Ethereum Price Holds Around $4,200 on August 22, 2025 — Is a Drop Below $4,000 Coming?

Jakarta, Pintu News – Ethereum’s attempted rally in early August pushed the largest altcoin to a cyclical peak of $4,793 on August 14, marking one of its strongest performances all year.

However, the sharp spike also triggered a wave of profit-taking, which subsequently depressed the asset’s price and erased most of its recent gains.

With the increased sell-off in the derivatives market, ETH now faces the risk of falling through the $4,000 price level.

Ethereum Price Drops 0.36% in 24 Hours

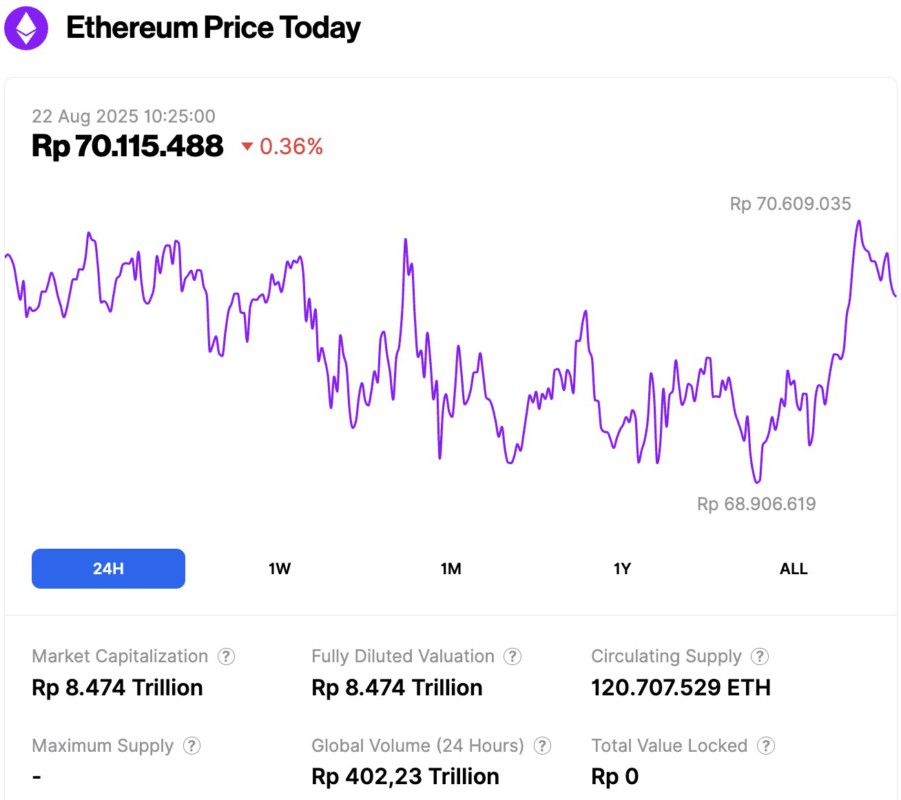

On August 22, 2025, Ethereum was trading at around $4,275, equivalent to approximately IDR 70,115,488, marking a slight 0.36% dip over the past 24 hours. Within this timeframe, ETH reached a low of IDR 68,906,619 and a high of IDR 70,609,035.

At the time of writing, Ethereum’s market capitalization is valued at roughly IDR 8,474 trillion, while its daily trading volume has declined by 30% to IDR 402.23 trillion in the last 24 hours.

Read also: Bitcoin Price Crashes to $113,000 on August 22, 2025: 4 Key Signs You Should Know

ETH faces heavy selling pressure

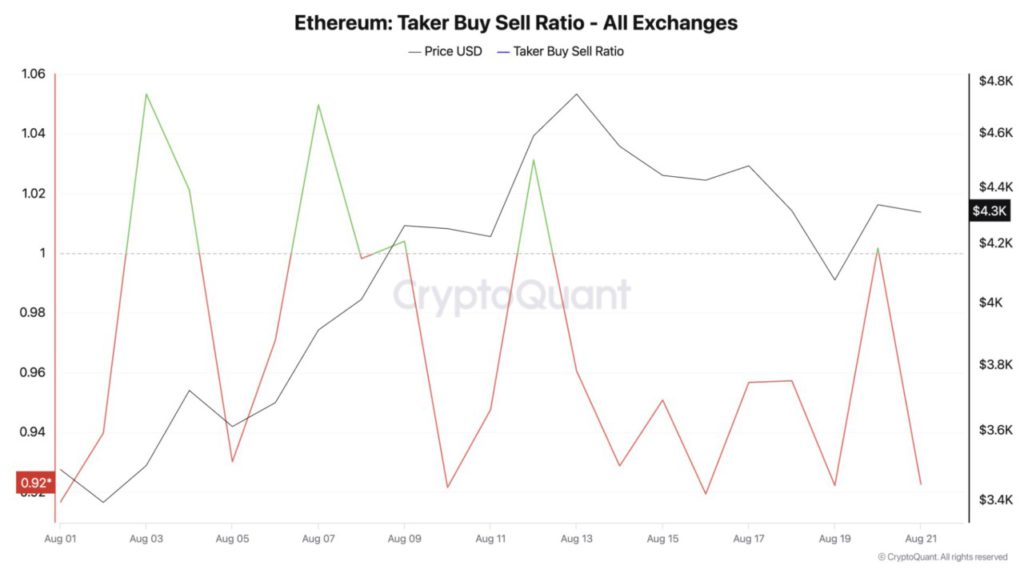

ETH price continues to be under pressure due to bearish sentiment among its derivatives traders. This is reflected in the buy/sell taker ratio which since early August has mostly stayed below one.

According to CryptoQuant data, at the time of writing this report, the ratio stands at 0.92, indicating that sell orders dominate buy orders in the ETH futures market.

The taker buy-sell ratio itself measures the balance between buy and sell orders in the futures market of an asset. If the number is above one, it means that buying pressure is stronger, signaling traders are actively pursuing price increases.

Conversely, values below one indicate the dominance of selling pressure, usually related to profit-taking or bearish sentiment.

Since early August, ETH’ s buy/sell taker ratio has mostly remained below one, confirming a continuous wave of sell-offs from futures traders.

To give you an idea, ETH’s performance had been relatively sluggish throughout the year. Therefore, when an uptrend finally emerged in July and continued into early August, many traders seized the moment to secure profits.

This growing selling pressure confirms the weakening bullish sentiment, and if it continues, could exacerbate ETH’s price decline.

Traders abandon high-risk bets amid price pressure

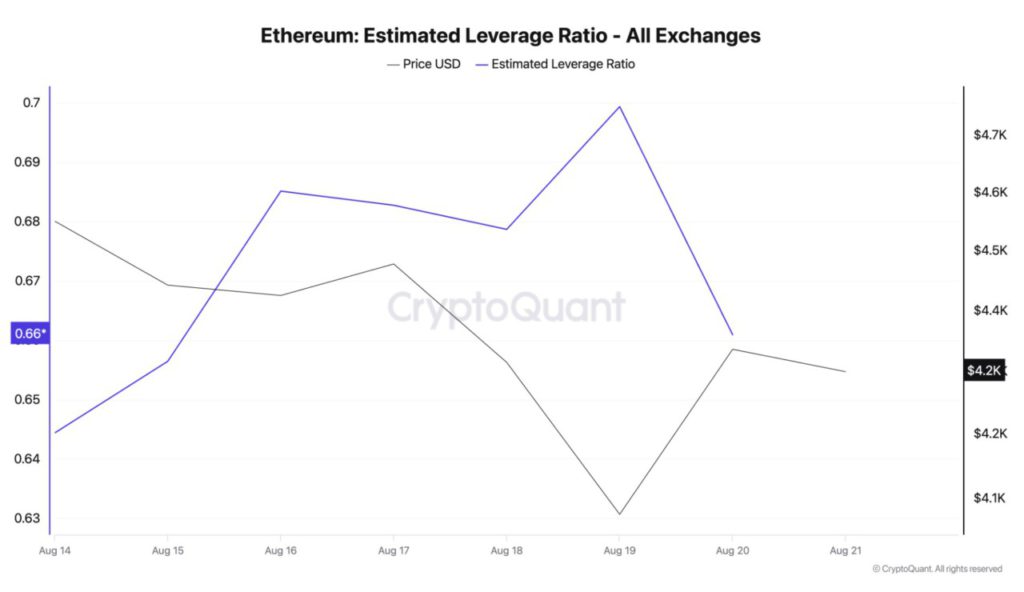

The latest drop in ETH’s Estimated Leverage Ratio (ELR) also confirms the low level of confidence among coin holders. Based on CryptoQuant data, ETH’s ELR is currently at 0.66 – the lowest value in the last five days.

Read also: Toyota Launches Blockchain to Turn Vehicles into Digital Assets!

The ELR of an asset measures the average leverage that traders use to make transactions on a crypto exchange. This calculation is derived by dividing the asset’s open interest by the exchange’s reserves for the same currency.

When the ELR of an asset falls, it reflects a reduced risk appetite among traders. This trend suggests that ETH investors have become more cautious in the past week, and are now avoiding highly leveraged positions that could potentially magnify losses.

Which came first: $3,491 or $4,793?

At the time of writing, ETH is trading at $4,295. If the selling pressure gets stronger, this altcoin has the potential to retest the support level at $4,063. If the key price point is broken, ETH could plummet to $3,491.

On the other hand, if new demand emerges in the market, ETH has a chance to bounce up and test the $4,793 level again.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum’s Early August Surge Meets Reality Check as Bears Eye Dip Below $4,000. Accessed on August 22, 2025