Chainlink (LINK) Price to Surge? Crypto Whale Activity and Technical Formations in the Spotlight!

Jakarta, Pintu News – Chainlink tokens are under the spotlight after a whale sold 938,489 tokens worth $21.46 million, at an average price of $22.87 per token. This action resulted in a profit of about $212,000.

This large sell-off came amid a broader market debate regarding short-term price resilience, as LINK was then trading in the $23.81 range.

Traders are now closely monitoring whether this sell-off signals renewed selling pressure building up, or is simply profit-taking before prices rise again. If this sell-off is successfully absorbed by new buyers, the overhead pressure may be reduced.

The main question now is whether investors see this exit as a signal of market weakness, or simply an opportunistic profit-taking move.

Sellers Strengthen Grip on LINK Market

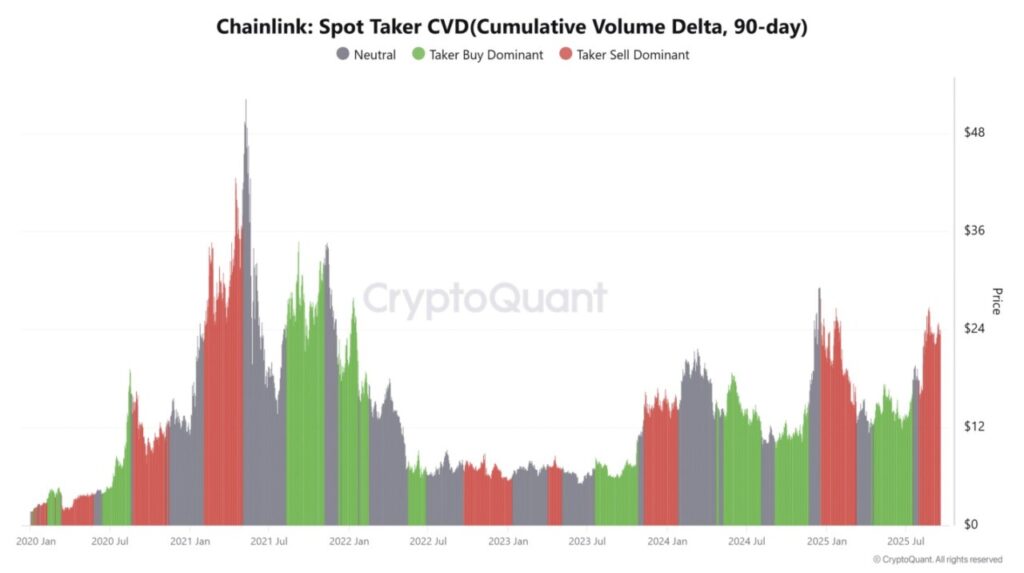

CVD’s Spot Taker metrics data showed that sellers dominated trade execution, with aggressive market selling outpacing buying activity. This dynamic indicates a weakening of bulls’ confidence in higher price levels.

Read also: Analysts Predict Shiba Inu to Rise 138%, SHIB Futures Listing Paves the Way for ETF?

This kind of taker-sell dominance usually suppresses intraday momentum, drives prices bid lower, and increases volatility. Although some traders still anticipate a price bounce, the persistent seller dominance raises caution in the short term.

For LINK to rally again,buy-side flows will have to increase significantly to shift cumulative volume to the buy-side. Until that happens, market activity is still skewed towards downside risk.

Can Chainlink Score a Breakout?

Despite the short-term pressure, LINK’s daily chart shows a developing cup and handle pattern – a technical formation that generally signals the continuation of a bullish trend.

LINK is currently moving between the support level at $21.96 and the resistance at $26.66. If it manages to break this resistance, the next price target is projected to be $30.86.

As long as LINK is able to hold above the support level without a deeper drop, this technical pattern remains valid and provides an opportunity for the bulls. This setup offers an optimistic narrative in stark contrast to the previous whale-induced selling pressure.

If the price breaks out of the handle part of the pattern, speculative flows can increase sharply and push the price to higher levels – rapidly changing the market sentiment in a positive direction.

Open Interest Rises Sharply, Signals Speculative Positioning Increases

Open Interest (OI) for Chainlink jumped to $1.65 billion, an increase of 6.72%. This increase shows that derivatives traders are starting to take speculative positions, although the market is still cautious due to the whale selloff.

This increase in OI indicates that market participants are preparing for volatility, with many expecting breakout attempts.

In many cases, a high OI can amplify price movements when support or resistance levels are tested – magnifying the impact of the eventual winning direction.

Read also: Hyperliquid Overtakes Ethereum and Solana in Transaction Fees, HYPE Sets a Record High!

In this situation, OI growth in line with bullish chart patterns such as cup and handle gives additional weight to the price’s upside potential.

Traders are now at a crucial point, where market confidence is tested by technical structure and pressure from on-chain data.

Can LINK Conquer Selling Pressure and Break Resistance Again?

Chainlink has the potential to overcome selling pressure due to whale action as long as the price is able to stay above the $22.00 support.

The persistence of the cup and handle structure, plus the consistent increase in Open Interest, strengthens the signal that a continuation of the bullish trend is more likely.

If the price manages to break the resistance at $26.66, it will be a confirmation of technical strength and pave the way towards the next target at $30.86.

Although the dominance of sellers is still felt in the short term, a combination of technical analysis and derivative data points to the possibility of LINK regaining its momentum and moving to higher levels.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Why a Chainlink whale’s sell-off sparked debate over LINK’s next move. Accessed on September 19, 2025