Dogecoin Surges 16%: Will it Reach $0.40 After Interest Rate Cut?

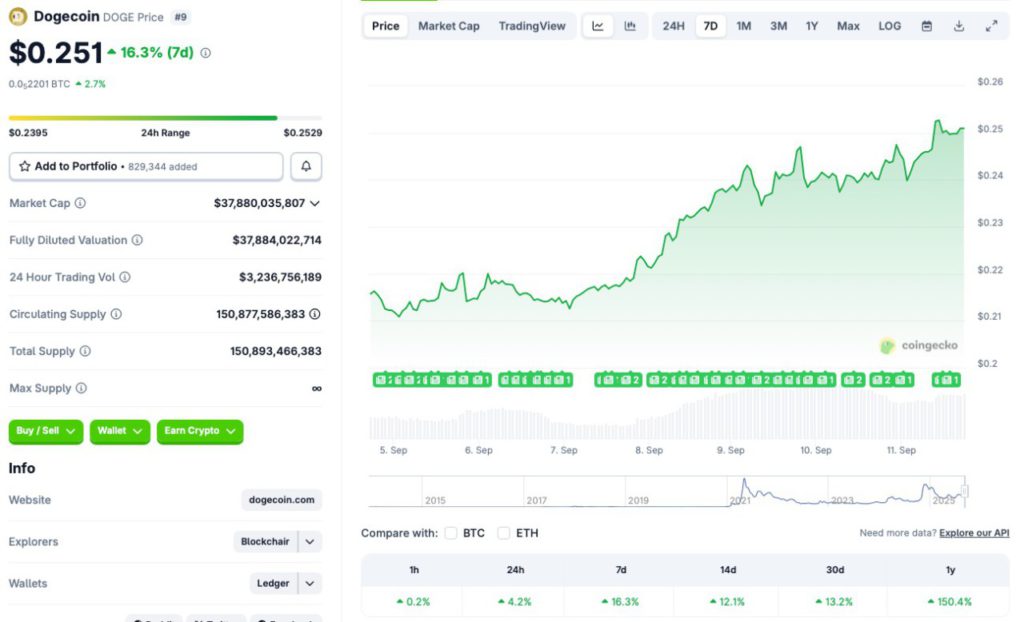

Jakarta, Pintu News – The crypto market seems to be on a roll again. Bitcoin has reached the $114,000 mark again, and other assets are following suit. Dogecoin has not been left out of the market-wide rally either, hitting the $0.251 mark.

According to statistics from CoinGecko, the price of DOGE has risen 4.2% in the last 24 hours, 16.3% over the last week, 12.1% in the 14-day chart, and 13.2% over the previous month. With interest rate cuts becoming a real possibility in the next few weeks, let’s discuss whether DOGE can finally reach the $0.40 mark.

Dogecoin (DOGE) Potential After Interest Rate Cut

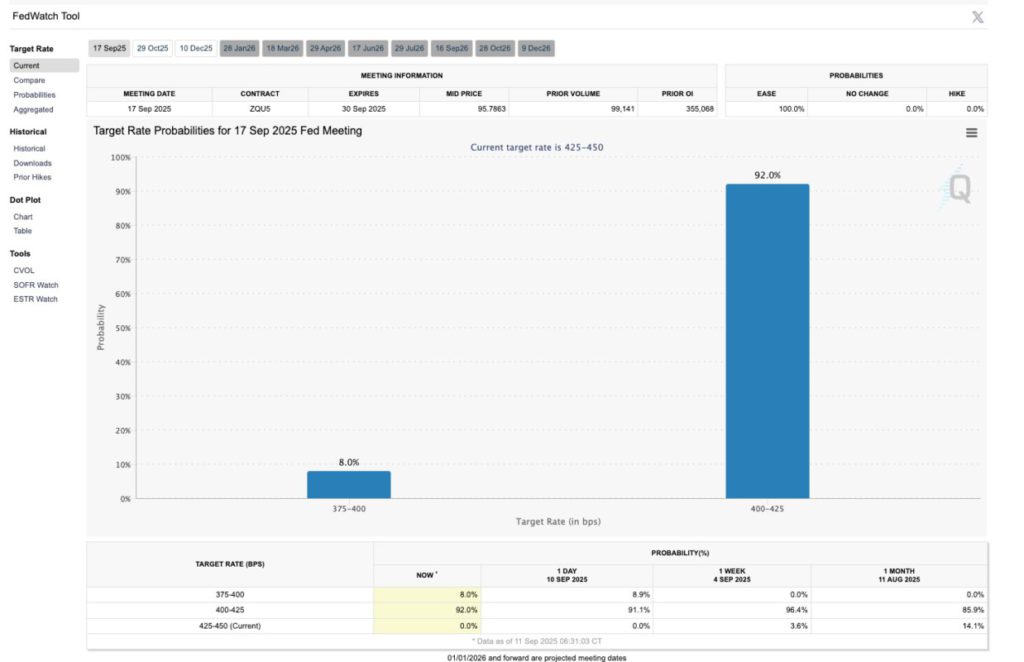

Dogecoin’s (DOGE) latest rise came after the United States reported declining inflation figures for August 2025. This decline in inflation figures further increases the likelihood of an interest rate cut after the next Federal Reserve meeting. CME FedWatch records show that there is a 92% chance of a 25 basis point rate cut this month.

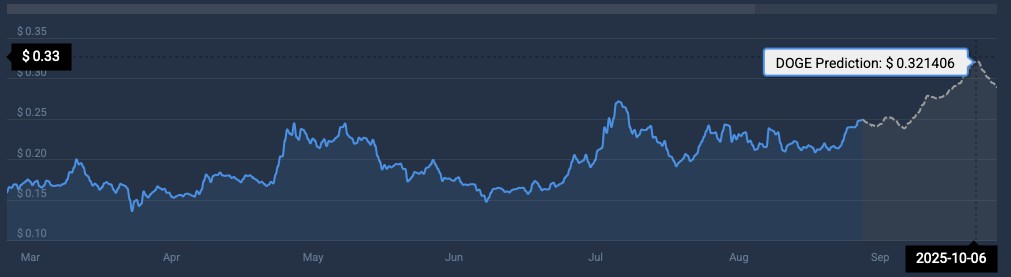

The rate cut is likely to trigger a continued rally in the crypto market as investors may increase their risky investments. According to analysis from CoinCodex, Dogecoin (DOGE) will continue to rise in the coming weeks.

The platform expects theecoin to reach $0.321 on October 6, 2025. The DOGE price will increase by 27.89% if it reaches the $0.321 target. CoinCodex does not expect the DOGE price to stay at $0.32, and predicts a correction after reaching the target.

Also Read: Solana (SOL) Strengthens, Can it Continue to Rise in September 2025?

Dogecoin ETF and Its Impact on Price

While CoinCodex doesn’t expect Dogecoin (DOGE) to reach $0.40 anytime soon, it’s possible that it will gain more momentum than the platform thinks. A DOGE ETF is scheduled to launch soon, which could lead to a surge in institutional interest.

Such a development could push the price of DOGE past the $0.40 mark. The era of memecoin ETFs appears to be about to begin with the launch of $DOJE on Thursday, albeit under Act 40 like $SSK. There is still a large group awaiting SEC approval under the ’33 Act. This is likely the first ETF in the US to hold something that intentionally has no utility.

Investor Strategy: Hold, Buy More, or Exit?

Current Dogecoin (DOGE) investors may be wondering if they should hold, buy more, or exit their investment. With the potential for significant price increases and the upcoming launch of an ETF, there may be strong arguments to hold or even add to a position in DOGE.

However, it is also important to consider the risk of a price correction that may occur after reaching a new peak. It is important for investors to monitor market developments and news related to Dogecoin (DOGE) as well as external factors such as interest rate policy. Decisions should be based on careful analysis and a good understanding of crypto market dynamics.

Conclusion

With ever-changing market dynamics and the significant influence of macroeconomic policies, the future of Dogecoin (DOGE) seems full of potential. Despite the uncertainties, opportunities for growth remain wide open, especially with supporting factors such as possible interest rate cuts and the launch of ETFs.

Also Read: Mid-September XRP Price Outlook, Ready to Surge Again? Check out the Latest Analysis!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Watcher Guru. Dogecoin Turns Bullish with 16% Rally, Next $0.40 Post Rate Cut. Accessed on September 12, 2025