Corporate Bitcoin Investments: Innovation or Risk?

Jakarta, Pintu News – Companies that allocated large funds to buy Bitcoin seem to be facing challenges from the market. Next Technology Holding and KindlyMD are two examples of companies that have seen their stock value drop after announcing their investments in Bitcoin (BTC). Both cases raise serious questions about corporate investment policies focused on crypto assets.

Stock Drop After Bitcoin Investment Announcement

Next Technology Holding recently announced plans to raise $500 million through a share sale. The funds raised are planned to be used for Bitcoin (BTC) purchases and other corporate purposes. This announcement had an immediate impact on the company’s stock value.

This suggests that the market may still be skeptical of crypto-focused investment strategies, especially when done on a large scale.

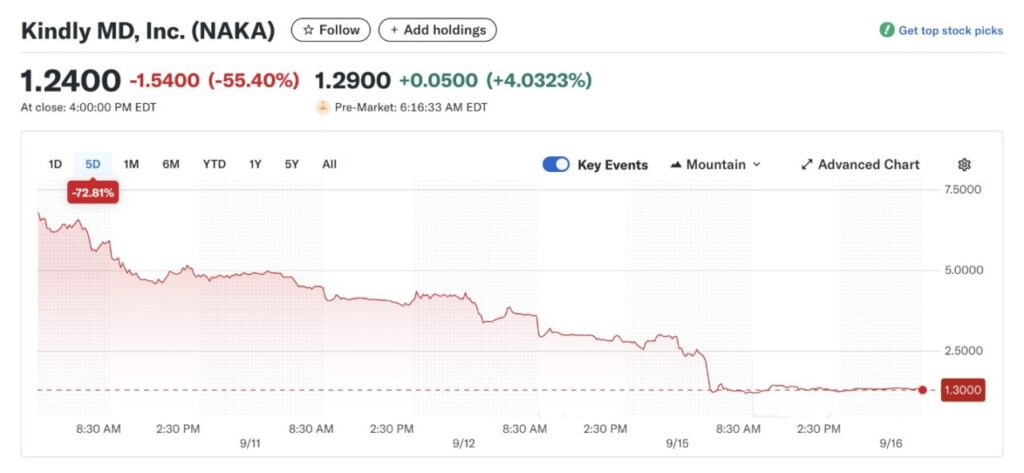

Meanwhile, KindlyMD, which recently merged with Nakamoto Holdings to form Bitcoin Treasury, experienced a more drastic stock drop. The company’s shares plummeted by 55% after their PIPE shares hit the market. This indicates that the risks associated with the Bitcoin strategy may be greater than previously thought.

Read also: Top 5 Altcoins that Rise when Altseason Index is High

Market Response to Bitcoin Strategy

Investments in Bitcoin (BTC) by large companies are eye-catching, but market reactions are often mixed. On the one hand, there is a belief that Bitcoin (BTC) as a digital asset can provide significant long-term returns. However, on the other hand, high volatility and regulatory uncertainty have some investors worried.

The drop in share value of Next Technology Holding and KindlyMD following their Bitcoin (BTC) investment announcements suggests that the market may not be fully ready to accept a one-sided corporate strategy on crypto assets.

This raises the question of how effective this kind of strategy is in creating long-term value for shareholders.

Read also: Boundless Mainnet Officially Launched on September 15, 2025, What are the Prospects?

Future Prospects and Risks

Despite concerns, some analysts are still optimistic about Bitcoin’s (BTC) potential as part of corporate investment portfolios. They argue that diversifying into digital assets can reduce risks and increase potential profits. However, companies must be very careful in managing their asset allocation to avoid extreme market fluctuations.

It is important for companies looking to adopt Bitcoin (BTC) as part of their treasury strategy to conduct an in-depth analysis and consider all the risks involved. The decision to invest in Bitcoin (BTC) should not be taken lightly, given the significant impact it can have on share value and investor confidence.

Conclusion

The cases of Next Technology Holding and KindlyMD provide important lessons about the risks and potential of corporate investment in Bitcoin (BTC). While there are opportunities for growth, the volatility and unpredictability of market reactions mean that such moves should be considered very carefully. Going forward, companies need to be more transparent and strategic in communicating and implementing their investment decisions in crypto assets.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. NXTT, Naka Stocks Bitcoin Treasury Losses. Accessed on September 17, 2025

- Featured Image: Generated by AI