Ethereum Price Prediction: Will Ethereum Climb Beyond $5,500 or Face a Pullback?

Jakarta, Pintu News – As of August 24, 2025, the price of Ethereum is still holding strong, briefly up 1.1% at around $4,770. The asset is trading less than 2% below its record high, with gains in the last three months reaching 85% and a yearly yield of more than 70%.

This rally has been one of the strongest among the major altcoins, but traders are now divided on two possibilities: a short correction or a continued rally that pushes ETH through the $5,500 level. Both scenarios have reasons to support them.

Big Holders Continue to Accumulate

Ethereum’s price remains resilient around $4,770, while large holders are quietly adding to their holdings. Wallets with balances between 1 million and 10 million ETH increased their holdings from 7.42 million ETH ($35.39 billion) on August 19 to 7.63 million ETH ($36.39 billion) as of August 24.

Read also: BitMine Expands the World’s Largest ETH Reserve, Turning a $45M Buy Into $1.9B Gains

This means that an additional approximately 210,000 ETH worth approximately $1 billion has been absorbed in the past few days.

At the same time, the group holding 10 million-100 million ETH also increased its holdings from 66.8 million ETH ($318.63 billion) to 66.94 million ETH ($319.30 billion), an increase of about 140,000 ETH with a value of $668 million.

This consistent accumulation, despite Ethereum’s price being near its highs, reflects a strong conviction. However, while spot buying is strengthening the foundation, on-chain activity is showing signs of profit-taking.

This is where metrics such as liveliness and cost-based heatmaps provide an additional layer of context.

Liveliness Hints at Correction, But Limited

The Ethereum Liveliness metric, which measures whether the coin is being held or traded more, has risen to its highest monthly level above 0.70. A higher number indicates more long-hold coins are starting to move, which is usually associated with profit-taking.

The last time liveliness spiked in early August, Ethereum price dropped from $4,748 to $4,077 in just a few days. A similar cooling may occur again now, although the scale is likely smaller due to the presence of a strong demand zone below the current price.

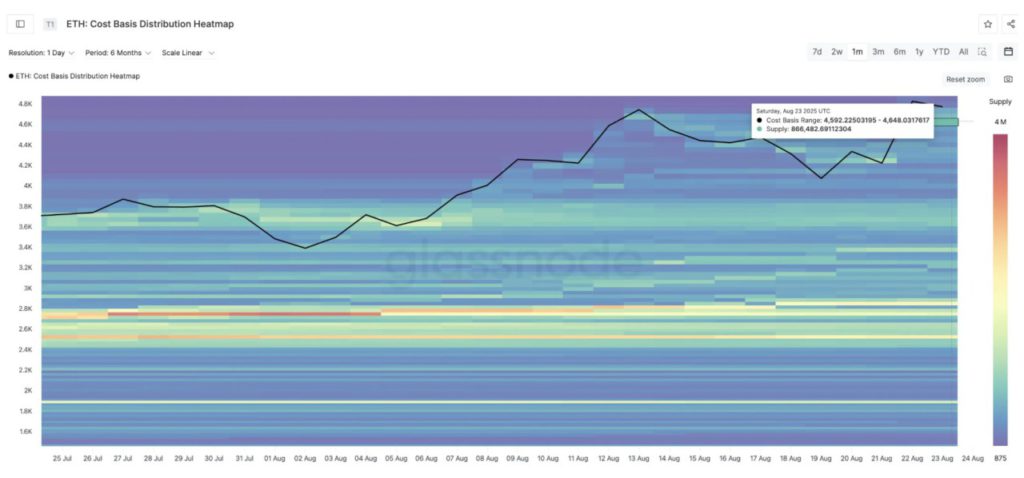

One of the reasons why the potential correction could be limited is seen in Ethereum’s Cost Basis Distribution Heatmap. This tool shows at what price level the coin last changed hands, thus highlighting the price zones with concentrated ETH buying activity.

Three main clusters were formed:

- $4,592-$4,648 with almost 866,000 ETH

- $4,648-$4,704 with almost 700,000 ETH

- $4,704-$4,761 with almost 545,000 ETH

Combined, these accumulation layers suggest a large demand in the $4,590-$4,761 range. If ETH drops to that zone, it is likely that buyers will quickly absorb the selling pressure so that the downside risk could be limited.

Read also: Whales Return to Accumulate as PEPE Turns Green – What’s Next?

This is made even more apparent by the accumulation actions of large holders, including whales, who continue to add ETH as the rally progresses – and are likely to do the same if the price drops slightly.

Ethereum Price Levels to Watch

From a technical standpoint, Ethereum recently respected the 0.618 Fibonacci extension level at $4,948, which is often one of the strongest areas of resistance.

If it manages to close the day convincingly above this level, the path to the extension 1.0 at $5,496 will be open – which also marks an important milestone around $5,500.

On the downside, failure to defend the $4,610 zone-which is in line with Fibonacci support as well as accumulation areas within the cost basis clusters-couldtrigger a move down towards $4,400.

However, this scenario is likely to happen only if whales and large holders of ETH start selling, which so far doesn’t seem to be the case.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Price Pullback or Further Rally. Accessed on August 25, 2025