3 Reasons Why Dogecoin (DOGE) Traders Should Beware of the $0.20 Support Level!

Jakarta, Pintu News – Dogecoin has been consolidating in recent months, forming an ascending triangle pattern that signals that the price could soon make a bigger move.

Currently, many traders are waiting to see if DOGE will break the resistance level or get caught in a false breakout. Based on recent analysis, the $0.20 support level is key to Dogecoin’s price movement. Here are 3 reasons why this level is so important.

1. Dogecoin consolidation coming to an end, watch for triangular ascending pattern

In recent weeks, Dogecoin has been moving in an ascending triangle pattern, a technical formation that usually signals a continuation of a trend if broken properly. This pattern has almost reached its breaking point, which means that the price of DOGE could soon experience a significant move. The $0.20 level serves as an important support level in this pattern, which has been tested several times.

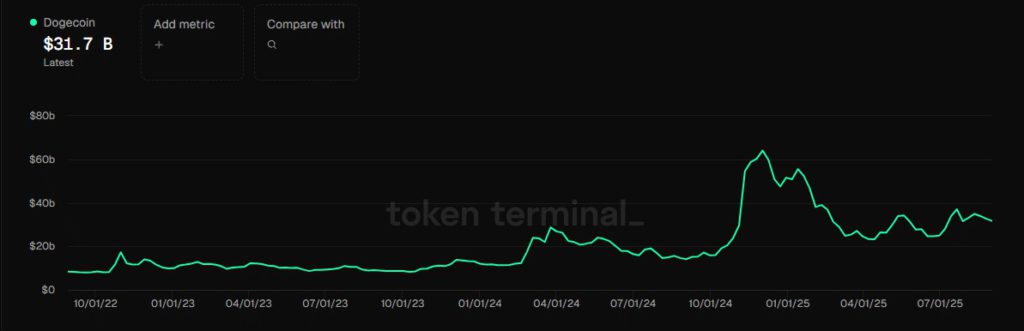

On the other hand, DOGE’s trading volume has recently experienced a significant spike, with volume reaching $13.49 billion in the last week of August 2025. This increase gives an indication that traders are preparing positions for larger price movements. If the price holds above the $0.20 level, this could be a positive signal for a stronger bullish movement. This data is based on analysis from Token Terminal.

Also Read: Ondo Finance could be a crypto dark horse in Q4 2025? Here are 4 ONDO facts to know!

2. Market Volatility and Increased Market Capitalization of DOGE

One of the main factors affecting the Dogecoin market right now is the volatility that comes with a significant increase in market capitalization. On September 1, 2025, Dogecoin’s market capitalization was recorded at $31.7 billion, a sharp increase compared to its peak recorded in July 2025 at $40 billion. This surge in market capitalization indicates greater investor interest, but also increases the risk of volatility.

This increase means that more traders and investors are involved in Dogecoin trading, which could be a positive signal if the market continues to move steadily. However, it also suggests that the potential for sharp price movements could occur at any time, depending on whether the $0.20 support level is able to hold or not.

3. Waiting for Dogecoin Breakout or False Breakout

The biggest question now haunting traders is whether Dogecoin will actually breakout or if it will experience a false breakout which is common in ascending triangle patterns. To confirm whether the DOGE price will move up, many traders are now waiting for confirmation from volume and further price action.

If DOGE manages to break through the resistance level present in this pattern, a significant price spike is likely to occur. However, due to the high level of retail participation, price movements could be heavily influenced by market sentiment. If there is not enough demand to sustain the momentum, DOGE may fall back to lower support levels.

Conclusion

While Dogecoin (DOGE) is in an interesting consolidation phase, the $0.20 level is key in determining the next direction of price movement. Traders need to keep an eye on whether DOGE can hold this support level and make a breakout that could trigger a larger price movement.

With the increasing trading volume and market capitalization, the potential for a bullish movement for Dogecoin is very likely, but it is also important to be aware of the potential false breakouts that often occur in this pattern.

Also Read: XRP or Bitcoin? 3 Facts from the Chart that Reveal the Truth

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Kelvin Murithi. Dogecoin traders, look out for the $0.20 support level – Here’s why! Accessed 4 Sepetmber 2025