Ethereum Price Falls to $4,300 on September 1st: Whales Exit as Spot Market Heats Up!

Jakarta, Pintu News – The Ethereum market has come under significant pressure after whales sold more than 430,000 ETH – equivalent to about $1.8 billion – in the past two weeks.

This selling pressure caused the whale-held ETH balance to drop to its lowest level in weeks, sparking concerns about the market’s resilience.

Historically, such massive exits have often preceded price corrections as market liquidity dwindles. Even so, retail investors or small holders remain active, providing a slight buffer against deeper declines.

Now, the balance of power between whales and retail investors is the key factor determining the next direction of the market.

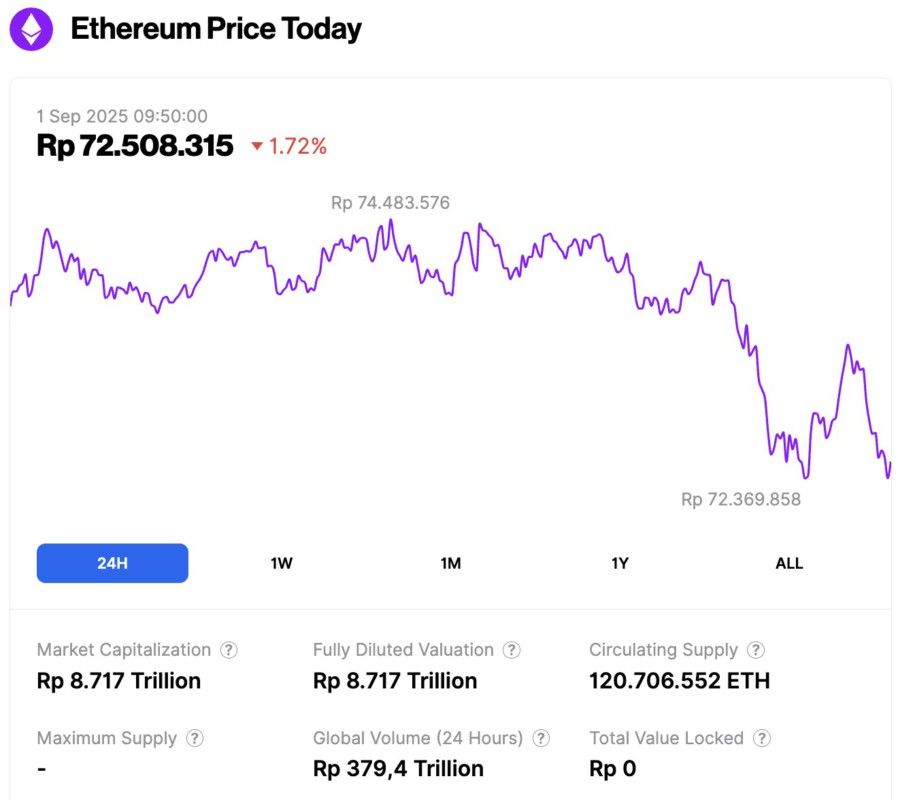

Ethereum Price Drops 1.72% in 24 Hours

On September 1, 2025, Ethereum was trading at approximately $4,381, or around IDR 72,508,315 — marking a 1.72% decline over the past 24 hours. During this time, ETH hit a low of IDR 72,369,858 and reached a high of IDR 74,483,576.

At the time of writing, Ethereum’s market capitalization stands at roughly IDR 8,717 trillion, while its 24-hour trading volume has climbed by 9.7% to IDR 379.4 trillion.

Read also: Bitcoin Drops to $107,000 on September 1 – Is a Rebound to $113,500 Possible?

Why is Spot Trading Activity Warming Up?

CryptoQuant’s Spot volume bubble map shows that Ethereum market activity is entering a “heating up” phase, with large amounts of trading concentrated on various exchanges.

This signals increased interest in ETH, but also comes with the risk of higher volatility. A rise in Spot trading volume often reflects an intense battle between buyers and sellers, which can magnify price fluctuations in the short term.

Nonetheless, these spikes in activity can also increase market liquidity and cushion sudden shocks. The question now is: does this surge reflect ETH accumulation by big players, or is it continued distribution by whales?

What does the Persistent Selling Dominance Reveal?

The 90-day Spot Taker CVD indicator shows a strong sell-side dominance in Ethereum’s order flow.

Aggressive sellers dominated the market compared to buying demand, reinforcing the bearish pressure triggered by the whale selloff.

However, seller dominance doesn’t necessarily mean the downtrend will continue. A sharp reversal could happen when the selling pressure starts to weaken.

As such, while the market is currently bearish, the key question is whether buyers are able to absorb this pressure and regain control of the market in the short term.

Read also: 3 Altcoins that Crypto Whale is Collecting Right Now

How Risky is Ethereum’s Current Leverage Environment?

The liquidation data highlights how fragile leveraged positions are in the Ethereum market. At the time of writing, short positions have been liquidated to the tune of $23 million, far more than the $2.4 million in long positions.

This loss reflects how an overly aggressive bearish bet turned costly when the ETH price stabilized around $4,472.

Nevertheless, repeated liquidations on both sides over the past few weeks indicate the high sensitivity of the market to price movements.

This means that traders now face increased risk due to the combination of whale fund flows and leverage, which simultaneously increases volatility whenever there is a sharp move.

Overall, Ethereum is now under pressure from whale sell-offs, ongoing selling flows, as well as heated spot activity.

Even so, the liquidation trend suggests that short-sellers remain vulnerable. While downside risks remain high, ETH still has a chance to stabilize-especially if retail demand and a healthy leveraged position are able to balance the pressure from whale exits.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Ethereum whales exit, spot activity heats up: Will ETH make a surprise move? Accessed on September 1, 2025