Circle and Finastra Partnership to Change the Global Payments Landscape with USDC

Jakarta, Pintu News – Circle has announced a strategic partnership with Finastra on Wednesday, to integrate USDC settlement into Finastra’s Global PAYplus platform, which manages more than $5 trillion in cross-border payment flows every day.

Innovative Collaboration with Global PAYplus

Global PAYplus (GPP), Finastra’s flagship payment center, serves thousands of banks in over 130 countries. Through this partnership, institutions using the platform will be able to complete transactions using Circle’s USDC stablecoin. Finastra, based in London, provides financial software to more than 8,000 customers, including 45 of the world’s top 50 banks.

By linking GPP with USDC, the two companies aim to modernize settlement which has been criticized for inefficiency, high costs, and delays. A blockchain-based settlement process allows transactions to be settled around the clock at a much lower cost.

Regulators in the United States, Europe, and Asia continue to monitor stablecoins, highlighting their potential risks and benefits. USDC currently has a circulating supply of approximately $69 billion. The integration of USDC into GPP allows banks to test blockchain settlements without disrupting compliance or foreign exchange processes.

Also Read: 3 Reasons Why Altcoins Are Predicted By Analysts And Tapiero To Explode And Surpass Bitcoin (BTC)

Circle’s Expansion of USDC Usage

This collaboration provides a large institutional channel for Circle’s adoption of USDC. The company had gone public earlier this year, with its stock rising as investors sought exposure to the rapidly growing stablecoin market. The move puts Circle in line with other payment giants such as Stripe and PayPal, which have developed their own stablecoin infrastructure.

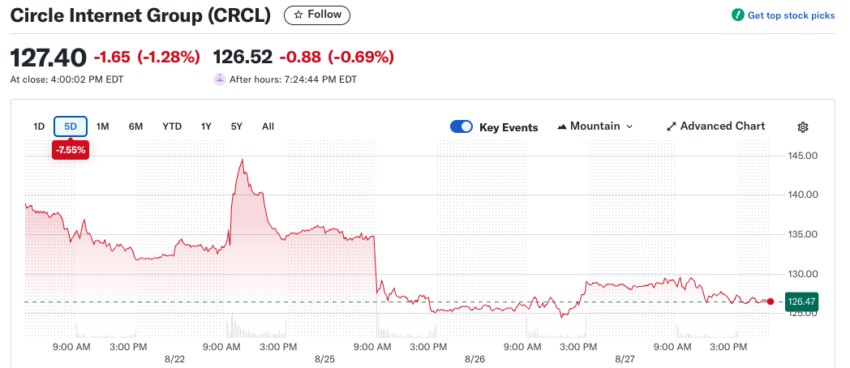

Some banks and retailers are also exploring token-based payment models. On the same day, Circle (CRCL) shares closed at $127.4, down 1.28% from the previous session. This decline came amid a broader market pullback, with Bitcoin down 0.7% over 24 hours to $111,277 and Ethereum down 2.2% to $4,511.

Broader Implications for the Financial Sector

The integration of USDC into the global payment system marks an important step in the evolution of financial technology. By utilizing stablecoins, banks and other financial institutions can reduce the time and costs associated with settling traditional transactions. It also opens the door for further innovation in financial products and services that can leverage blockchain technology for greater security and efficiency.

In addition, with increased regulatory scrutiny of stablecoins, partnerships like this also demonstrate the potential for the development of a more mature regulatory framework that supports innovation while maintaining the stability of the financial system. This demonstrates both companies’ commitment to not only advancing their technologies, but also to ensuring that they operate within the boundaries set by financial supervisors.

Conclusion

The partnership between Circle and Finastra promises a new era in global payment settlement, where efficiency and security are top priorities. By adopting USDC, Finastra is not only enhancing its services, but also helping to shape a more transparent and accessible future of financial transactions.

Also Read: 3 Reasons Why Tom Lee Predicts Ethereum (ETH) Could Touch IDR196 Million by the End of 2025

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as Bitcoin price today, XRP coin price today, Dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Circle Partners with Finastra on $5 Trillion USDC Settlement. Accessed on August 29, 2025