5 Things You Should Know About Rebase Token: A Unique Mechanism in the Crypto World

Jakarta, Pintu News – Rebase tokens are a type of cryptocurrency asset with an elastic supply mechanism, meaning that the number of tokens in circulation will adjust automatically based on price movements in the market. The main goal is to maintain price stability without the need to use reserve assets such as stablecoins.

According to CoinMarketCap, while token rebase has a target price like stablecoins, its approach is different as it does not maintain a fixed value. Instead, the system will adjust the number of tokens in circulation to be close to the target price through the rebase process.

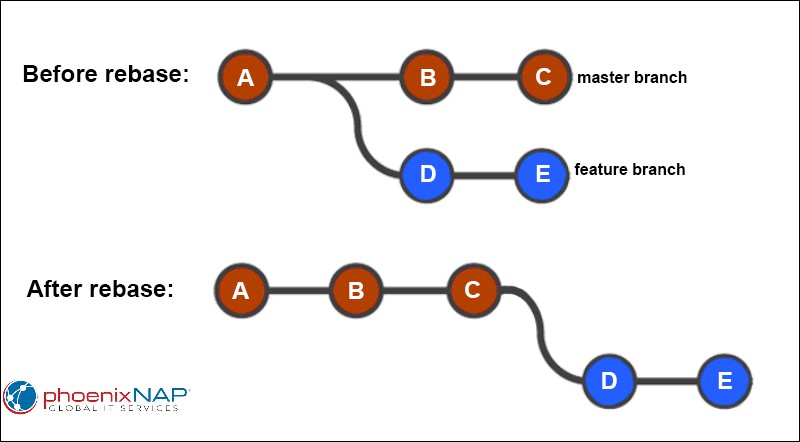

1. Rebase is an automatic supply adjustment

The rebase mechanism will increase or decrease the supply of tokens based on price fluctuations. For example, if the token price rises above the target, the supply will be increased to lower the price; conversely, if the price falls, the supply will be reduced to push the price up.

An example is Ampleforth (AMPL), which is targeting a price of $1. If the AMPL price is above this mark, the protocol will automatically increase supply every 24 hours to adjust the value of the token in the market.

Also Read: 3 Reasons Why Altcoins Are Predicted By Analysts And Tapiero To Explode And Surpass Bitcoin (BTC)

2. Wallet Value Doesn’t Change Even if the Number of Tokens Changes

What makes token rebase unique is that while the number of tokens in a user’s wallet may change, the total value of the portfolio remains the same. For example, if someone owns 1 AMPL and the price becomes $2 (IDR 32,940), then during the rebase, the number of tokens will be reduced to 0.5 AMPL, so the value remains $1 (IDR 16,470).

This is explained by CoinMarketCap as a way to keep the price balanced without affecting the economic value of token owners. So, users don’t lose value even if the number of tokens changes.

3. Regularly Scheduled Rebase

Rebase is not a random event, but rather a process that has been pre-scheduled by the protocol. In the case of AMPL, rebase occurs every 24 hours. This schedule allows the system to consistently match supply with market demand.

This mechanism makes rebase tokens more dynamic than regular tokens, as supply and price interact programmatically. However, it also makes the price of rebase tokens more volatile when compared to traditional stablecoins.

4. Some Notable Examples of Rebase Tokens

Besides Ampleforth (AMPL), there are several other projects that use the rebase mechanism. Among them are YAM, RMPL, and BASED, which also implement automatic supply adjustment with different models and schedules.

Each project has its own rebase parameters and goals. Some of them try to combine rebase with decentralized governance models to provide additional incentives for token holders.

5. Potential and Risks in Rebase Token Investment

Token rebase presents an innovative approach to price stability in the cryptocurrency sector. However, this mechanism can also be confusing for new investors as fluctuations in the number of tokens in a wallet can be perceived as a loss, when the actual value is fixed.

According to CoinMarketCap, it is important to understand how rebasing works before investing. Because while the concept offers a solution to price volatility, rebasing also brings its own complexities to crypto portfolio management.

Also Read: 3 Reasons Why Tom Lee Predicts Ethereum (ETH) Could Touch IDR196 Million by the End of 2025

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as Bitcoin price today, XRP coin price today, Dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinMarketCap. Rebase. Accessed August 29, 2025