Crypto Market Tanks, But Whales and Big Investors Keep Buying

Jakarta, Pintu News – On August 26, 2025, the cryptocurrency market experienced significant turmoil, with the total market capitalization falling by 3.83%. This drop triggered a liquidation of nearly $1 billion in crypto, mostly from long positions.

Despite the sharp decline, investors continued to buy on the downside, showing strong confidence in the long-term prospects of this market.

Crypto Market Plummets

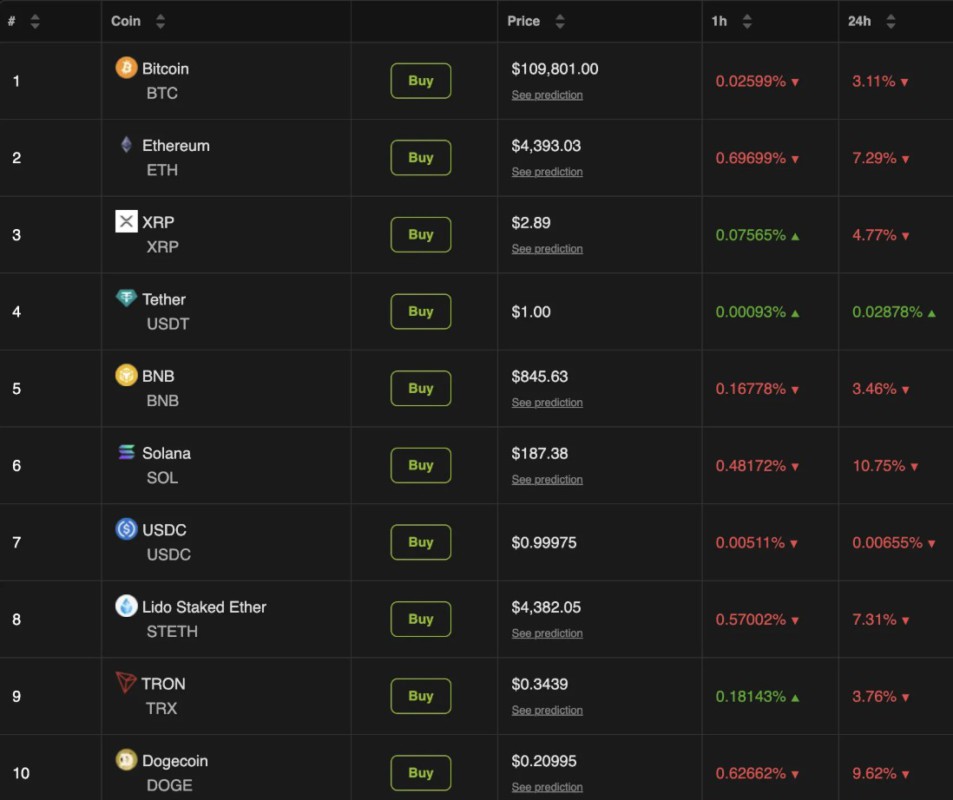

Data from BeInCrypto Markets (26/8) shows that the global crypto market capitalization stands at $3.86 trillion, with most major coins experiencing declines. Among the top 10 coins, Solana recorded the largest decline, down 10.75%.

Read also: PEPE Price Ready to Surge? $19 Million Net Outflows Signal Accumulation

Additionally, Bitcoin fell below the $110,000 threshold and traded at $109,801, down 3.11%. Ethereum experienced an even sharper decline.

The altcoin fell below $4,500 to $4,393, registering a decline of 7.29% in the same period. ETH is now 11.1% below its all-time high recorded on Sunday.

Amidst this downturn, crypto liquidations increased sharply. According to data from Coinglass, a total of 207,102 traders were liquidated, with liquidations totaling $942.72 million.

Of this amount, $832 million came from long positions. The largest single liquidation was recorded on HTX, involving a BTC-USDT trade worth $39.24 million.

Ethereum recorded the highest liquidation of $322.85 million, including $279.79 million from long positions. Bitcoin followed with a total liquidation of $264.73 million.

Causes of Crypto Market Decline

The main cause of this market movement seems to be the sudden crash of Bitcoin, which was triggered by a massive sell-off by whales releasing large amounts of BTC holdings.

Meanwhile, economist and vocal Bitcoin critic, Peter Schiff, commented on this drop, stating that BTC’s decline is cause for concern.

“Bitcoin just dipped below $109K, down 13% from its peak less than two weeks ago. Given all the hype and corporate buying, this weakness should be a reason for concern. At the very least, a drop to around $75K is possible, slightly below the average cost of $MSTR. Sell now and buy back at lower prices,” Schiff wrote.

Whales and Large Investors Remain Active in the Market

Nonetheless, investors seem unfazed by Schiff’s warning, with the sentiment of buying on price drops remaining strong in the market.

Read also: Ethereum Price Rises 3% to $4,500 Today (Aug 27): Are ETH Holders Starting to Sell?

Lookonchain, a blockchain analytics company, reported that a crypto whale (bc1qgf) had bought 455 BTC worth nearly $50.75 million.

“Since July 18, he has purchased 2,419 BTC ($280.87 million) at an average price of $116,104 – now sitting on a loss of over $16 million,” the company wrote.

Lookonchain notes that another OTC swing-trading whale (0xd8d0) invested 99.03 million USDC to buy 10,000 ETH worth almost $43.67 million and 500 Bitcoin worth about $54.99 million.

Additionally, BitMine Immersion, the largest public holder of ETH, added 4,871 coins to its portfolio. The company now holds 1,718,770 ETH worth $7.65 billion.

Finally, a whale address (0x4097) reappeared after four years of inactivity, withdrawing 6,334 ETH worth $28.08 million from Kraken. As such, this massive buying spree suggests that some market participants see the current downturn as an opportunity, rather than a long-term threat.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Crypto Liquidation: Whales Buy the Dip. Accessed on August 27, 2025