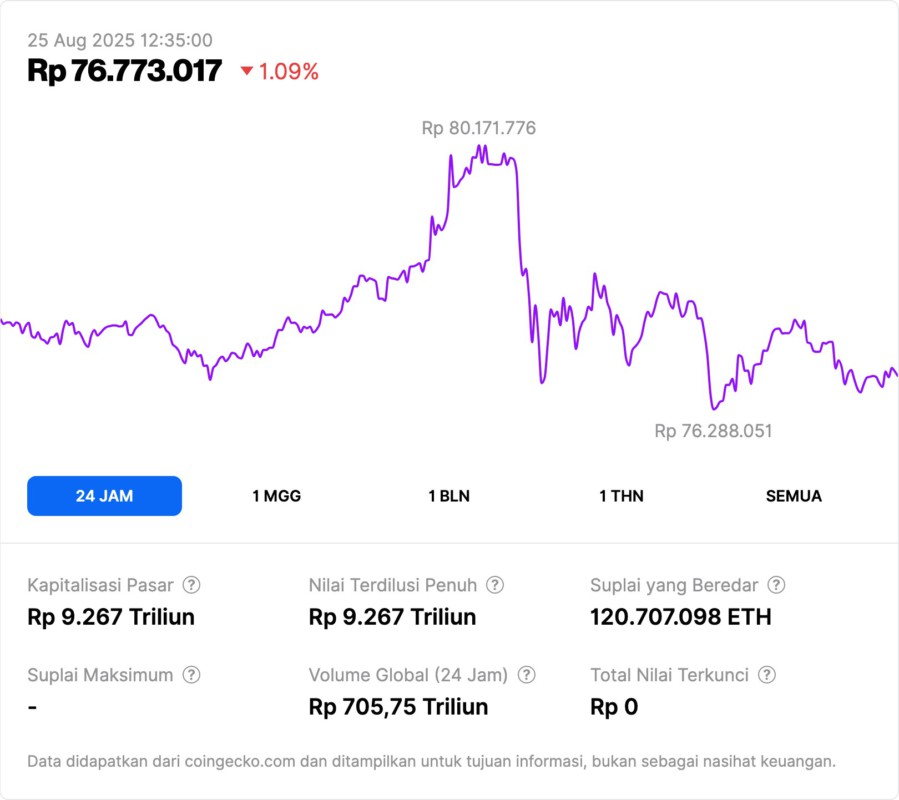

Ethereum (ETH) hits record highs, attractive investment opportunities in 2025

Jakarta, Pintu News – By 2025, Ethereum had reached near-record high prices, indicating strong investor demand amid growing institutional adoption.

Tom Lee, head of research at Fundstrat, predicts that Ethereum (ETH) could reach $15,000 by the end of the year. This signals renewed optimism regarding Ethereum’s role in stablecoins, decentralized finance , and tokenization of real-world assets.

Ethereum (ETH) Direct Holdings

Investing directly in Ethereum (ETH) is the purest way to get involved in the ecosystem. Investors have full control over assets and direct access to the DeFi ecosystem, NFTs, and staking in Ethereum. Ethereum (ETH) is traded 24/7 on global markets, but investors must manage the security and ownership of assets, either through personal wallets or third-party storage.

The fees involved are generally limited to exchange and gas fees. However, investors should also be prepared for evolving regulations that could affect the way they hold and transact with Ethereum (ETH).

Also Read: Ondo Finance (ONDO): RWA Project Claimed to be 10x in 2026, Is it True? Here’s the Analysis!

Ethereum (ETH) Spot ETF: Orderly Simplicity

Ethereum (ETH) spot ETFs have enabled traditional investors to gain exposure to Ethereum (ETH) through their brokerage accounts in a regulated manner. Several issuers are now seeking permission from the US Securities and Exchange Commission (SEC) to add staking features to their products.

If approved, the staking will allow the fund to earn additional yield by securing Ethereum’s proof-of-stake network and flowing that income to shareholders. This would be a first for a crypto ETF in the US, providing an opportunity for investors to earn passive income while maintaining a regulated and accessible investment structure.

Corporate Treasury: Equity Exposure with Additional Volatility

Investing in shares of companies that have Ethereum (ETH) in their treasury is another route. For example, BitMine Immersion Technologies has revealed that it owns more than 1.5 million Ethereum (ETH), which is currently worth around $7.3 billion.

This approach ties shareholder value to movements in the price of Ethereum (ETH) and, potentially, the company’s staking income. However, this equity exposure adds new risks, including share price fluctuations that may not always correlate directly with the price of Ethereum (ETH).

Also Read: Notcoin (NOT): Why 100 Billion Supply Could Be a Strength and Risk in the Crypto World

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as Bitcoin price today, XRP coin price today, Dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coindesk. Getting ETH Exposure in 2025: Ether Near Record Highs, Tom Lee Can See $15K by Year End. Accessed on August 25, 2025