Margin Call Alert: A Complete Guide to Managing Investment Risk

Jakarta, Pintu News – Margin call is a term often heard in the investment world, but not all investors understand what a margin call is and how to deal with it. This article will explain in depth about margin calls, examples of margin call situations, and strategies to avoid them.

Definition of Margin Call

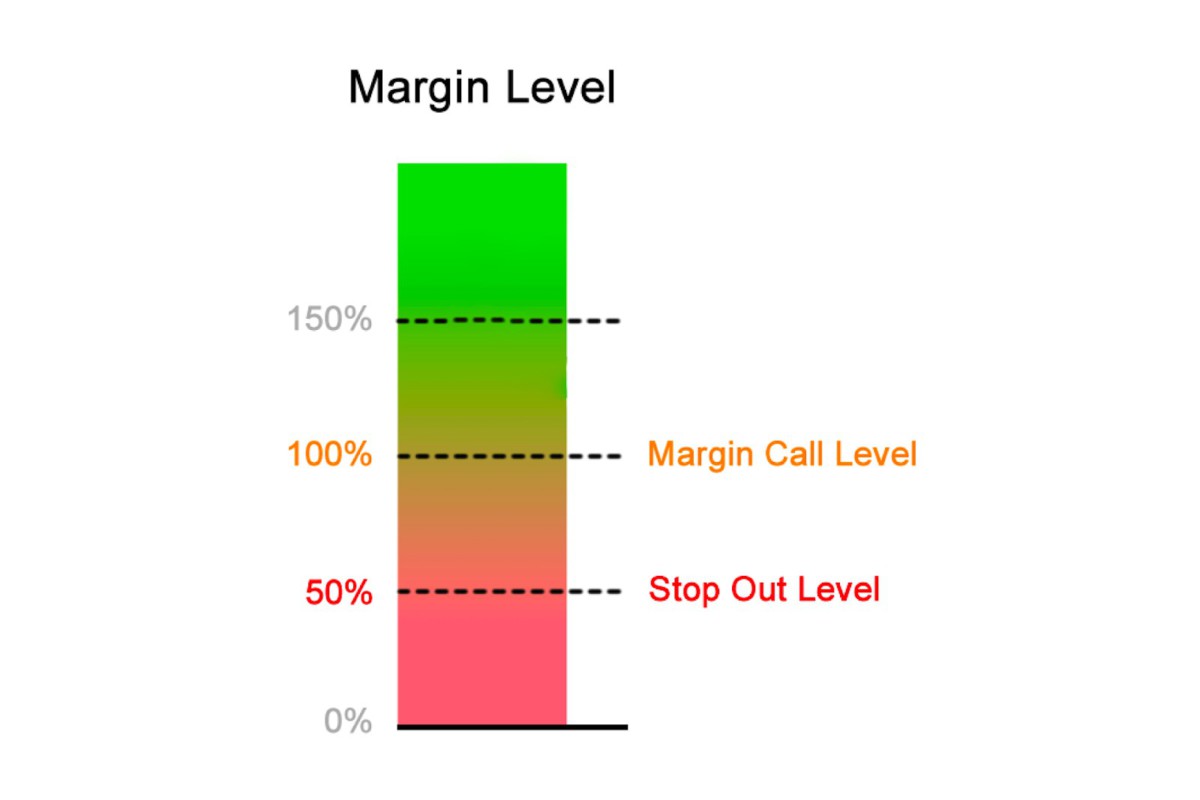

A margin call occurs when the value of securities in an investor’s margin account drops and no longer meets the minimum capital requirements set by the broker. A margin account is an account where an investor uses a combination of personal funds and borrowed funds from a broker to purchase securities.

When the value of those securities drops, the investor’s percentage of equity in the account also drops, triggering what is called a margin call. A margin call is a request from the broker for the investor to add funds or securities into the account to meet maintenance requirements. If not addressed, the broker may sell assets in the account to meet the shortfall, often without the investor’s consent.

Also Read: 5 Trading Signals Bitcoin (BTC) is Under Pressure-Is This the Start of a Major Correction?

Margin Call Example

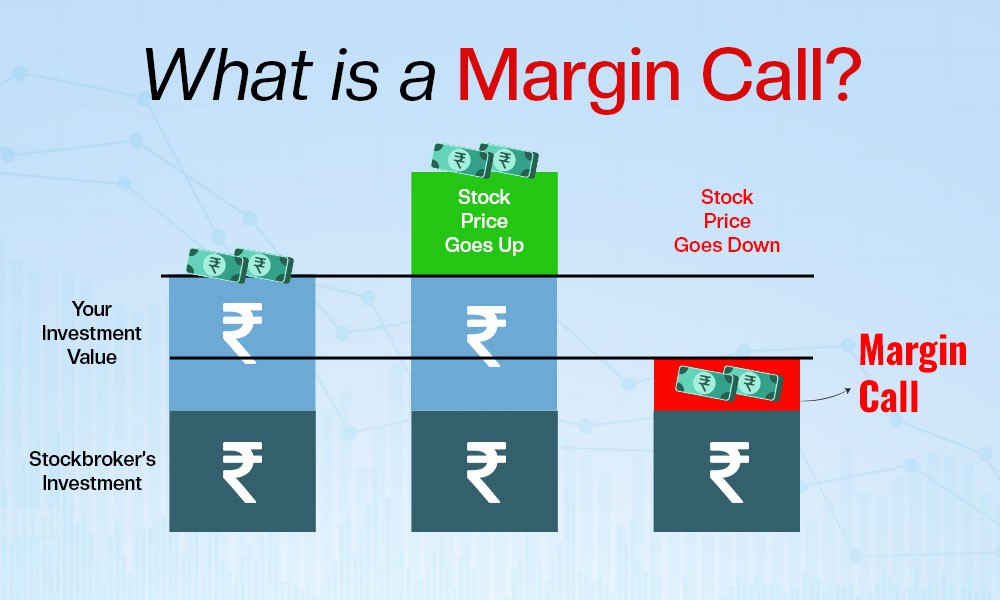

Suppose an investor buys $10,000 worth of stocks using $5,000 of personal money and $5,000 borrowed from a broker. If the value of the stock drops to $6,000, the investor’s equity drops to $1,000 ($6,000 current value minus $5,000 loan). If the broker’s maintenance requirement is 30%, then the minimum account value should be $1,800 (30% of $6,000).

Since the current equity is only $1,000, there is an $800 shortfall that the investor needs to address immediately. The investor has several options: adding cash to the account, adding collateralizable securities, or selling some assets to cover the shortfall. If no action is taken, the broker may sell assets to bring the account value back to the minimum requirement.

Margin Call Avoidance Strategy

One of the best ways to avoid margin calls is to actively monitor account values and use stop loss orders to limit losses. Investors are also advised not to use all available borrowing facilities and maintain a buffer of cash or securities higher than the minimum requirements.

Also, understanding the risks and costs associated with margin accounts is essential before deciding to invest using margin. Interest charged on margin loans can reduce profits and increase losses, especially if the market moves against positions taken.

Conclusion

Investing on margin offers the potential for greater returns, but also comes with higher risks, including the possibility of margin calls. Investors should consider carefully before choosing to invest on margin and should always be prepared with strategies to manage such risks.

Also Read: 5 Secrets to Using Crypto Trading Signals to Increase Investment Profits!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Investopedia. Margin Call. Accessed on August 21, 2025