Antam Gold Price Chart Today – August 22, 2025

Jakarta, Pintu News – Gold is still one of Indonesians’ favorite investment instruments, especially as it is considered a hedging asset amid global economic uncertainty.

Based on data from BRANKAS LM as of Friday, August 22, 2025 at 08:25 WIB, Antam’s gold purchase price was recorded at IDR 1,856,600 per gram for corporate BRANKAS and IDR 1,916,000 per gram for physical gold. Both increased by IDR 2,000 compared to the previous day.

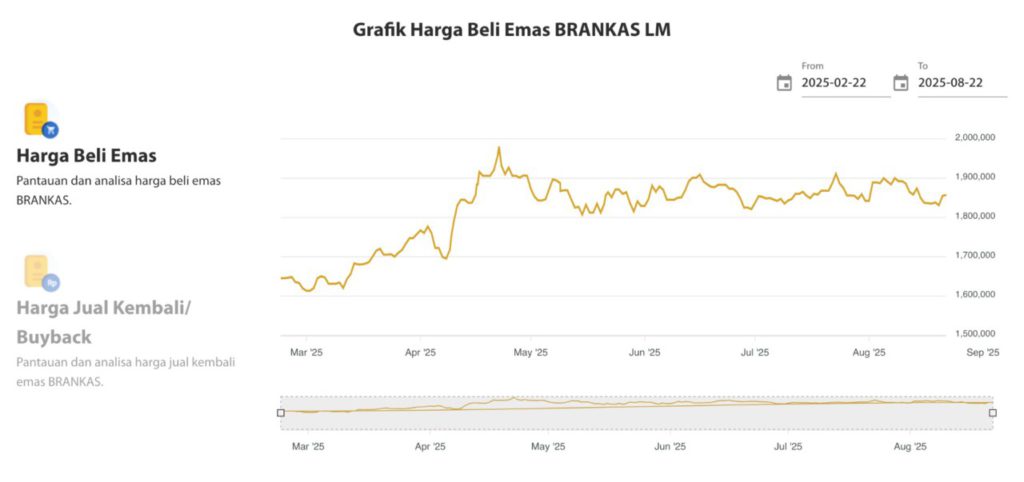

Below is a summary of gold price conditions and trends over the past six months.

1. Latest Antam Gold Price

According to BRANKAS LM data, today’s corporate gold price stands at Rp1,856,600 per gram, up from Rp1,854,600 per gram previously. Meanwhile, the physical gold price rose to Rp1,916,000 per gram from Rp1,914,000 per gram. This is a relatively small increase, but it still signals stable market demand.

The increase in gold prices is influenced by global conditions, including the movement of the rupiah exchange rate against the US dollar as well as fluctuations in world gold prices. BRANKAS LM notes that domestic gold prices generally move in line with international gold prices, despite the additional factors of import and distribution costs.

Also Read: 3 Predictions in the Crypto World in 2026 Based on Historical Data

2. Price Chart Trend of Last 6 Months

If you look at the BRANKAS gold price chart from February 22, 2025 to August 22, 2025, the trend shows quite dynamic fluctuations. In early March 2025, the price of gold was still in the range of Rp1,650,000 per gram, then it jumped sharply in April 2025 to break through Rp1,900,000 per gram.

The sharp increase occurred amid global geopolitical issues and increased investor demand for safe haven assets. However, after May 2025, gold prices tend to experience corrections and move in the range of Rp1,850,000 – Rp1,900,000 per gram until August 2025.

3. Factors Affecting the Gold Price

BRANKAS LM notes that gold prices are influenced by a number of external factors. First, international gold prices traded in the global market. If the world gold price rises, then the price of Antam gold in the country also tends to rise.

Second, the exchange rate of the rupiah against the US dollar. Since international gold transactions use dollars, a weakening rupiah will make domestic gold prices rise. Third, global interest rates are also influential. When interest rates are low, investors prefer to store assets in hedging instruments such as gold.

4. Gold as an Investment Instrument

According to the BRANKAS LM report, gold is still a desirable investment instrument due to its relatively stable nature compared to high-risk instruments such as stocks or cryptocurrencies. Gold is often chosen by investors as a portfolio diversification asset.

In the long run, gold has proven to be able to preserve the value of wealth despite short-term price fluctuations. Therefore, many investors have made gold one of the pillars of an investment strategy that focuses on capital security.

5. Gold Price Outlook Going Forward

Based on BRANKAS LM’s analysis, the outlook for gold prices in the coming months is influenced by the policies of the United States central bank (The Fed) as well as global geopolitical tensions. If the Fed cuts interest rates, then gold prices have the potential to rise again due to increased investor demand.

On the other hand, domestic demand factors, especially ahead of the festive season or certain moments, can also push up prices. BRANKAS LM emphasizes that investors should monitor price trends regularly before deciding to buy or sell gold.

Also Read: Dogecoin Breakthrough Prediction: Analyst Ali Martinez Predicts DOGE Price Spike of Up to 40%

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BRANKAS LM. BRANKAS Gold Price Dashboard. Accessed August 22, 2025