Bitcoin Holds Steady at $113,000 Today as Transaction Fees Drop to Record Lows

Jakarta, Pintu News – As reported by Crypto News (24/8), Bitcoin transaction fees plummeted to their lowest level in more than a decade, as public sentiment towards a possible Federal Reserve interest rate cut heated up, raising questions about the sustainability of the market.

Then, how is the current Bitcoin price movement?

Bitcoin Price Drops 1.64% in 24 Hours

On August 25, 2025, Bitcoin was priced at $113,431, equivalent to IDR 1,841,108,426, marking a 1.64% decline over the past 24 hours. During this time, BTC hit a low of IDR 1,822,060,505 and climbed to a high of IDR 1,871,855,628.

At the time of writing, Bitcoin’s market capitalization is approximately IDR 36,532 trillion, while 24-hour trading volume has surged 41% to IDR 688.73 trillion.

Read also: 5 Five Altcoins Gaining Momentum as September 2025 Approaches

Bitcoin Network Transaction Fees Drop

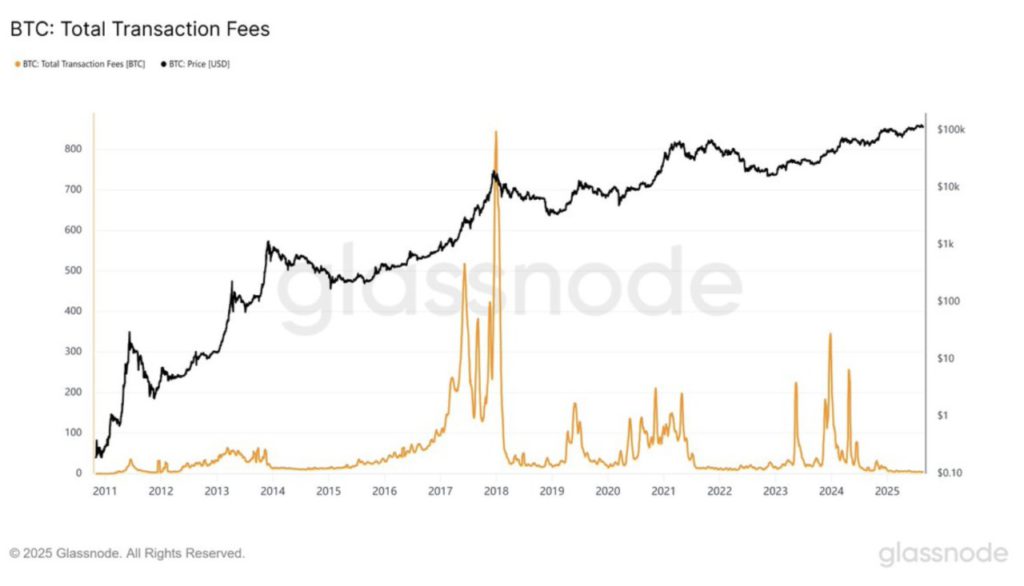

Based on Glassnode’s data, the daily transaction fee on the Bitcoin network (14-day SMA) recently dropped to 3.5 BTC. This is the lowest level since late 2011.

The main driver of recent market gains was Fed Chair Jerome Powell’s speech at Jackson Hole, where he signaled a possible interest rate cut by stating that “shifts in the balance of risks could warrant policy adjustments.”

Social Sentiment Enters Dangerous Territory for the Bullish Side

Mentions of keywords such as “Fed,” “rate,” and “cut” on various social media platforms have skyrocketed. Data from Santiment shows this spike is the highest in 11 months.

A major outburst of discussion about a single bullish narrative usually signals that the market euphoria has gone too far. When social sentiment towards a catalyst reaches extreme levels, it often coincides with the formation of a local price peak.

Glassnode’s analysis highlights a worrying state of affairs for Bitcoin holders. Since the beginning of July, there has been a heavy accumulation of supply in the $113,000 to $120,000 price range, the majority of which is held by investors with less than three months of ownership.

Read also: Bitcoin Loses Ground While 7 Altcoins Gain Attention

The SOPR by Age metric for this group of short-term holders is currently in the range of 0.96 to 1.01. The data shows a slight decline in realized gains.

Inflows to Exchanges Give Worrying Signals

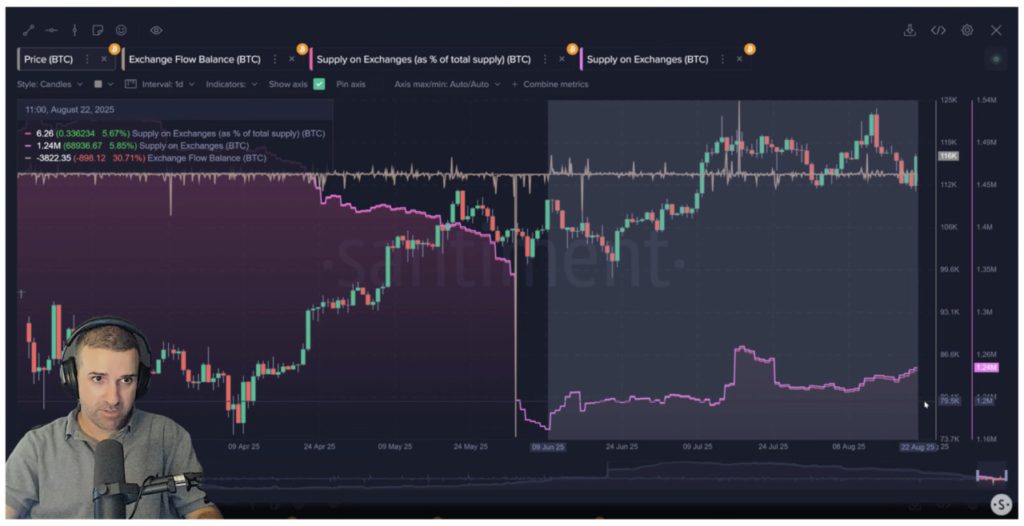

One worrying trend is the increasing supply of Bitcoin on exchanges. Since the beginning of June, the amount of BTC stored on exchanges increased by almost 70,000 coins.

This reverses a long-term trend where coins are usually moved to cold storage, and suggests that more and more Bitcoin holders are preparing to sell.

Historically, rising balances on exchanges often precede selling pressure, as investors move coins onto platforms in preparation for liquidation.

Bitcoin’s on-chain health metrics are currently showing neutral to cautious conditions, with the number of daily active addresses and transaction volume starting to decline from recent peak levels.

Meanwhile, the long-term MVRV ratio stood at 18.5%, signaling a somewhat risky zone for new investments.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto News. Bitcoin daily transaction fees hit lowest since 2011, Fed rate cut talk signals a local top. Accessed on August 25, 2025