Potential Interest Rate Cut by the Fed, How Will it Impact the Market?

Jakarta, Pintu News – At its upcoming meeting on September 17, the Federal Reserve (Fed) is expected to cut interest rates by 25 basis points. Goldman Sachs CEO, David Solomon, in an interview with CNBC, has made this prediction although advised caution against a larger cut of 50 basis points. The latest jobs data showed a slowdown, fueling this speculation.

Fed’s Interest Rate Cut Forecast

David Solomon emphasized that although the economy is still going, there are signs of weakness starting to show. The latest data from the US Labor Department showed that in the 12 months to March, the economy added 911,000 fewer jobs than previously estimated.

This shows that average monthly job growth was well below the previously reported figure of 147,000 jobs. Solomon said, “I’m pretty sure there will be a 25 basis point cut. Whether there will be a 50 basis point cut, I don’t think that’s likely.” He also did not rule out one or two additional cuts depending on how conditions develop.

Also Read: Solana (SOL) Strengthens, Can it Continue to Rise in September 2025?

Market Reaction to Interest Rate Predictions

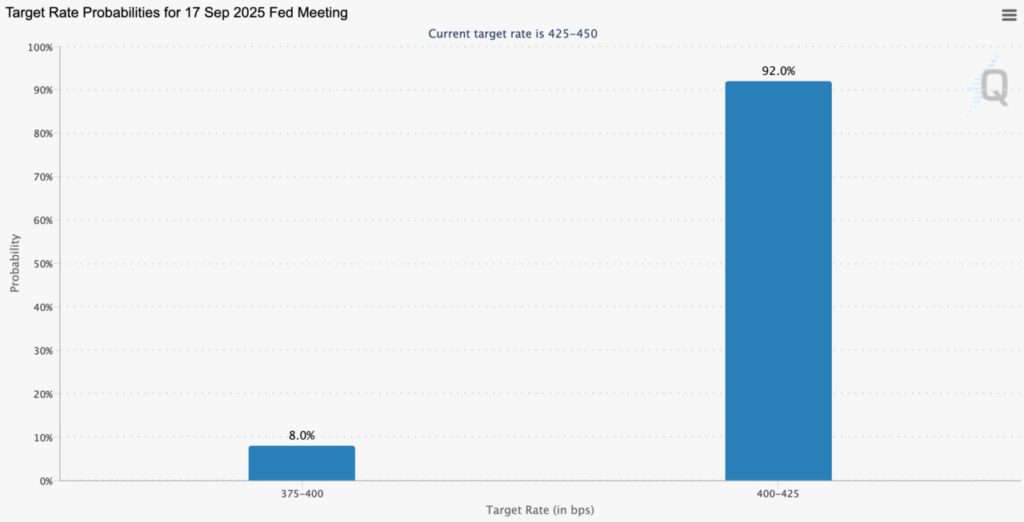

The CME FedWatch tool shows a 92% probability that the Fed will cut rates by 25 basis points next week. Meanwhile, the odds for a larger cut of 50 basis points stand at just 8%.

Nonetheless, Standard Chartered has a different view, anticipating a more aggressive cut of 50 basis points after the August jobs report. The market seems to share Solomon’s view. “If the Fed knows how bad the labor market is, they will cut 25bps in March and another 25bps in June/July. There is every reason for a 50bps cut in September,” Zerohedge wrote.

Impact on Crypto Market

The expected rate cut is widely seen as bullish for crypto markets, with lower interest rates seen as supporting risky assets. While a 25 basis point cut could trigger a price rally, a 50 basis point move would likely amplify the impact, providing stronger momentum for the crypto market.

One analyst noted that at least a 25 basis point cut is practically guaranteed. A 50 basis point move would be the real surprise. It could open up additional liquidity in Ethereum , decentralized finance , altcoins, non-fungible tokens (NFTs), and blockchain games.

Conclusion

As the September 17 meeting approaches, both investors and policymakers will continue to monitor incoming economic data. The Fed’s decision will greatly influence the direction of global markets, including crypto markets that are sensitive to changes in monetary policy.

Also Read: Mid-September XRP Price Outlook, Ready to Surge Again? Check out the Latest Analysis!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Goldman Sachs: Fed Rate Cut in September Forecast. Accessed on September 12, 2025