Pi Coin Drops to $0.34: Is Its Momentum Starting to Fade?

Jakarta, Pintu News – Pi Network’s recent price movements have shown persistent weakness, with the token struggling to recover after several failed breakouts. Despite attempts to build momentum, the cryptocurrency remains vulnerable to further corrections.

In recent days, Pi Coin’s decline highlights the difficulty it faces in moving away from historical lows.

Then, how is Pi Network’s current price movement?

Pi Network Price Rises 0.7% in 24 hours

On September 4, 2025, the price of Pi Network was recorded at $0.3464, a slight increase of 0.7%. If converted into today’s rupiah ($1 = IDR 16,428), then 1 Pi Network is IDR 5,690.

Although the price is showing fluctuations, Pi Network is still attracting the attention of many investors. In a 24-hour period, the Pi price has moved within the range of $0.3438 to $0.3582.

Read also: Pi Network Launches DeFi Game PiOnline: What’s Next for Pi Coin’s Price?

With a market cap of $2.66 billion, Pi Network currently occupies the 55th position on the list of the largest cryptocurrencies. In terms of 24-hour trading volume, there were $46.89 million in transactions, signaling a fairly high level of liquidity.

Pi Coin Loses Power

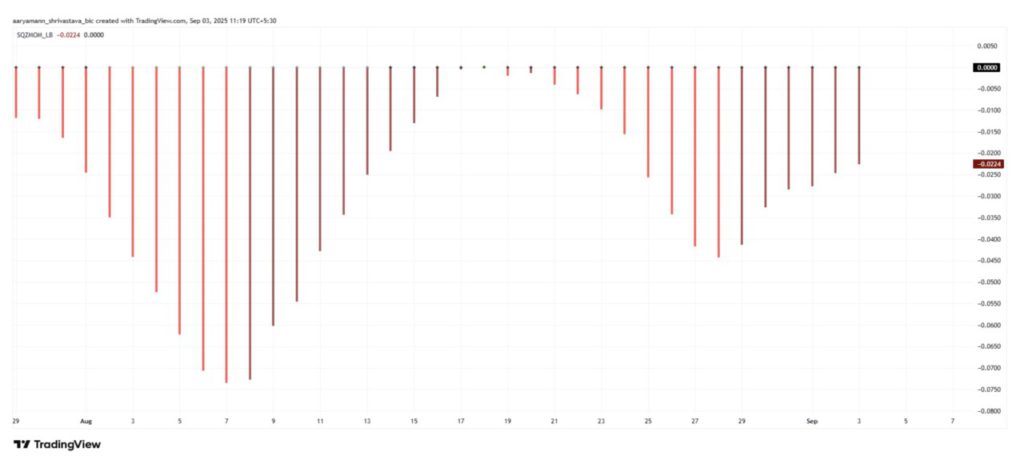

The Squeeze Momentum indicator shows a squeeze formation on the Pi Coin chart. Typically, a squeeze signals impending volatility, and with the indicator leaning bearish, the likelihood of downward pressure is greater.

When this squeeze ends, the token may experience a sharp drop if sellers dominate trading conditions.

This indicates a risk for Pi Coin holders. With bearish signals dominating, a squeeze release could push the price close to critical support levels. Without significant buying activity, this cryptocurrency is at risk of further decline, leaving investors vulnerable to losses.

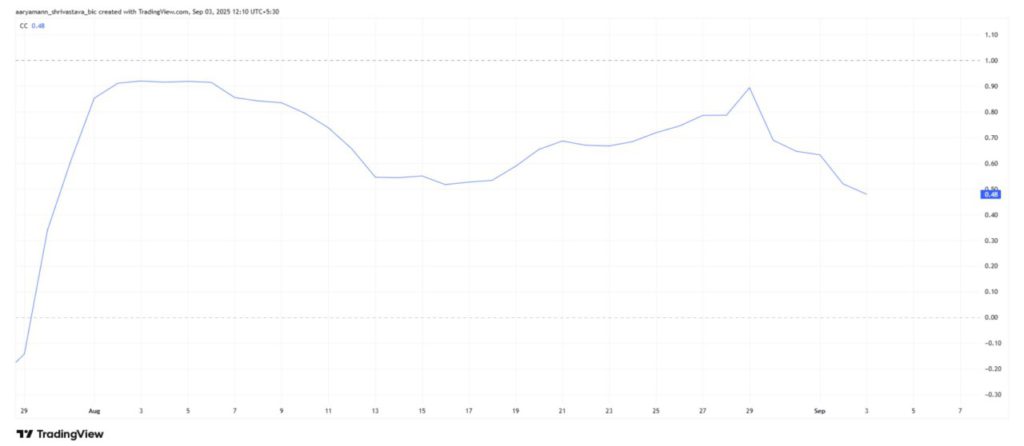

A broader view of Pi Coin is also hampered by its weakening correlation with Bitcoin . As of September 3, its correlation stood at 0.48, reflecting a divergence with BTC’s movements.

Typically, Pi Coin follows Bitcoin’s trend more closely, however, the recent divergence highlights its inability to capitalize on BTC’s upward movement this month.

Historically, Pi Coin’s correlation with Bitcoin strengthens during bearish cycles and weakens as BTC rises. This pattern proved to be detrimental as Bitcoin continued to rise while Pi Coin remained stagnant.

Read also: SharpLink Expands Ethereum Treasury to 837,230 ETH Worth almost $3.6 Billion!

Pi Network Price is in Trouble

On September 3, Pi Network was trading at $0.343, down 12.4% in the last three days. The token is holding above the $0.344 support level, which has repeatedly prevented further declines. However, this level remains fragile as selling pressure continues to mount in the market.

If bearish factors dominate, Pi Coin could lose support at $0.344 and test an all-time low of $0.322. A further drop below this limit would likely push the token to a new low, creating a new all-time low and magnifying downside risks for holders.

If Pi Coin experiences a rebound from $0.344, the token could rise to $0.360 in the short term. A stronger rally would allow the token to test $0.401, which would invalidate the bearish theory.

Moves like this will provide temporary relief for investors while showing renewed recovery efforts.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Sellers Tighten Grip on Pi Coin – Is a Breakdown Below All-Time Low Next? Accessed on September 4, 2025