3 Powerful Indicators Driving HBAR to Become the ‘Star’ of the Crypto Bull Run

Jakarta, Pintu News – The cryptocurrency market is always full of unexpected dynamics, and Hedera Hashgraph seems to be a hot topic among major investors.

A number of indicators hint at potential upside, and according to the analysis of Ananda Banerjee, technical content writer at BeInCrypto, there are several reasons why HBAR has a chance to become a star amid the ongoing bull market.

Check out the full analysis in this article!

Strengthening Accumulation by Whale

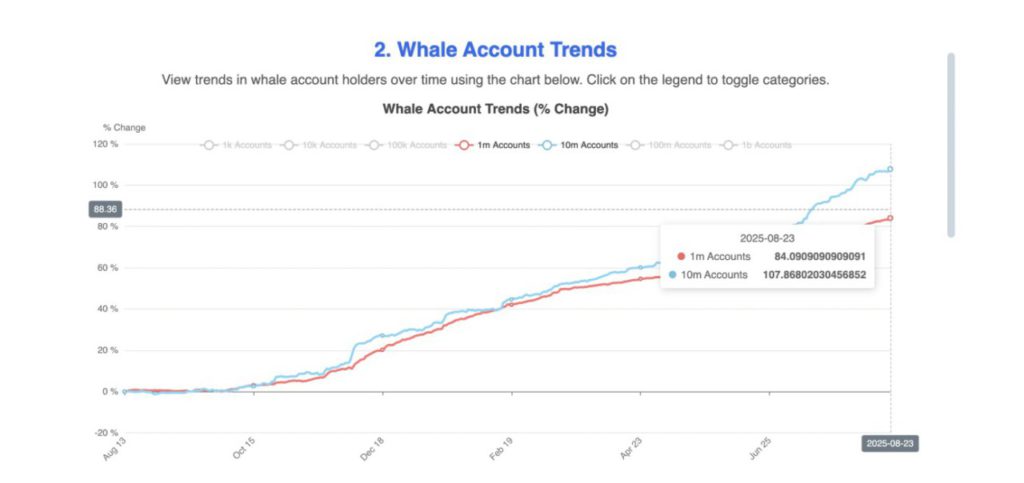

In the past week, large holders of Hedera Hashgraph (HBAR) have increased their holdings significantly. Accounts holding at least 1 million tokens increased from 82.41 on August 16 to 84.09 on August 23.

Meanwhile, the group with 10 million tokens also showed an increase from 106.59 to 107.86 in the same period.

At Hedera Hashgraph’s (HBAR) current price of $0.25, this addition reflects the acquisition of a minimum of 1.68 million tokens worth $420,000 in the 1 million pool and 1.27 million tokens worth $317,500 in the 10 million pool.

This steady accumulation shows quiet confidence among whales, indicating their expectation of further price increases.

Read also: RWA Tokenization Gaining Ground, Asia Pacific to Play a Strategic Role in 2025?

RSI Divergence Adds to Optimism

Accumulation by whales is now supported by momentum signals. Between August 19 and August 22, the price of Hedera Hashgraph (HBAR) dropped from $0.23 to $0.22, registering a lower low. However, in the same period, the Relative Strength Index (RSI) increased from 43 to 51.

This bullish divergence indicates that although the price action is showing weakness, the underlying demand is actually strengthening.

In other words, buyers are quietly absorbing supply despite the decline in spot prices, which reinforces the accumulation already seen among the whale group. The combination of increased whale holdings and an improving RSI indicates growing confidence in the market.

Also read: Ethereum (ETH) Touches $4,900 After Jerome Powell’s Speech, Will it Last?

HBAR Price Action and Key Levels

Hedera Hashgraph (HBAR) price is currently trading near $0.25, holding above immediate support. For a stronger rally, the price needs to break resistance at $0.27. If successful, this could push the price towards $0.30 and higher, potentially outpacing the broader market.

On the other hand, failure to hold support could trigger downside risks. A drop below $0.22 could expose the price to further declines, with little technical support up to $0.15.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Hbar Price Metrics Hint at Potential Market Rally. Accessed on August 25, 2025

- Featured Image: Vritmes