Ethereum Price Drops to $3,900 on Sept 26 — Is a Deeper Decline Ahead?

Jakarta, Pintu News – Ethereum is under pressure as bearish sentiment in the market increases. In the past week, the major altcoin has lost around 13% of its value, pushing its price down below the crucial $4,000 level.

With negative sentiment from traders and the withdrawal of institutional support, ETH now faces the risk of testing even lower price levels. So, how is Ethereum’s current price movement?

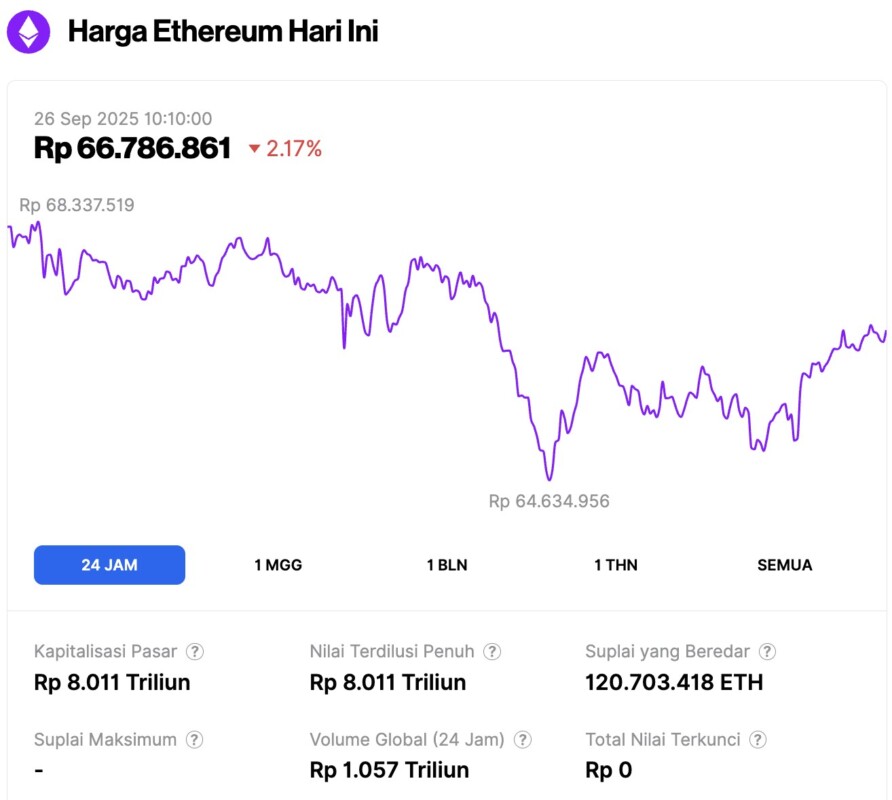

Ethereum Price Drops 2.17% in 24 Hours

On September 26, 2025, Ethereum was trading at around $3,963, equivalent to IDR 66,786,861, marking a 2.17% drop over the past 24 hours. Within the same period, ETH slipped to a low of IDR 64,634,956 and climbed as high as IDR 68,337,519.

At the time of writing, Ethereum’s market capitalization is approximately IDR 8,011 trillion, while its daily trading volume has surged 88% to IDR 1,057 trillion in the last 24 hours.

Read also: Bitcoin Price Sinks to $109K Today, But Analysts See a Rebound Ahead Following Fed Trends

Institutional Withdrawals and Declining Long/Short Ratio Raise Concerns

ETH’s declining long/short ratio confirms the increasing bearish bias towards the coin in the futures market. At the time of writing, the ratio stands at 0.95, signaling that more traders are betting on a short-term price drop than a recovery.

The long/short ratio itself compares the number of long positions to short positions in the futures market. If the ratio is above 1, it means there are more long positions than shorts, indicating the majority of traders are anticipating a price increase.

Conversely, as seen with ETH, a ratio below 1 means that the majority of traders are short, signaling a stronger bearish sentiment as well as an expectation of further price drops.

In addition, consistent outflows from spot ETH ETFs throughout the week suggest that institutional investors are starting to pull out, reducing support for the asset.

According to SosoValue data, net outflows from these funds have reached $217 million this week, showing weakening participation from large market participants.

When institutions sell or withdraw their funds, it can exacerbate the downward momentum and make the asset more vulnerable to short-term volatility. This slow retreat of major investors increases the likelihood that ETH will test lower support levels in the near future.

Read also: Chainlink Price Prediction: Whale Buys 800K LINK – Can it Trigger Recovery?

Ethereum Faces Test at $4,000 Level as Bears Strengthen

ETH was trading at around $3,981 on September 25, 2025, holding slightly above the $3,875 support level. If this level is broken, ETH has the potential to drop deeper to $3,626.

Conversely, if demand picks up again, the coin’s price could recover and move up towards $4,211.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Price Breaks Below $4,000 – Is a Deeper Correction Ahead? Accessed on September 26, 2025