Ethereum Stuck at $4,300 Today — Messari Analyst Claims ETH Is Dying

Jakarta, Pintu News – As reported by Cointelegraph, an analyst from Messari recently sparked a heated debate over the weekend after stating that Ethereum is “dying” as the network’s revenue declined in August.

Then, how is Ethereum’s current price movement?

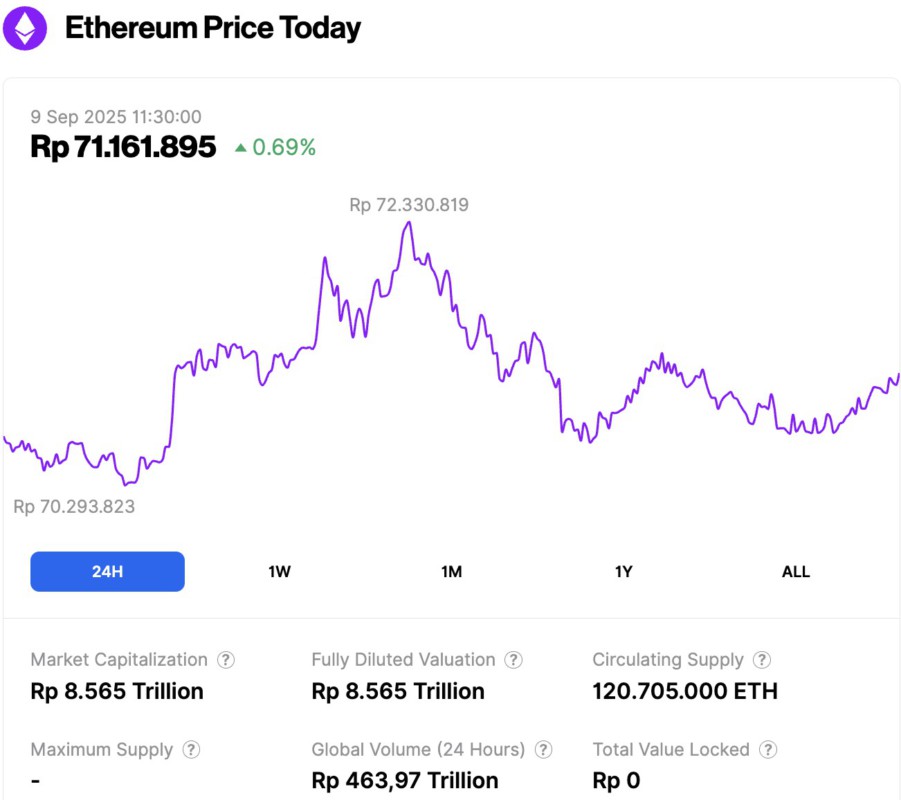

Ethereum Price Up 0.69% in 24 Hours

On September 9, 2025, Ethereum was trading at approximately $4,313, or around IDR 71.16 million, marking a modest 0.69% increase over the past 24 hours. Within that timeframe, ETH hit a low of IDR 70.29 million and reached a high of IDR 72.33 million.

At the time of writing, Ethereum’s market capitalization stands at roughly IDR 8,565 trillion, while its 24-hour trading volume has surged by 56%, reaching IDR 463.97 trillion.

Read also: Bitcoin Holds at $111K as Crypto Whale Dumps 115,000 BTC — What’s Going On?

Analyst Says Ethereum’s Fundamentals are Crumbling

In a post on the X platform on Saturday, Messari’s research manager AJC mentioned that “Ethereum’s fundamentals are crumbling,” with revenue from transaction fees in August reaching just $39.2 million – down more than 40% compared to last year and around 20% compared to the previous month.

However, many people disagree with this statement. They highlight Ethereum’s improving metrics, growing revenue from applications, a steady supply of stablecoins, the development of Layer 2 scaling solutions, as well as the important distinction between Ethereum being a commodity and not a tech stock – meaning its value shouldn’t be judged solely on revenue.

Ethereum is still a Dynamic Ecosystem

Much of Ethereum’s revenue decline was due to the Dencun update in March 2024, which lowered transaction fees for layer-2 scaling networks that use Ethereum as the base layer to record transactions.

In an interview with Cointelegraph, Henrik Andersson, Chief Investment Officer of investment firm Apollo Crypto, stated that it is unlikely that Ethereum is dying.

He cited data from Ethereum L2’s analytics tool, growthepie, which shows that Ethereum is still a “vibrant ecosystem, with stablecoin supply, throughput, and number of active addresses at or near all-time record highs.”

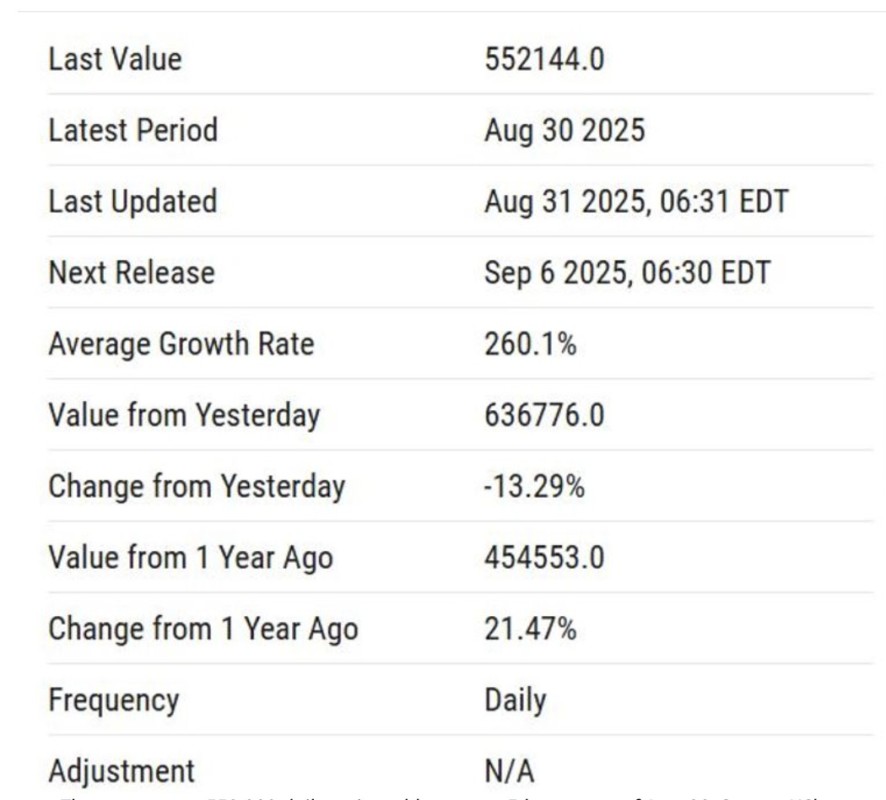

As of August 30, there were more than 552,000 daily active addresses on the Ethereum network, according to investment research platform YCharts – a 21% increase over the same period in 2024.

“We believe that both Ethereum and Bitcoin have their role to play in a crypto portfolio,” Andersson said.

“Ethereum is developing into a neutral and decentralized base layer for the financial sector. Just as Bitcoin is not valued based on revenue, but rather as a store of value, we also don’t believe that Ethereum should be valued solely on its revenue side.”

However, in response to its critics, AJC still defends the use of revenue metrics to assess this layer-1 blockchain. It explained that since revenue is collected in the form of Ethereum, one of the main drivers of historical demand is now “pointing to zero.”

Read also: 4 Crypto that Gained Over 50% Today

At the same time, AJC also argues that the number of active addresses and transactions are “meaningless statistics when it comes to demand.”

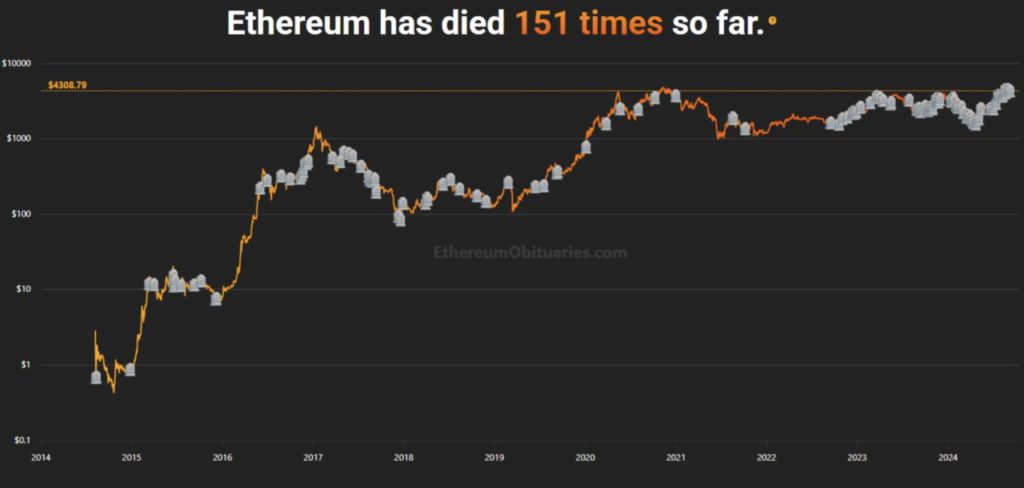

Ethereum Has Been Declared “Dead” 40 Times This Year

Since 2014, Ethereum has been declared “dead” at least 150 times by various sources – and about 40 of those were recorded just this year alone, according to data from Ethereum Obituaries.

Ryan McMillin, Chief Investment Officer at Merkle Tree Capital, told Cointelegraph that Ethereum is constantly adapting and is usually declared “dead” when the public narrative weakens, transaction fees decrease, network activity slows down, or when competitors perform better.

In theory, since the smart contract sector is highly competitive, developers and capital could slowly and permanently migrate to other networks.

“But in practice, the strong developer community, established DeFi protocol, and regulatory acceptance give Ethereum greater staying power than those obituaries imply,” McMillin said.

“Right now, the narrative is that Ethereum will be the chain of choice for traditional finance (TradFi), although the Solana ETF could disrupt that position as well.”

McMillin emphasized that he doesn’t think Ethereum is “dying”, but acknowledged that it’s been in a difficult position for most of the last two years. Ethereum is caught between the narrative of Bitcoin as digital gold and Solana being positioned as a faster and cheaper alternative.

“Framing Ethereum as ultra-sound money has never really been able to rival Bitcoin on the merits of a harder monetary premium. And in terms of speed and fees, Solana offers significant improvements,” he said.

One of the factors that helped Ethereum in 2025 was the approval of the Ethereum spot ETF, which opened up capital flows from the traditional financial sector and positioned Ether as a way to bet against stablecoin adoption and network growth.

However, McMillin warns that this advantage may not last, as Solana’s spot ETF is expected to launch in the next few weeks – which could soon equalize the opportunity for capital flows from institutional investors.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Ethereum metrics are telling 2 very different stories right now. Accessed on September 9, 2025