market participation despite the price decline.

This unusual difference between price and volume signals increased speculation among market participants. Meanwhile, an analyst projected a cautious upside target of $0.5 for Pi Coin’s price, amid speculation regarding the mainnet migration that continues to influence market sentiment.

Pi Coin Price Action Shows Rebound in Demand Zone

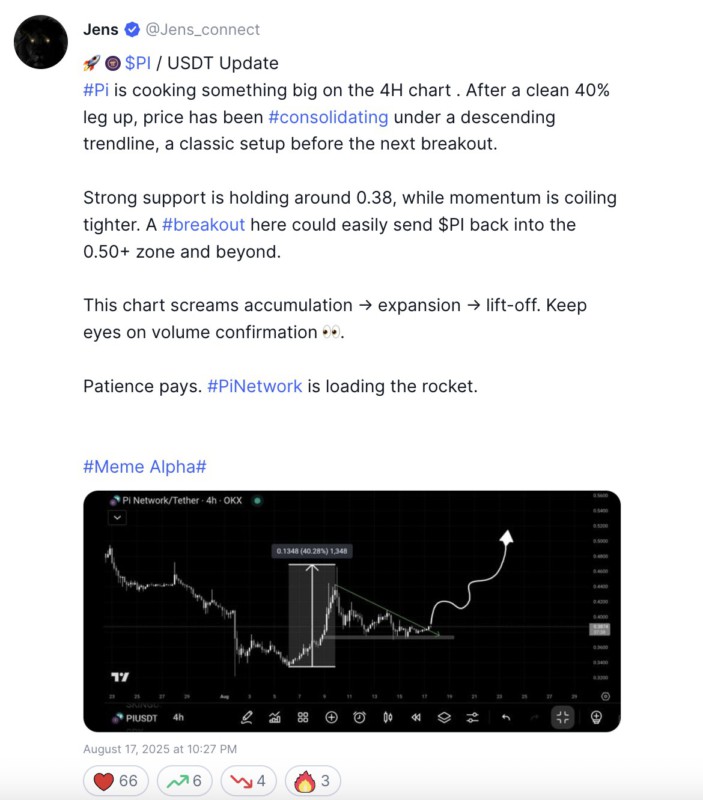

According to Jen, a market analyst, Pi is currently consolidating below its downward trend line after a sharp 40% rally. This pattern is considered a signal of a possible breakout, with strong support levels around $0.38.

Read also: Pi Network Price Holds Around $0.34 Today as Bearish Pressure Intensifies

He added that the narrowing price movement indicates pressure to move up. If confirmed, the Pi coin price has the potential to rally towards the $0.50 level or even higher. This formation reflects accumulation before growth, which supports the bullish projection of the Pi coin price in 2025.

On the 4-hour chart (18/8), Pi coin has just broken below the descending channel and is now retesting the demand zone. The price is currently holding around $0.35, which is a crucial level for short-term positions.

The Bollinger Bands indicator shows the price approaching the lower band, signaling oversold conditions, while the Money Flow Index (MFI) is at 33, neutral but close to the oversold area.

If there is a bounce at this level, the price has the opportunity to retest the resistance at $0.41 and then $0.50.

But on the contrary, in case of rejection below this zone, it could trigger new selling pressure. Thus, the Pi coin price is currently at a balance point between a short-term decline and a potential recovery.

Mainnet Migration Speculation Drives Market Anticipation

Speculation regarding Pi Network’s highly anticipated second mainnet migration is still a major factor in the Pi coin price outlook.

Read also: Pi Network Launches Hackathon 2025 Soon, Will this be the Turning Point of Pi Coin?

In the context of Pi Network, migration is the process of moving user balances from a closed testnet to an active mainnet, thus unlocking the true functionality of the coin.

This process allows Pi to be used in decentralized applications and integrated services, so its value is not limited to mobile mining. Previous early-stage migrations served as proof of scalability, moving early adopters into an active ecosystem and validating Pi’s underlying infrastructure.

Now, there is growing speculation that there will be a second wave of migration. This advanced migration will bring more users to the network while adding liquidity in the secondary market.

In addition, this move may also increase confidence in the Pi ecosystem, thus increasing the chances of its adoption. For a large part of the community, this anticipation gives more weight to the debate around the price performance of the Pi coin.

In summary, the Pi coin price is currently in a conservative trading zone, balancing between analyst targets and migration-related speculation.

The recent price recovery shows resilience, but the ability to maintain momentum is highly dependent on the possibility of a second mainnet migration in the near future.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Pi Coin Price Prediction 2025: Analyst Eyes $0.50 as Mainnet Migration Intensifies. Accessed on August 20, 2025