Massive Investment into Ethereum ETP Reaches $4 Billion in a Month, Outperforming Bitcoin!

Jakarta, Pintu News – In a recent report from VanEck, Ethereum showed impressive performance with massive fund flows into Ethereum-based Exchange-Traded Products (ETPs).

In the month of August alone, Ethereum ETPs attracted $4 billion in funds, while Bitcoin experienced a $600 million outflow of funds. This phenomenon marks a shift in dominance in the crypto market, with Bitcoin (BTC) dropping from 65% to 57%.

Big Funds Flow into Ethereum

According to VanEck, despite a decline from $5.5 billion in July, fund flows into Ethereum ETPs remained strong totaling $4 billion in August. This suggests that there is a significant increase in institutional adoption of Ethereum. On the other hand, Bitcoin (BTC) saw a drastic decline, from inflows of $6.1 billion in July to outflows of $600 million in August.

This increase not only reflects investors’ preference for Ethereum (ETH) compared to Bitcoin (BTC), but also indicates a growing confidence in Ethereum’s long-term potential. This is mainly driven by recent developments in the Ethereum network that continue to attract institutional investors.

Also Read: Dogecoin vs Shiba Inu: Who Will Win Meme Coin in 2025? Latest Data Answers!

Ethereum’s Performance Outperforms the Market

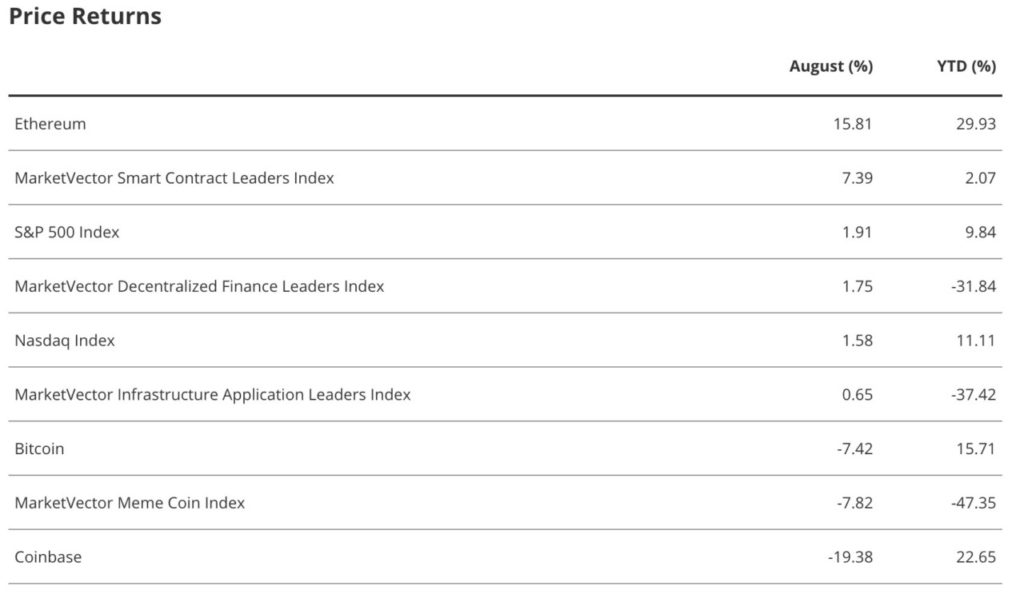

In addition to massive fund flows, Ethereum also managed to outperform various other asset classes, including the S&P 500 and Nasdaq. This shows that Ethereum is not only popular among crypto investors, but also an attractive investment option among various asset classes. This success adds to the evidence that Ethereum can be an important component of a diversified investment portfolio.

Furthermore, Coinbase stock, which is one of the largest crypto trading platforms, was also unable to keep up with Ethereum’s performance. This shows that interest in Ethereum is not just limited to market speculation, but is also backed by real adoption and practical applications of Ethereum’s blockchain technology.

Bitcoin Whale Turns to Ethereum

Reports from Lookonchain reveal that an unidentified Bitcoin ‘whale’ has sold Bitcoin (BTC) to buy Ethereum (ETH). This whale has bought a total of 886,371 ETH, which is worth approximately $4.07 billion. This movement indicates a shift in preference among large investors from Bitcoin to Ethereum.

On Monday, the whale sold 2,000 BTC worth $215 million and bought 48,942 ETH for the same amount. This marks one of the largest transactions in the crypto market and shows growing confidence in Ethereum as a long-term investment asset.

Conclusion

With large fund flows and impressive market performance, Ethereum is further asserting its position as a major player in the crypto world. Going forward, Ethereum will probably continue to attract more institutional and individual investors, who are looking for asset diversification and high growth potential.

Also Read: 2 Crypto Analysts Predict Cheds to Reach ATH, One of Them Can Reach $9,000!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Daily Hodl. $4,000,000,000 Flows Into Ethereum ETPs in Just One Month as ETH Outperforms Bitcoin and Other Major Asset Classes: VanEck. Accessed on September 9, 2025