Bitcoin (BTC) Price Approaches $115,000: What Does This Level Mean?

Jakarta, Pintu News – Bitcoin is entering a pivotal phase as it heads into its weekly close, with prices approaching US$115,000 (around Rp1,882,000,000), according to data from Cointelegraph Markets Pro and TradingView.

Popular trader Skew warns that now is the moment where market participants should pay attention to price action, especially with considerable liquidity just below the level.

Macroeconomic conditions and the wait for the interest rate decision by the Federal Reserve add pressure on BTC to maintain its bullish momentum. If BTC is unable to keep the crucial support above US$114,000, there is a risk that the potential rise to US$117,000 could be temporarily stifled.

Bitcoin Price Approaches Rp1.9 T and Its Dynamics

The price of Bitcoin briefly reached US$116,800 – its highest level since August 23 – before dropping back down to near US$115,000. This movement illustrates that despite attempts at an upward push, selling pressure remains.

Skew traders observed that the exchange’s order book shows significant depth and liquidity below US$115,000, which could serve as potential support. Meanwhile, the US$114,000 level is referred to as an important line: if Bitcoin is able to close the week above that level, then bullish sentiment will be stronger.

Also read: Crypto Market Rally Faces FOMC Test: Will Momentum Continue This Week?

Analyst Opinions and Short-Term Strategies

Other analysts, such as Rekt Capital, suggest that the best strategy now is not to head straight for US$117,000, but to maintain US$114,000 as support first. According to them, consolidation above US$114,000 will allow for “premium” buying and enough buying pressure to push prices above US$117,000 later.

Skew traders also mentioned that the formation of price weakness (“being walked down”) ahead of the new week suggests that market participants should be wary. Optimistic parties highlighted that if volumes remain strong and support levels are not cracked, the opportunity for a short-term rally towards US$117,000 or more remains open.

Read also: 4 Reasons Why Avantis (AVNT) Price Has Surged, Did You Know?

Influence of Fed Decision and Macro Factors

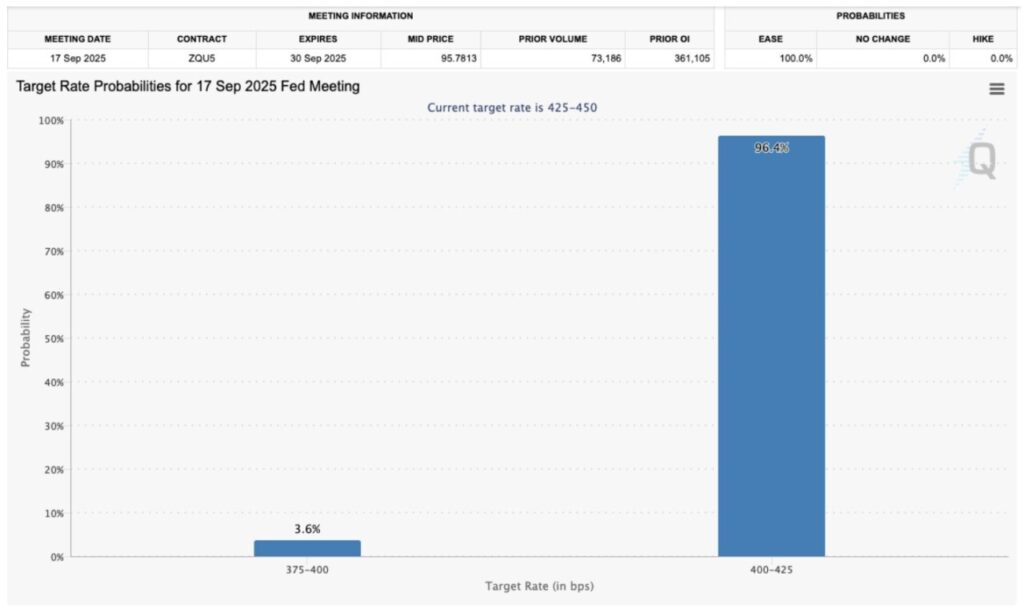

One factor that is being closely watched is the interest rate decision from the US Fed (Federal Reserve) scheduled for the near future. Markets are generally expecting a rate cut of at least 0.25%, which could be a positive catalyst for crypto and risk assets in general.

US macroeconomic data showing indications of improvement also reinforced expectations that loose financial conditions will continue, which usually favors speculative assets like Bitcoin. However, if the Fed’s decision or policy communication disappoints investors’ expectations, downward pressure on support levels such as US$114,000 could intensify.

Conclusion

Bitcoin is now at a crucial point: approaching US$115,000 with significant pressure and liquidity below. The US$114,000 support level is the line that must be maintained for bullish momentum to hold, while resistance towards US$117,000 is a potential target if conditions are favorable.

Fed action and macro data this week could be a big trigger for either market direction. For market participants and crypto investors, this is no time to be indifferent – paying attention to technical details and fundamental conditions is crucial in the next few days.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Bitcoin trader says ‘time to pay attention’ to $115K BTC price. Accessed September 16, 2025.

- Featured Image: Generated by Ai