XRP Price Prediction September 9, 2025: Just Hours Away, Where is it Headed?

Jakarta, Pintu News – As of today, Ripple price is at $2.88, showing stability above the $2.84 support while facing short-term resistance at the 100-EMA. The situation is back in the spotlight among traders considering the October ETF decision window and the compressed technical conditions. This could change the outlook for Ripple (XRP) in the future.

Price Defense at Key Support

On the 4-hour chart, Ripple (XRP) continues to show gains from the $2.77-$2.84 accumulation range. This zone has been successfully defended multiple times by buyers, with the 200-EMA at $2.82 anchoring the bullish sentiment. Above it, the immediate resistance is at $2.92-$2.93, where the 100-EMA and the trend line converge.

This rise shows that there is strong confidence from buyers that Ripple (XRP) still has the potential to go higher. If this zone continues to hold, it is possible that Ripple (XRP) will try to break higher resistance in the near future.

Read also: Ripple News (9/9): XRP to $3.50, What are the Challenges?

On-Chain Inflows Show Optimism

Exchange flow data recorded a net inflow of $9.28 million on September 8, which is the first positive sign after several weeks of muted activity. Although this figure is moderate compared to the summer peak, it signals that traders are starting to accumulate again ahead of potential ETF catalysts.

This inflow is important as it indicates buying interest which could support further price increases. If this trend continues, it could provide the impetus needed to overcome existing resistance and push prices to higher levels.

Derivative Data Shows Cautious Optimism

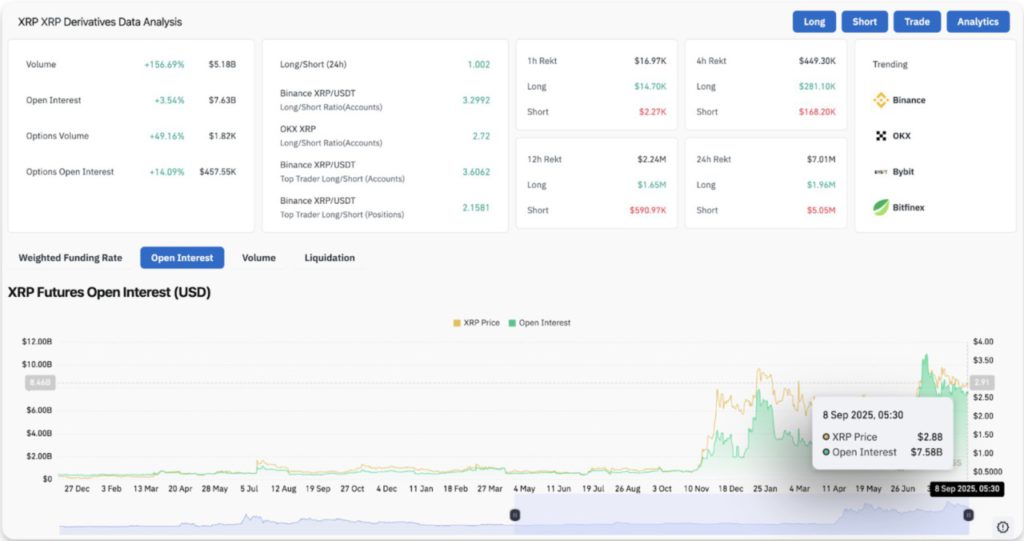

The derivatives market showed a mixed but slightly bullish picture. Open interest for Ripple (XRP) futures rose to $7.58 billion, an increase of 3.5% in 24 hours, signaling increased speculative activity.

Options volumes increased by almost 50%, while funding rates remained balanced, indicating the absence of extreme leverage imbalances. This data suggests that despite the caution, there is growing optimism among traders. The rise in open interest and options volume could be an early indicator of more dynamic price movements in the future.

Read also: Crypto Whale News (9/9): Whale Sells Massively, BTC Threatened to Drop to $100,000?

Technical Outlook for Ripple (XRP) Price

With ETF speculation, rising inflows, and technical improvements converging, Ripple (XRP) price is at a tipping point. The short-term bias is bullish as long as the $2.82-$2.84 zone can be maintained, with the potential to reach $3.20 if momentum continues to build.

However, without stronger inflows or ETF clarity, the consolidation might continue. The October ETF decision will be highly awaited as a trigger for Ripple’s (XRP) continued rally.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- CoinEdition. XRP Price Prediction for September 9, 2025. Accessed on September 9, 2025