3 US Economic Indicators That Could Affect Crypto Markets This Week

Jakarta, Pintu News – The crypto market is often influenced by various economic data from the United States. This week, there are three important economic indicators that crypto traders and investors need to pay attention to. Here is a full review of the three economic signals, based on analysis from Lockridge Okoth, crypto journalist at BeInCrypto!

US Consumer Confidence and Sentiment

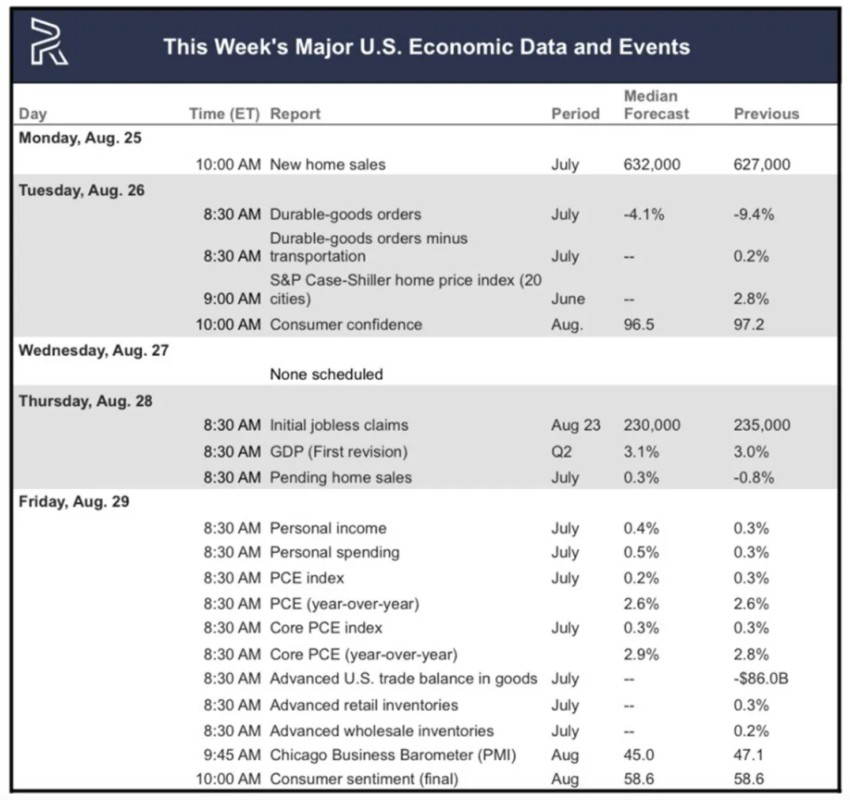

The consumer confidence data to be released on Tuesday is expected to show a decline to 96.5 from the previous value of 97.2. This decline reflects a slight concern among consumers that could have an impact on markets, including the crypto market.

Consumer confidence is an important indicator that shows consumers’ perceptions of current economic conditions and their expectations for the future. Meanwhile, the consumer sentiment report scheduled for Friday is expected to remain stable at 58.6.

This stability suggests that despite concerns, consumers still maintain a certain level of optimism. Changes in consumer sentiment can signal to crypto markets potential changes in spending behavior that could affect the exchange rate of digital currencies.

Read also: Japan Directs Web3 to Boost Domestic Economic Growth, What’s the Strategy?

Initial Jobless Claims

Initial jobless claims are another important indicator for the crypto market. The latest data shows that in the week ending August 16, there were 235,000 jobless claims. However, for the week ending August 23, a drop to 230,000 claims is expected.

This decline could be a positive indicator for the US economy. Lower jobless claims indicate that fewer people are out of work, which could boost consumer confidence and potentially support the price of Bitcoin and other cryptocurrencies.

Crypto markets often react to changes in labor market conditions as these affect liquidity and investment in the tech and financial sectors.

Read also: Brazil Plans to Make Bitcoin a Strategic Reserve, What’s the Purpose?

Personal Consumption Expenditure (PCE)

Personal Consumption Expenditures (PCE) is another important indicator that measures total spending by US consumers on goods and services. This indicator provides a snapshot of the strength of consumer spending, which is a key component of US economic growth.

An increase in PCE indicates that consumers feel confident enough to spend money, which could have a positive impact on the crypto market. A strong PCE could encourage investors to increase their investments in the crypto market, given the link between consumer confidence and the adoption of financial technology. Therefore, the PCE data that will be released this week is very important for crypto market participants to observe.

Conclusion

Keeping an eye on US economic indicators is an important part of trading strategies in the crypto market. Data on consumer confidence, jobless claims, and PCE provide insights that can help in making investment decisions.

By understanding how these indicators affect the market, traders and investors can be better prepared for the volatility that often occurs in the crypto market.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. US Economic Signals for Crypto Traders in Bitcoin and Ethereum. Accessed on August 26, 2025

- Featured Image: Generated by Ai