5 Things You Need to Know About Antam Gold Price Chart Today: Crypto Lovers Take a Glance!

Jakarta, Pintu News – Gold prices are back in the spotlight after recording interesting fluctuations in recent months.

Amidst the ups and downs of the crypto market and cryptocurrencies such as Bitcoin and Ethereum , traditional investors are starting to look back at precious metals as one of the more stable hedging tools.

The latest data from the BRANKAS platform as of Tuesday, September 2, 2025, shows that there are movements in gold prices that are worth watching.

1. BRANKAS and Physical Gold Prices Both Fall Today

Based on data taken from the official BRANKAS LM dashboard, the BRANKAS gold purchase price for corporate customers was recorded at IDR 1,949,600 per gram, a decrease of IDR 2,000 from the previous price, which was IDR 1,951,600. This price was last updated at 08.05 WIB on September 2, 2025.

Meanwhile, physical gold prices also experienced a similar decline. The current price stands at IDR 2,009,000 per gram, down IDR 2,000 from the previous price of IDR 2,011,000. This decline shows a stable trend despite price spikes in the previous few months.

Also Read: Altcoin Surge 2025: An Interesting Investment Opportunity to Watch As the Year Ends!

2. Price Chart for the Last 6 Months Shows a Gradual Increase Pattern

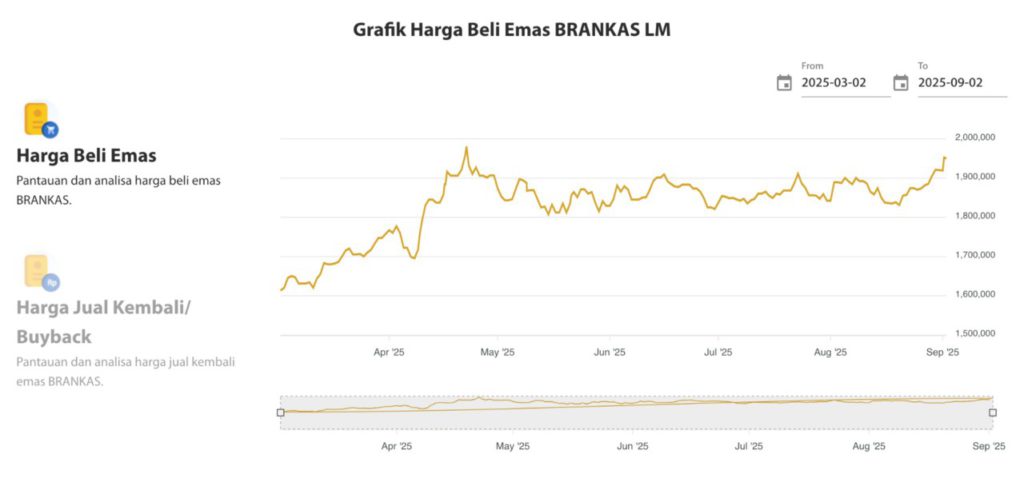

Through the BRANKAS LM gold price chart from March 2 to September 2, 2025, it can be seen that the price of gold touched a high of close to Rp 2,000,000 per gram in May 2025. After that, the price experienced a correction and tended to stabilize in the range of IDR 1,850,000 to IDR 1,950,000.

The significant increase occurred from April to May 2025. According to BRANKAS data, this period coincided with a drop in investor confidence in cryptocurrencies due to major corrections in Bitcoin (BTC) and Ethereum (ETH), which each lost 8-12% of their market value in the space of one week.

3. Gold is an alternative investment when crypto is volatile

In the investment world, gold is known as a safe haven asset. When cryptocurrencies like Ripple and Pepe Coin experience sharp fluctuations, investors tend to move their funds to more stable assets like gold. The value of 1 troy ounce of gold as of September 2, 2025 is equivalent to approximately USD 2,025 or approximately IDR 33,293,175 (referring to the exchange rate of IDR 16,447 per USD).

BRANKAS data shows an increase in gold demand during periods of crypto market downturns, especially from retail investors reducing exposure to high-risk tokens. This phenomenon reinforces gold’s role as a portfolio diversifier amidst digital market uncertainty.

4. Corporate and Physical Gold Price Differences Can Reach IDR 59,400

The corporate-specific BRANKAS gold price is lower than the physical gold price intended for individuals. The price difference per gram currently stands at IDR 59,400, based on BRANKAS’ latest data as of September 2, 2025.

This difference is due to different fee structures as well as additional services provided for physical gold, such as certification and delivery. BRANKAS recommends that individual customers view gold prices through their official app to obtain more appropriate information.

5. Gold Price Trend Still Positive Despite Short Correction

Despite a small decline in the past day, the medium-term trend in gold prices still shows an upward trend. This can be seen from the price chart since March 2025 which shows an overall positive trend line.

Unstable global macroeconomic conditions, including uncertainty over the Fed’s interest rate policy and fluctuations in cryptocurrencies, are encouraging investors to maintain positions in assets such as gold. Some analysts also predict that gold could reach a price of IDR 2,050,000 per gram in the next three months if geopolitical pressures and crypto volatility continue.

Also Read: Bitcoin Price Increase Prediction: Analyst Dave The Wave Reveals Potential Spike in September!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BRANKAS LM. BRANKAS Gold Price Dashboard. Accessed on September 2, 2025.