3 Reasons Why the Whale Movement in the XPL Crypto Market Can Be a Lesson for Traders

Jakarta, Pintu News – In the fast-moving cryptocurrency market, sharp price changes are often caused by large movements from “crypto whales” (large investors). Recently, the XPL token experienced a price spike of over 200% in just a few minutes after a whale made a large transaction on the Hyperliquid platform.

This incident shows how important it is to understand market dynamics and how major actions by a single entity can affect the market. Here are three things crypto traders can learn from this remarkable move.

1. How Whale Movement Changed the XPL Market in a Short Time

A large wallet that deposited 16 million USDC into the Hyperliquid platform opened a large long position on XPL (XPL Token). In just a few minutes, the move wiped out the entire existing order book, rolling up short positions and driving the price of XPL to soar by more than 200%, from a price of around $0.58 (IDR 9,490) to a peak of $1.80 (IDR 29,654).

According to data from Lookonchain, this whale managed to close a portion of their position in just under a minute, securing a profit of $16 million (IDR 261,568,000,000) in a matter of seconds.

Big moves like this show how the cryptocurrency market can be very susceptible to volatility triggered by large transactions. In situations like this, retail traders, who don’t have the buying power to fight back, are often the losers.

Also Read: Tardigrad Trader Predicts Dogecoin Preparing to Surge 3x Compared to Bitcoin!

2. High Risk for Liquidity Providers and Retail Traders

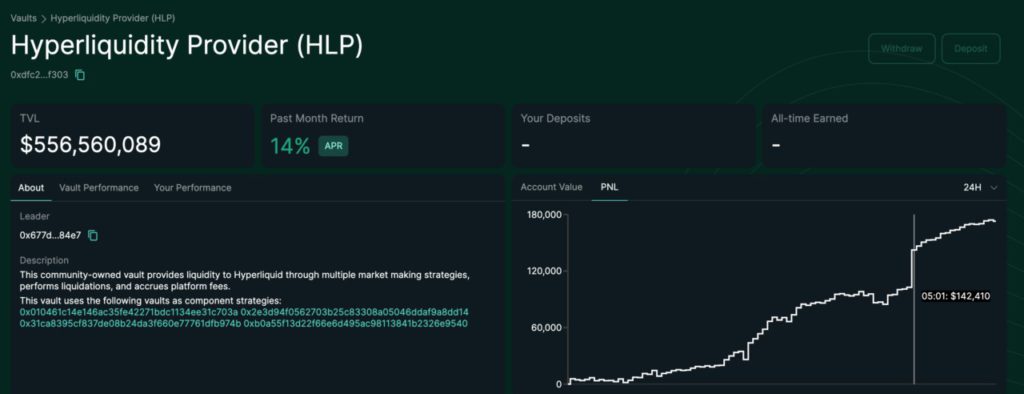

As a result of this big move, the Hyperliquid platform experienced a profit of around $47,000 (IDR768,332,000) from high transaction fees. However, they had also lost almost $12 million (IDR 196,176,000,000,000) in a previous similar incident. This shows how extreme market volatility can be risky, not only for ordinary traders but also for liquidity providers who seek to profit from price spreads.

This case is a reminder that in markets with limited liquidity, liquidity providers can face huge losses when the order book is “cleared” by whales. While they can earn fees from large transactions, the risk of loss is also comparably large, depending on unexpected price movements.

3. What Retail Traders Can Learn from This Incident

XPL’s drastic price spike taught three important lessons to crypto traders, especially those involved in high-risk trading. First, it is important to avoid using too much leverage when market liquidity is limited. High leverage in illiquid markets can quickly liquidate a trader’s account when prices move sharply in a short period of time.

Secondly, it is important to monitor the depth of the order book and the flow of funds on-chain before opening a position. Understanding the broader market dynamics can help traders avoid situations where they fall victim to whale action.

Lastly, for those participating in liquidity vaults such as HLP (Hyperliquid Vault), it is important to understand that short-term gains come with great risk when market volatility increases in depth.

Also Read: 3 Things You Need to Know About Linklogis & XRP Ledger Partnership!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Linh Bùi. Was It Justin?XPL Soars 200% on Hyperliquid as Whale Wipes Out Order Book. Accessed August 28, 2025