Bitcoin Holds Steady at $111,000 Today — Is the Bullish Trend Still Alive?

Jakarta, Pintu News – On August 28, Bitcoin briefly traded at $112.1K, experiencing a slight increase. Citing AMB Crypto’s report, the short-term price action shows a bearish trend, although there is still a chance for a rebound towards $115K.

Then, how is the current Bitcoin price movement?

Bitcoin Price Up 0.12% in 24 Hours

On August 29, 2025, Bitcoin was priced at $111,535, equivalent to approximately IDR 1,825,335,658 — marking a slight 0.12% increase over the past 24 hours. During this time, BTC dipped to a low of IDR 1,817,918,112 and reached a high of IDR 1,853,036,754.

At the time of writing, Bitcoin’s market capitalization is around IDR 36,445 trillion, while its 24-hour trading volume has risen by 0.63% to IDR 594.68 trillion.

Read also: Which Altcoin Sectors will Shine in the Next Crypto Cycle? Analysts Give Their Views

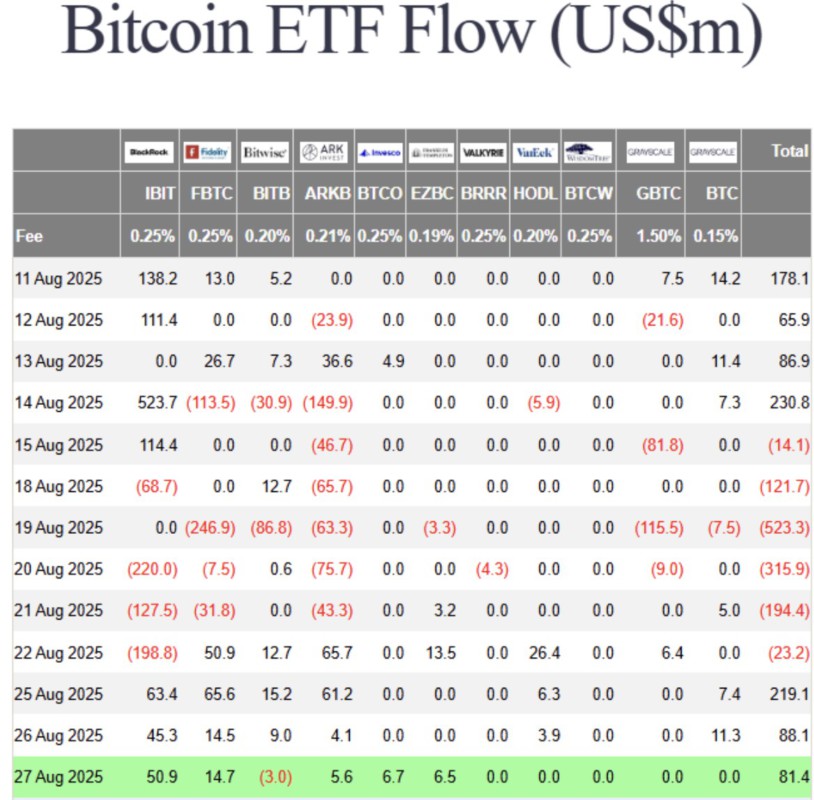

Spot Bitcoin ETF Inflows Show Positive Trend

Citing the AMB Crypto report (28/8), market sentiment appears neutral to bullish. The Fear and Greed index stands at 46, signaling neutral conditions.

At the end of last week, BTC experienced a drop from $117K to $109K and has yet to fully recover.

Spot ETF inflows have shown a positive trend since August 25, which is a more encouraging sign. However, an analyst noted that flows from the derivatives market are also needed to push the market into a bullish phase.

Bitcoin’s Bullish Phase Is Still Ongoing; Holders Should Not Panic

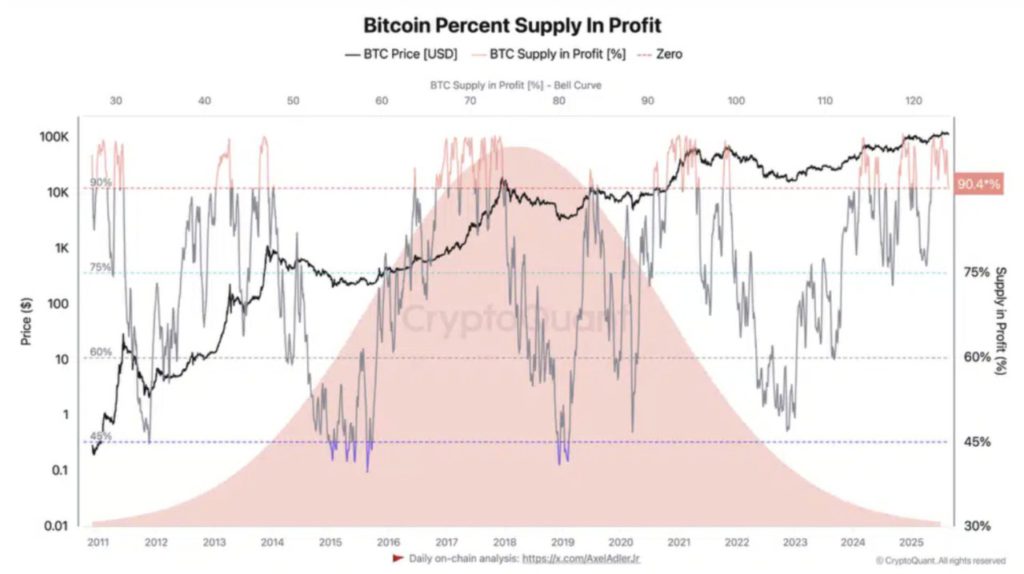

In a post on CryptoQuant, Darkfost analysts highlighted that the percentage of Bitcoin supply that is in a profit position has reached 90%. This figure is considered an important threshold that often accompanies bull markets.

The analyst emphasized that high supply in profit conditions is not a negative signal. On the contrary, it is needed to push prices higher and trigger the usual wave of euphoria that fuels the crypto market.

Therefore, long-term holders are advised to remain patient until the short-term conditions strengthen again. If the percentage of profitable supply falls below 90% – which has not happened to date – it could be the start of a corrective phase.

In a post on X, crypto analyst Axel Adler Jr noted that the market is currently on the verge of bearish mode.

As of August 28, the unified market index stood at 43%, reflecting a slight bearish tendency but still close to the neutral zone. The market is at a critical juncture: a few hours of consistent positive inflows in the derivatives sector could shift sentiment back to neutral or even bullish.

Read also: Pi Network Hackathon Winner Hints Pi Coin will be Listed on Coinbase, Really?

Without renewed confidence in the derivatives market, the price movement towards the resistance at $115K will most likely only be a temporary bounce, not a true bullish trend reversal.

Bearish Short-Term Indicators

In addition, short-term indicators also show bearish tendencies, especially if the supply in profit falls below 90%. However, if that threshold holds, BTC still has a chance to recover.

On the 4-hour chart (28/8), the price of BTC is moving up near the dynamic resistance of the 50-period Moving Average (MA) around $113K.

Meanwhile, the Accumulation/Distribution (A/D) indicator shows that the buying volume in recent days is still weak. The MA also reinforced the bearish momentum. Trading volume during the week was also recorded to be declining along with the price drop.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Bitcoin – Here’s what could drive BTC’s next push to $115K. Accessed on August 29, 2025