Ripple (XRP) in September: Bullish Breakout or Bearish Pullback?

Jakarta, Pintu News – XRP is back in the spotlight this September as traders watch for signs of a possible change in trend direction. After hitting the $3 level in August, the token has seen a slight decline but remains steady trading around the $2.80 mark.

The question that now arises in the minds of many: is XRP preparing to go even higher, or will a deeper correction occur this September?

Surge in Open Interest Signals Strong Market Activity

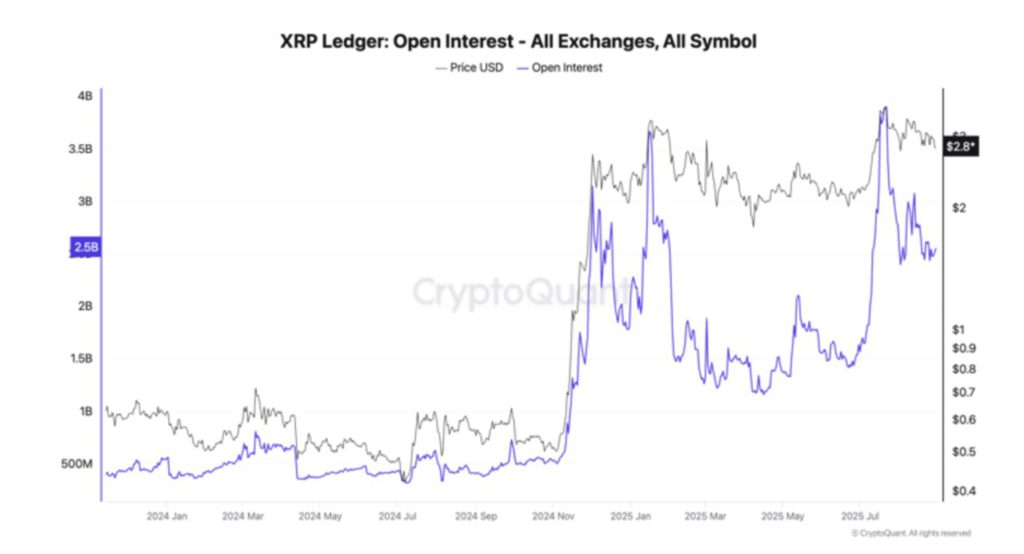

One of the clearest signals came from the derivatives market. XRP’s open interest (OI)-the total value of futures and options contracts-jumped to over $3.5 billion as its price rose to near $3.

Read also: Solana Soars: What Makes SOL Stand Out Over Bitcoin and Ethereum?

This surge reflects the high speculative interest, with many traders placing leveraged positions to take advantage of price movements.

Although OI has since declined, the XRP price is still holding above $2.80. Trader Tyler McKnight thinks that this could just be a consolidation phase after a big spike, not that the market is weakening.

Institutional Demand Still Unseen

While derivatives activity is fairly active, adoption by large institutions is still minimal. Unlike Bitcoin which already has ETFs and strong institutional fund flows, XRP is still awaiting approval for eight spot ETFs in the US.

Despite favorable legal rulings, large companies remain cautious, with the main buyers currently coming from retail or small-scale investors.

For now, only small players have shown interest in making XRP a backup asset.

Read also: Bitcoin Price Prediction: Is October the End of the Bull Run? Here’s What Analysts Are Saying

Technical Analysis Indicates Downside Risk

Citing the Coinpedia report, the price of XRP has fallen by around 6.7% in the past week, and is currently trading at around $2.83.

On the weekly chart, the MACD indicator shows a potential bearish crossover, a pattern that previously preceded price corrections of 50% or more in 2021 and early 2025.

If this pattern repeats, the price of XRP could drop towards the weekly 50 EMA at around $2.17, or about a 25% drop. This level also coincides with the 0.618 Fibonacci retracement , which is often considered a strong support area.

But on the other hand, any positive news could push XRP back above $3. If that level can be maintained, the next target could be an increase towards $3.36.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. XRP Price Outlook: Will September Bring a 25% Correction or Fresh Upside? Accessed on September 1, 2025