5 Crypto Market Signals: Has Bitcoin’s Bull Run Ended at Rp1.8 Billion?

Jakarta, Pintu News – While many are calling the “bull run over”, some analysts argue that this is a natural correction phase after a sharp rise. Trader Roman, for example, sees a head and shoulders pattern indicating a potential further decline.

Analyst BorisD of CryptoQuant revealed that as long as the $105 , 000 level holds, the potential for a rebound remains open. This is a critical level that will determine the direction of the market in the next few weeks.

1. Bitcoin (BTC) Price Falls to the Lowest Level in Weeks

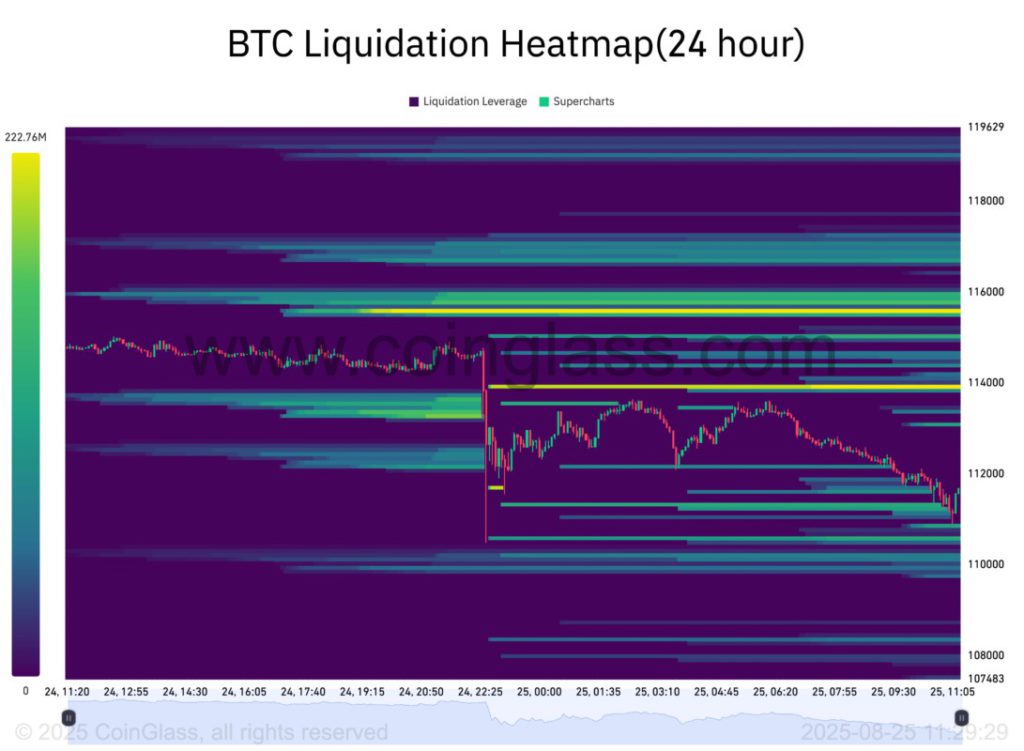

Bitcoin started the last week of August 2025 with significant selling pressure. Based on data from Cointelegraph Markets Pro and TradingView, the price of BTC briefly touched $110 , 700 – its lowest point since July 10. This is a warning for leveraged investors who opened long positions too late.

According to analytics platform CoinGlass, there was a $640 million liquidation of long positions in crypto in 24 hours. Many traders are now projecting a potential drop to the psychological $100,000 level if the selling pressure continues.

Also Read: Ondo Finance could be a crypto dark horse in Q4 2025? Here are 4 ONDO facts to know!

2. Gap Spikes in CME Futures Come into Focus

Traders like Daan Crypto Trades mentioned that BTC opened the week with a large “gap” in the CME futures market. This gap is considered an important technical signal, as generally the market tries to fill the gap within one or two trading days.

Daan noted that this gap is the largest in recent weeks, which has the potential to create high volatility. On the other hand, trader Jelle warns that the pressure is still strong and if the price fails to hold in the current area, BTC could drop back to its previous range below $100,000.

3. Bitcoin Whale Action: Massive Profit Taking

Last weekend’s price drop sparked speculation regarding the actions of whales or owners of large amounts of BTC. Based on data from Arkham via Lookonchain, one entity sold around 22,769 BTC worth $2 . 59 billion and converted it to Ethereum (ETH).

The entity bought around 472,920 ETH worth $2.22 billion and opened additional long positions. Vijay Boyapati, a Bitcoin watcher, called this distribution a “healthy” process as it helps expand BTC holdings to the public at large.

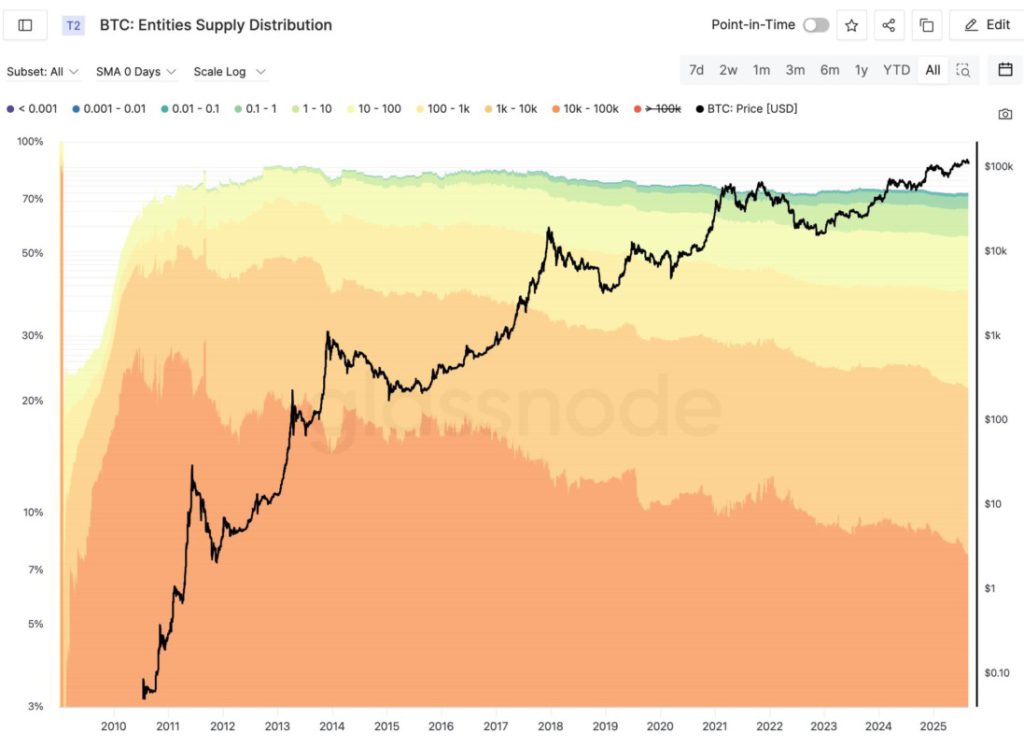

4. Small Investors Still Keep Accumulating

Data from CryptoQuant shows that small investors-owners of up to 10 BTC-are still in accumulation mode. Unlike the whales, they keep buying despite the price correction. This reflects long-term confidence in Bitcoin’s potential as a major crypto asset.

Wallets with 10-100 BTC holdings started taking profits after the price touched $118,000 (approximately Rp1.92 billion). Meanwhile, 100-1,000 BTC wallets showed a mixed pattern of distribution and accumulation, signaling uncertainty in the market.

5. Macroeconomic Factors and Potential Interest Rate Cut

External factors also play an important role in the current dynamics of the cryptocurrency market. This week, the market is looking forward to the release of the PCE (Personal Consumption Expenditures) inflation index, which is the Fed’s favorite indicator for assessing inflationary pressures.

At the Jackson Hole symposium, Fed Chair Jerome Powell gave more moderate signals than usual, fueling market expectations of a rate cut in September. According to CME Group’s prediction tool, the probability of a 0.25% rate cut now stands at almost 90%.

Conclusion: Crypto Market Faces Consolidation Phase

While many are calling the “bull run over”, some analysts claim that this is a natural correction phase after a sharp rise. Trader Roman, for example, sees a head and shoulders pattern that indicates a potential further decline.

However, as stated by analyst BorisD from CryptoQuant, as long as the $105 , 000 level holds, the potential for a rebound remains open. This is a critical level that will determine the direction of the market in the next few weeks.

Also Read: XRP or Bitcoin? 3 Facts from the Chart that Reveal the Truth

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- William Suberg / Cointelegraph. BTC bull run over at $111K? 5 things to know in Bitcoin this week. Accessed August 26, 2025