The Secret Behind WACC Calculation and Its Impact on Investment Decision

Jakarta, Pintu News – The use of Weighted Average Cost of Capital (WACC) is one of the important methods in financial analysis to assess a company’s financing costs.

WACC incorporates the average after-tax cost of capital from both equity and debt. This article will explain how WACC is calculated, its role in corporate finance, and its importance in investment decision-making.

What is WACC?

Weighted Average Cost of Capital (WACC) is a metric used to measure the average cost of capital employed by a company. WACC calculates the cost of all sources of capital, including equity and debt, adjusted for their respective proportions in a company’s capital structure.

The higher the WACC, the greater the risk that investors have to bear, so they will expect higher returns. WACC is very important in determining the rate of return expected by investors.

Companies use WACC as a discount rate to evaluate the net value of a proposed project or acquisition. If the rate of return from the investment is higher than the WACC, then the investment is considered viable. Conversely, if it is lower, then the funds can be allocated elsewhere that are more profitable.

Also Read: 5 Trading Signals Bitcoin (BTC) is Under Pressure-Is This the Start of a Major Correction?

How to Calculate WACC?

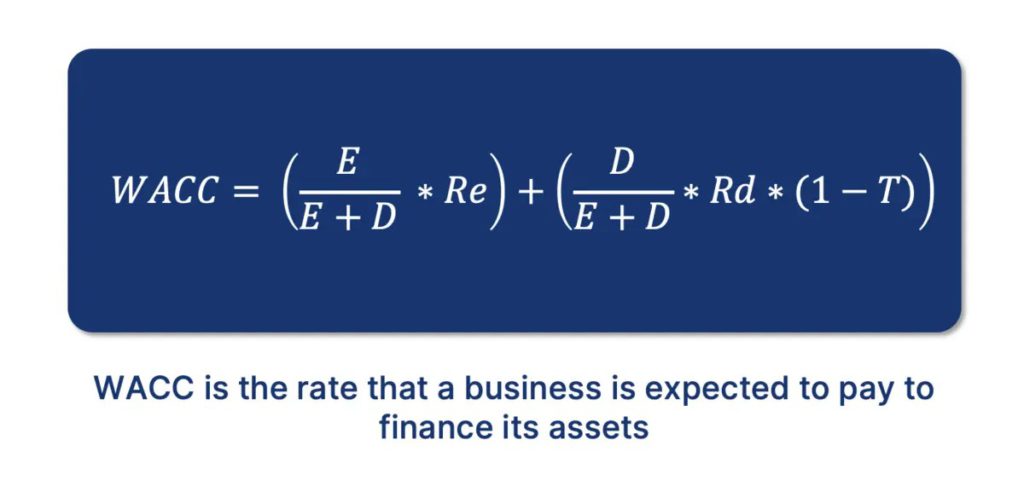

To calculate WACC, it is necessary to know the proportion of debt and equity in the company’s total financing. The basic formula of WACC is as follows: \[ \text{WACC} = \left ( \frac{ E }{ V} \times Re \right ) + \left ( \frac{ D }{ V} \times Rd \times ( 1 – Tc ) \right ) \] where E is the market value of equity, D is the market value of debt, V is the total of E and D, Re is the cost of equity, Rd is the cost of debt, and Tc is the corporate tax rate.

Using this formula, a company can calculate the average cost of capital adjusted for its capital structure. For example, a company has $1 million of debt and $4 million of equity. If the cost of equity is 10% and the cost of debt is 5%, with a tax rate of 25%, then the WACC can be calculated to determine the average cost of capital that the company has to pay to its capital providers.

Factors Affecting the Calculation of WACC

Calculating the cost of equity can be challenging as there is no explicit cost that a company has to pay to shareholders. The Capital Asset Valuation Model (CAPM) is often used to estimate the cost of equity by considering the relative risk of the stock compared to the overall market.

This is important because shareholders expect a certain rate of return on their investment. The cost of debt, on the other hand, is easier to calculate as it is usually based on the yield to maturity of the company’s existing debt. Companies can deduct interest costs from taxes, resulting in a lower after-tax cost of debt. This is calculated by multiplying the cost of debt by (1 – tax rate).

Conclusion

WACC is a very useful tool in financial analysis, but it needs to be used with caution. WACC calculations can be complex and require a deep understanding of a company’s capital structure. Therefore, it is important to use WACC along with other financial metrics to get a more complete picture of the financial health and investment potential of a company.

Also Read: 5 Secrets to Using Crypto Trading Signals to Increase Investment Profits!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Investopedia. WACC (Weighted Average Cost of Capital). Accessed on August 21, 2025