Window Dressing Practices in the Financial World: What Do You Need to Know?

Jakarta, Pintu News – Window dressing is a term that originated in the retail world, where stores decorate their storefronts to attract customers. In the financial industry, the term takes on a different but equally strategic meaning.

Window dressing here refers to the practice of manipulating financial data to make a company or investment appear more attractive to investors. This practice is often misleading and can give an inaccurate picture of actual financial performance.

Definition and How Window Dressing Works

Window dressing in finance is the act of altering financial information to make an entity appear more successful than it actually is. This practice is often used to attract investors or to retain existing investments. While it can appear to be a clever tactic, window dressing is actually misleading and can harm investors who are unaware of what is really going on.

This manipulation can be done in various ways, such as changing the timing of revenue recognition, using aggressive accounting methods, or replacing underperforming assets with better ones before the financial statements are published. The aim is to create a positive picture that may not be entirely true.

Also Read: 5 Trading Signals Bitcoin (BTC) is Under Pressure-Is This the Start of a Major Correction?

Window Dressing in Investment Funds

In the investment fund industry, fund managers are often under pressure to show good results. When fund performance is not satisfactory, managers may resort to window dressing to make the portfolio appear more attractive. This is done by replacing underperforming assets with up-and-coming assets just before the end of the reporting period.

This practice is not only misleading but can also impact investors’ investment decisions. Investors who do not realize that these changes are only temporary may make decisions based on inaccurate information. This can be fatal, especially if the assets purchased are only to cover up the true weakness of the portfolio.

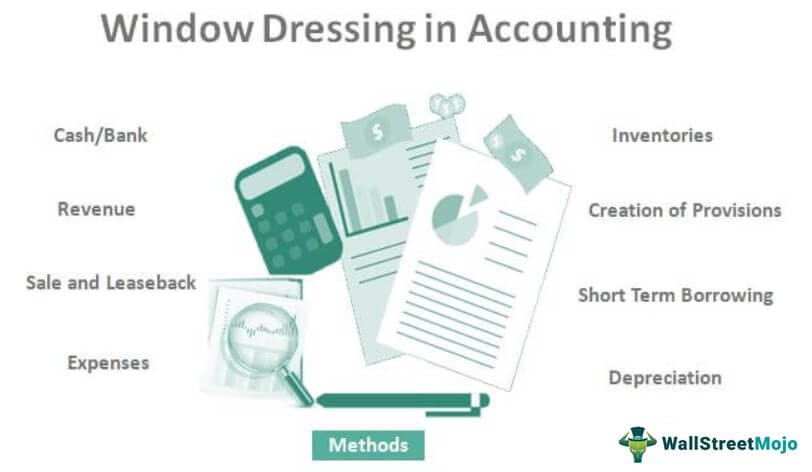

Window Dressing in Accounting

Companies listed on the stock exchange are required to follow strict accounting guidelines to ensure transparency to investors and regulators. However, some companies may still try to ‘dress up’ their financial statements.

This can be done by changing the amortization method, making aggressive revenue recognition, or using optimistic estimates for costs and liabilities.

Detecting window dressing practices in accounting can be challenging. However, by comparing financial statements from multiple periods and reading news releases and investor reports, it is possible to spot discrepancies that may indicate manipulation.

Conclusion

Window dressing is a risky and often misleading practice in the financial world. While it can provide a temporarily positive picture, ultimately, it can harm investors and undermine confidence in the financial system. It is important for investors to do their due diligence and fully understand what they are investing in.

Also Read: 5 Secrets to Using Crypto Trading Signals to Increase Investment Profits!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Investopedia. Window Dressing. Accessed on August 21, 2025