Japanese Company Invests heavily in Bitcoin, What will be the Impact?

Jakarta, Pintu News – Two major Japanese companies, Metaplanet Inc. and Convano Inc. have announced significant purchases of Bitcoin as part of their treasury strategy. The move marks an important shift in the way companies in Japan manage their wealth.

In an environment of low interest rates and high exchange rate volatility, more and more companies are looking at digital assets as an alternative store of value. These two companies show how asset diversification into cryptocurrencies can be part of a broader corporate finance strategy.

Metaplanet: Digital Asset Expansion

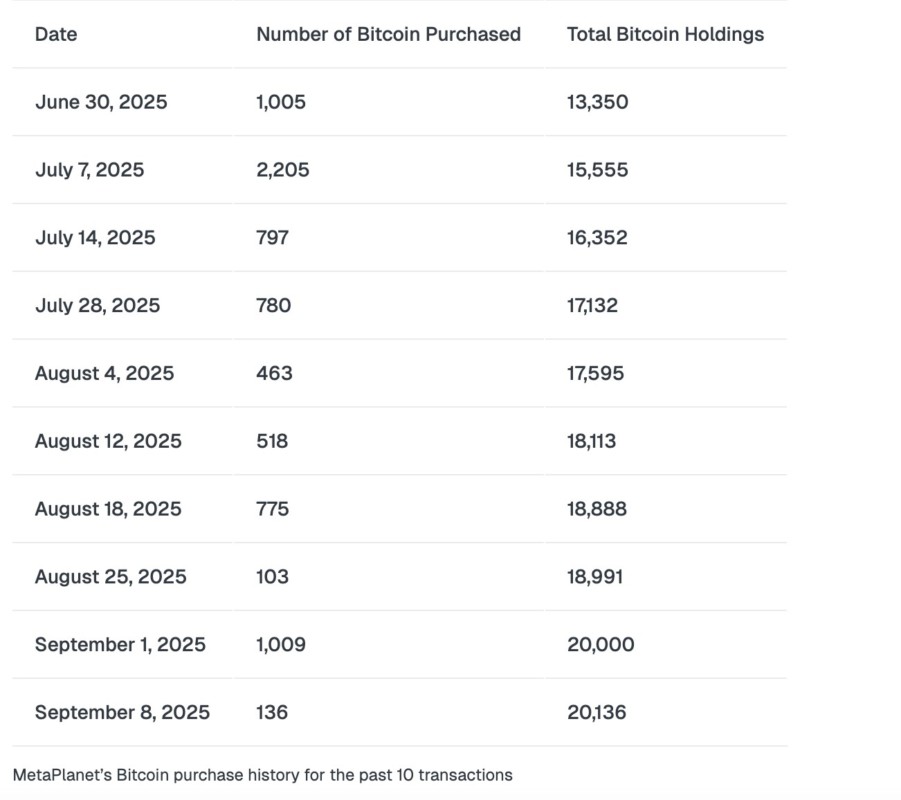

Tokyo-based Metaplanet Inc. has significantly increased their Bitcoin (BTC) purchases. In the past ten weeks, the company has acquired a total of 7,791 BTC through ten separate transactions. With the latest purchase of 136 BTC worth $15.3 million, their total Bitcoin (BTC) assets now stand at 20,136 BTC, valued at approximately $2.07 billion.

This aggressive strategy demonstrates Metaplanet’s confidence in Bitcoin (BTC) as a long-term investment asset. With the average acquisition cost already invested, Metaplanet demonstrates a strong commitment to integrating Bitcoin (BTC) into its financial portfolio.

This ongoing purchase not only increases the company’s digital assets but also positions Metaplanet as one of the major players in the cryptocurrency market in Japan. The move also reflects the company’s vision of adapting to global trends and financial innovation.

Also Read: Dogecoin vs Shiba Inu: Who Will Win Meme Coin in 2025? Latest Data Answers!

Convano: The First Step Toward a Big Goal

Meanwhile, Convano Inc. better known for its chain of beauty salons, recently announced an ambitious plan to purchase $136 million worth of Bitcoin (BTC) through November 2025. This plan will be financed through the proceeds of their Fifth Ordinary Bond issue.

The move is part of a broader strategy to integrate Bitcoin (BTC) into their corporate assets. This first purchase is the first step of a larger plan to accumulate a total of 21,000 Bitcoin (BTC).

By taking this proactive step, Convano has not only secured its financial position but also positioned itself as a pioneer in the retail and beauty industry in the adoption of cryptocurrency. This investment demonstrates Convano’s belief in the long-term value of Bitcoin (BTC) and its potential to provide financial stability.

Broader Implications for Corporate Treasury Strategy in Japan

These two announcements highlight a shift in corporate attitudes in Japan towards Bitcoin (BTC) as a treasury asset. With persistently low interest rates and high exchange rate volatility, Bitcoin (BTC) offers an attractive alternative for companies to maintain or even increase the value of their assets over the long term.

It also signals a possible new trend in corporate financial management in Japan. Moreover, this move could trigger more companies in Japan to consider Bitcoin (BTC) and other digital assets as part of their asset diversification strategy.

With major companies like Metaplanet and Convano leading the way, the growth potential for the cryptocurrency market in Japan is wide open. This could also be a signal for regulators to adjust policies and frameworks to support the healthy growth of the cryptocurrency ecosystem.

Cover: A New Era of Corporate Investment

Metaplanet and Convano’s bold move in adopting Bitcoin (BTC) as a treasury asset marks a new chapter in corporate finance strategies in Japan. It shows not only adaptation to global economic conditions but also confidence in cryptocurrency as a stable and profitable investment instrument. With this, Japan might just lead the digital transformation in corporate asset management in Asia.

Also Read: 2 Crypto Analysts Predict Cheds to Reach ATH, One of Them Can Reach $9,000!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Metaplanet and Convano Buy More Bitcoin. Accessed on September 9, 2025