Bitcoin Surges to $117,000 as Traders Set Sights on $120K Post-FOMC

Jakarta, Pintu News – Bitcoin options traders are optimistic that Bitcoin will break the $120,000 mark again after the FOMC meeting, despite the current market volatility.

The crypto market is eagerly awaiting the Fed’s interest rate decision and the release of the FOMC Economic Projections scheduled to come out today as clues to the direction of market movement. Then, how is the current Bitcoin price movement?

Bitcoin Price Up 0.22% in 24 Hours

On September 18, 2025, Bitcoin traded at $117,002, or approximately IDR1,922,016,510, marking a modest 0.22% increase over the past 24 hours. During the same period, BTC’s price ranged between a low of IDR1,888,277,068 and a high of IDR1,925,837,459.

As of this writing, Bitcoin’s market capitalization stands at roughly IDR38,308 trillion, while 24-hour trading volume jumped 36% to IDR927.5 trillion.

Read also: Bitcoin Price Prediction: BTC Could Hit $750,000 in 5 Years? Check out the Analysis!

Bitcoin Options Traders Aim for $120,000 Level after FOMC Meeting

Bitcoin options traders were very optimistic about a price rally after the FOMC meeting. This positive sentiment was triggered by rising expectations of a 25 basis point Fed rate cut, following weak employment data and cooling inflation data.

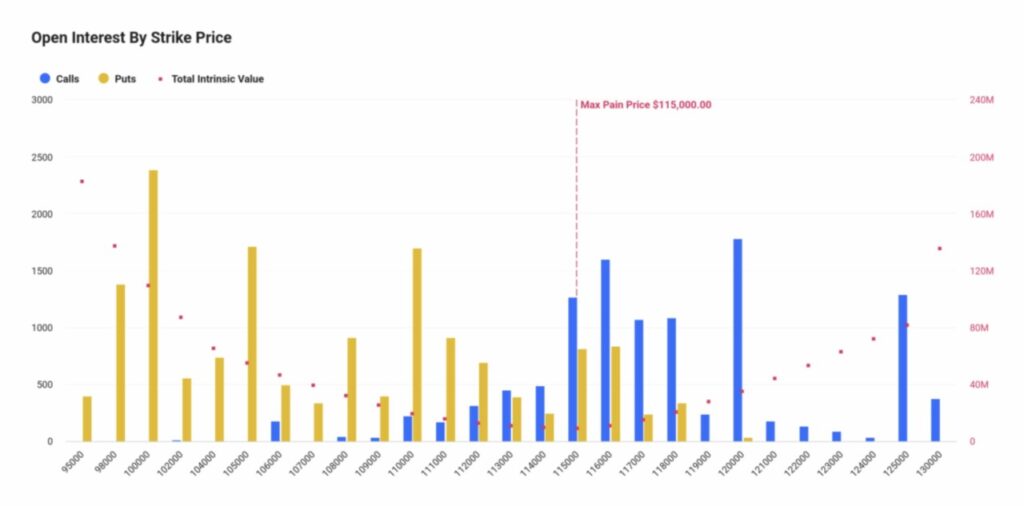

Bullish market participants are targeting Bitcoin prices to reach $120,000 or even $125,000 after the FOMC meeting.

Specifically, the $120,000 strike price level was noted to have call positions with a notional value of around $200 million for each BTC option expiry in the next three days. Moreover, in a bullish scenario, options traders are also aiming for the $125,000 level, while in a bearish scenario, the target is in the $115,000 range for BTC options maturing on Friday after the FOMC.

In the last 24 hours (17/9), 24-hour call volume was much higher than put volume. The put-call ratio stood at 0.68 on September 17, 2025.

Mixed Expectations in Crypto Market Ahead of Fed Rate Decision

The entire market’s attention today is on the Fed’s interest rate decision, amid heightened market sentiment as seen by the continued inflow of funds into spot Bitcoin ETFs.

Some market participants believe that a rate cut by the Fed could push the price of Bitcoin through the $120,000 level, while others see it as a classic “sellthe news” moment.

Meanwhile, global investors await the release of the FOMC Economic Outlook. Monetary policy easing by the Fed is expected to trigger bullish sentiment in global stock markets and crypto markets, driving further gains in risky assets such as Bitcoin.

The CME FedWatch tool shows a high probability that the Fed will cut interest rates three times.

Last year’s surprise interest rate cut sparked an immediate rally in the market, with a significant role played by seasonal cycles, shifts in liquidity, and market structure-all factors that pushed Bitcoin through $100,000.

According to 10x Research, a similar dynamic is again occurring today, even with a more positive outlook due to greater capital flows and bullishness on risk assets.

Read also: 3 Popular Cryptos Set to Dominate Conversations in 2025 — Here’s Why

Additionally, the crypto research firm revealed that traders who were previously bearish are now starting to turn bullish ahead of the FOMC meeting.

“Call positions are more expensive than puts,” said Markus Thielen, analyst at 10x Research.

Bitcoin On-Chain Data Shows Strong Bullish Sentiment

Bitcoin on-chain data indicates increasing positive sentiment amidst the FOMC meeting. Based on 24-hour Trading Volume and Change data from CryptoQuant, the price of BTC is currently moving in a narrow range between $114,600-$117,100, with the upper and lower bounds of the range having increased in the last 24 hours.

Amid this constructive trend, Bitcoin is holding in the upper third of that price range, although it has not shown a strong push before the results of the decision were announced.

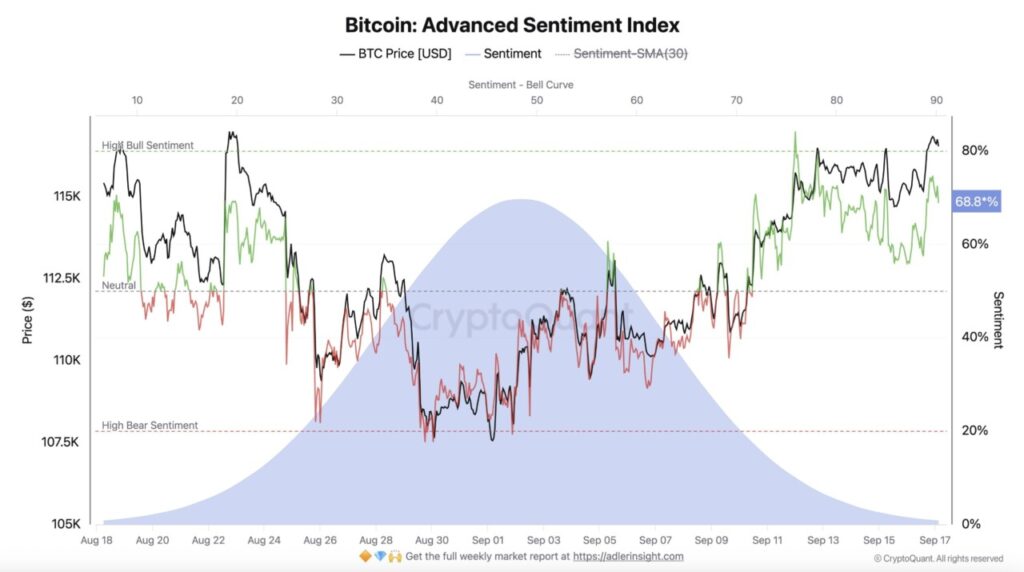

The Bitcoin Advanced Sentiment Index shows the dominance of bullish sentiment in the market, indicating support for a potential further breakout in BTC prices.

The Advanced Sentiment value reached 68.8%, close to the Bull Sentiment high zone of 80%. If the FOMC results give a positive signal, Bitcoin price has the potential to continue its rise.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Will Bitcoin Reclaim $120K as Options Bulls Target $125K Highs Post-FOMC? Accessed on September 18, 2025