3 Big Liquidation Risks in September 2025 Crypto Market that Traders Need to Be Aware of

Jakarta, Pintu News – The cryptocurrency derivatives market was back in the spotlight in September 2025. Recent data shows that traders face a very high risk of liquidation, especially on assets such as Bitcoin and other major altcoins.

Based on CoinGlass analysis and the opinions of leading analysts, the following are the three main factors that led to the potential for massive liquidation this month.

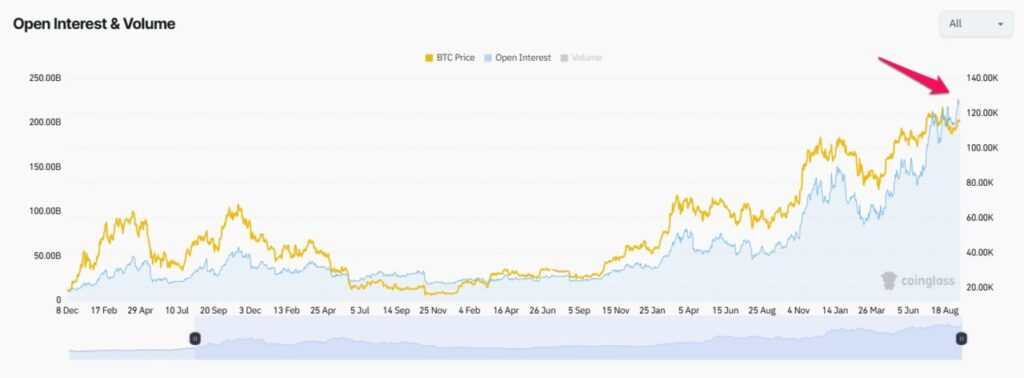

1. Open Interest Reaches IDR3,650 Trillion, the Highest of the Year

According to data from CoinGlass, the Open Interest value of the crypto futures market has broken through the $220 billion mark or around Rp3,650 trillion (at an exchange rate of 1 USD = Rp16,592). This figure is a record monthly high and signifies the high exposure of open positions by traders.

This spike reflects the increasingly aggressive behavior of short-term traders using high leverage ahead of important economic events. This increases the risk of liquidation as even small fluctuations can trigger automatic closure of positions.

A rapid increase in leverage also indicates the market is “overheating”. Based on historical patterns, this often leads to mass liquidation when prices move unexpectedly.

Also Read: 5 Reasons Crypto Liquidation Risk Could Break Records in September 2025

2. Bitcoin Futures Trading Volume 10 Times Bigger than Spot

CoinGlass also reports that the ratio of trading volume between Bitcoin Perpetual Futures and spot trading remains high. Currently, futures volume is recorded to be 8 to 10 times greater than spot volume.

This dominance of the derivatives market makes price movements more easily influenced by forced liquidations due to high leverage. This is exacerbated by the fact that many positions are opened without strong liquidity support in the spot market.

In this situation, liquidation does not only affect one side of the market. Both overly optimistic long and short positions are at risk of sudden large losses.

3. High Volatility Due to Fed Policy Uncertainty

Although the majority of market participants believe that the outcome of the FOMC (Federal Open Market Committee) meeting is predictable, analysts such as Crypto Bully assert that the market direction remains uncertain. According to him, FOMC results often trigger volatility rather than clear price movements.

Through his X account (formerly Twitter), Crypto Bully mentioned that “FOMC does not guarantee prices to rise or fall. It only brings volatility.” It is this volatility that often triggers large liquidations when positions are not carefully managed.

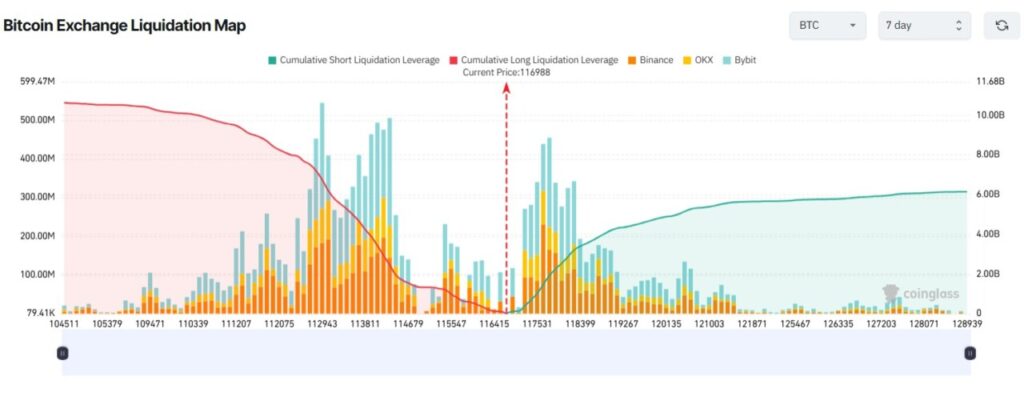

CoinGlass also added that the liquidation map shows many highly leveraged positions above and below the current Bitcoin price. If BTC drops to $104,500 (around Rp1,732 billion), the liquidation volume of long positions could exceed $10 billion (Rp165 trillion). Conversely, if BTC rises above $124,000 (US$2,057 billion), short positions could lose more than $5.5 billion.

How Can Crypto Traders Avoid Losses?

Luckshury analysts advise derivatives traders to understand that they are actually “fighting” directly against the exchange market mechanism. In other words, misreading price zones can mean the destruction of a portfolio in an instant.

The most sensible mitigation measure is to limit position sizes and understand liquidation maps from platform data such as CoinGlass. This way, traders can avoid vulnerable zones that are often targeted for mass liquidation.

Going forward, education on risk management becomes even more crucial, especially amidst the dominance of derivatives trading and the increasing role of macroeconomic sentiment in the cryptocurrency market.

Also Read: 5 UK-US Crypto Cooperation Agenda that Could Accelerate Stablecoin Adoption

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 3 Reasons Crypto Traders Face Major Liquidation Risk This September. Accessed September 19, 2025