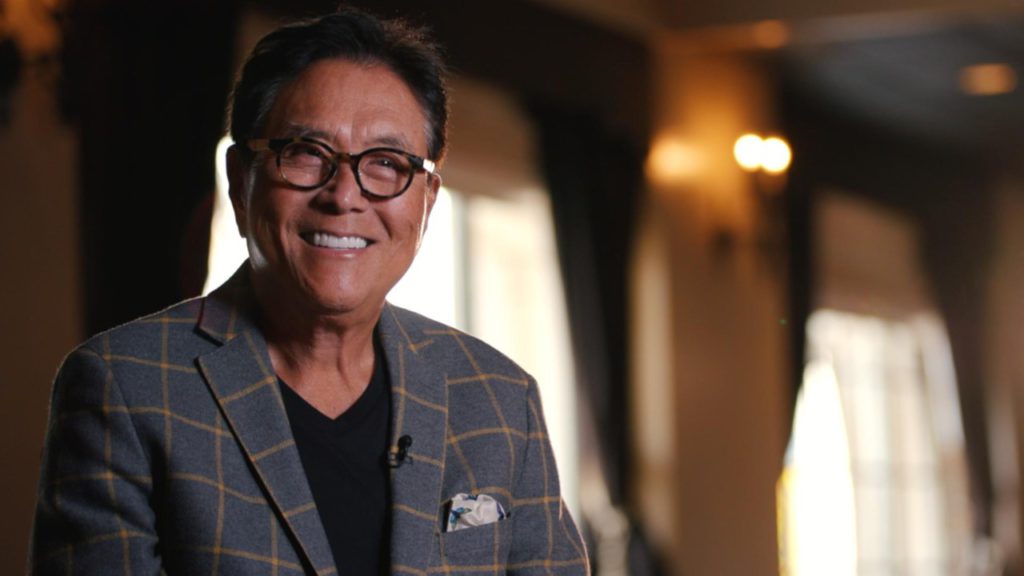

Robert Kiyosaki reveals the reality of sudden wealth: Many People Remain Poor After Getting Rich?

Jakarta, Pintu News – Wealth is no guarantee of financial freedom. This is the main message delivered by Robert Kiyosaki, author of the legendary book Rich Dad Poor Dad.

In his latest post on the X platform (formerly Twitter), Kiyosaki exposes the harsh reality that professional athletes, lottery winners, and ordinary workers often experience: they make millions of dollars throughout their lives, but still end up poor.

1. Sudden Wealth Doesn’t Guarantee a Financial Future

Robert Kiyosaki says that money, in many cases, actually makes individuals and countries poorer. He gave an example of many professional athletes who earn a large income, but eventually go bankrupt within 7 years of retirement. Data recorded that around 65% of professional athletes went bankrupt within that period.

Something similar happens to lottery winners. Instant wealth is often followed by financial ruin due to a lack of understanding and money management. Kiyosaki concludes that “money without financial education is like a weapon without training.”

Also Read: Ondo Finance (ONDO): RWA Project Claimed to be 10x in 2026, Is it True? Here’s the Analysis!

2. Ordinary Workers Are Also Caught in the Same Pattern

Kiyosaki expanded his view by targeting ordinary workers. He gives the example of a restaurant waiter in the United States who can earn $35,000 per year for 50 years, a total of about $1.75 million or more than Rp28 billion, but still live in poverty when he retires.

According to him, this is due to poor financial patterns and lack of financial education from an early age. High income does not necessarily guarantee wealth if it is not accompanied by intelligence in managing assets, savings and investments.

3. Education system fails to educate about money

Kiyosaki emphasizes that formal education today is more focused on theory and academics, not on financial realities. He blames the education system that is “taught by teachers who are academically smart, but financially poor.” This mirrors the “Poor Dad” character in his book.

As a solution, he suggests that people learn from mentors or “wealthy gurus ” – like the advisors featured in the Rich Dad network. They write books on business, financial resilience and real mission-based entrepreneurship.

4. The Importance of Investing in Real Assets

In his closing message, Kiyosaki urges people to not only work hard, but also learn to manage the fruits of that labor. He questions, “Why win the lottery only to go broke? Why work a lifetime only to remain poor?”

He has again raised concerns about fiat currencies such as the US dollar that continue to weaken. On numerous occasions, Kiyosaki has repeatedly advocated investing in gold, silver, and Bitcoin as a form of protection from a potential economic crisis.

5. Moral Message: Wealth Requires Financial Intelligence

Kiyosaki’s core message is that income does not equal wealth. To be truly financially free, one must have strong financial literacy, not just a big salary. Many people are “trapped” in extravagant lifestyles and high consumption patterns simply because they feel secure with a steady income.

Financial intelligence allows one to make smart decisions about investments, savings, debt, and strategies to survive in uncertain economic conditions.

Conclusion

Kiyosaki exposes the harsh reality that money alone is not enough. Without financial literacy and intelligence, both sudden wealth and a steady paycheck can be lost. This message is an important reflection amidst the growing interest in crypto assets and instant opportunities in the digital world.

Also Read: Notcoin (NOT): Why 100 Billion Supply Could Be a Strength and Risk in the Crypto World

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto markets such as Bitcoin price today, XRP coin price today, Dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Kevin Helms / Bitcoin.com News. Robert Kiyosaki Exposes the Brutal Truth Behind Sudden Wealth and Collapse