Here Are 3 Meme Coins Worth Watching in October 2025

Jakarta, Pintu News – The meme coin market has been on the decline for the past seven days, dropping 10.8%. The combined value of the joke tokens now stands at $69.5 billion. This sharp decline is a warning sign for investors looking to buy meme coins.

Even so, BeInCrypto has analyzed three meme coins that are worthy of investors’ attention, because they still have the potential to bounce back as market conditions change.

Toshi (TOSHI)

The price of TOSHI has been one of the few meme coins to register gains this week, rising 20.8% in the last seven days. On September 22, the token briefly traded at $0.00075, which serves as an important support area and could determine the altcoin’s short-term price direction.

Read also: AI Predicts 3 Meme Coins Poised to Become the Next ‘Ethereum’

The position of the 50-day EMA below the candlestick shows that the bullish momentum still persists. If TOSHI is able to maintain its position, the price has a chance to rebound to the $0.00086 level.

If this rise continues, the token could push the price even higher until it tries to touch $0.00098, which would be another strong move for this meme coin.

However, risks remain if bearish pressure increases or investors choose to sell. TOSHI could lose support at $0.00075, which could pave the way for further declines. If the breakdown occurs, the price is likely to drop to $0.00068, which would simultaneously invalidate the bullish outlook and depress investor sentiment.

MemeCore (M)

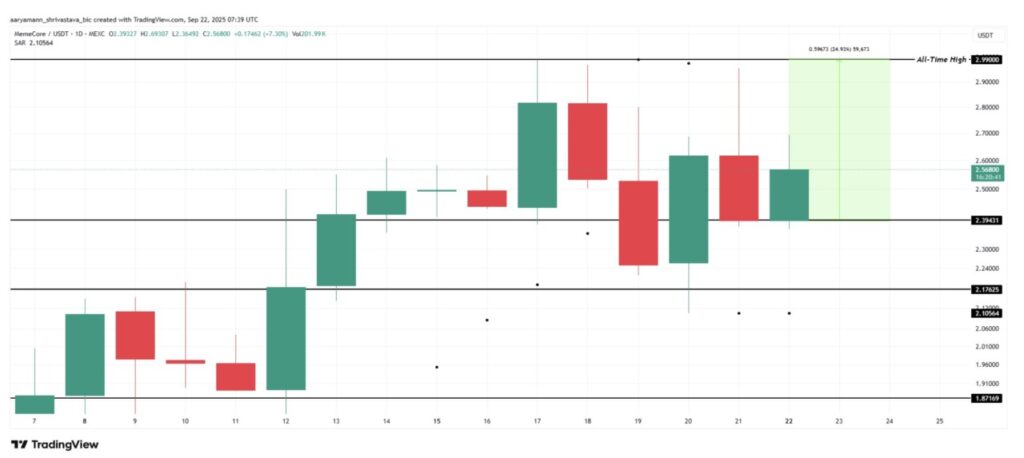

M’s price has been relatively stable compared to other meme coins this week, managing to avoid major losses. The token is trading at $2.56, remaining above the important support at $2.39. This resilience suggests that M investors are defending that level, which could determine the direction of the next move.

If M manages to bounce off $2.39, a gain of about 24.9% is required to reach the all-time record high of $2.99. The Parabolic SAR indicator currently below the candlestick signals that bullish momentum is starting to build, supporting a potential recovery and a possible breakout towards ATH.

However, if investor sentiment changes, M could fall through the $2.39 support. This breakdown could open the door to further downside, with a target of $2.17 or even lower. Such a move would invalidate the bullish scenario and reignite bearish pressure on the outlook for this meme coin.

Read also: Shiba Inu Gains Momentum with Burn Rate Surging Nearly 400%

Fartcoin (FARTCOIN)

Fartcoin suffered heavy losses this week by plummeting 24.29%, making it one of the worst performing altcoins. Despite the sharp decline, there is still potential hope for investors.

The Relative Strength Index (RSI) indicator is approaching an oversold area, which historically often signals a rebound opportunity for the asset. If the momentum reverses, FARTCOIN could potentially bounce off the support at $0.600 with upside targets to $0.678 and even $0.732.

This rise could provide some relief to holders looking for a recovery after the recent sharp decline.

However, if the bearish pressure continues, FARTCOIN is at risk of breaking the $0.600 support. This move could pave the way for a deeper drop towards $0.500. This would invalidate the bullish outlook and prolong losses for meme coin investors.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 3 Meme Coins To Watch In The Fourth Week Of September. Accessed on September 26, 2025