Ethereum Climbs to $4,100 on Sept 29, 2025: Whale Activity Signals Potential Rebound

Jakarta, Pintu News – In the past week, Ethereum price has corrected by 10.35% and dropped through the important support level of $4,000. Big players in the market and ETH whale entities view this correction as an opportunity to add to their holdings.

Crypto market experts also think that the phase of the formation of the lowest price of ETH may be near, so a potential trend reversal towards the rise could be imminent. So, how will ETH price move today?

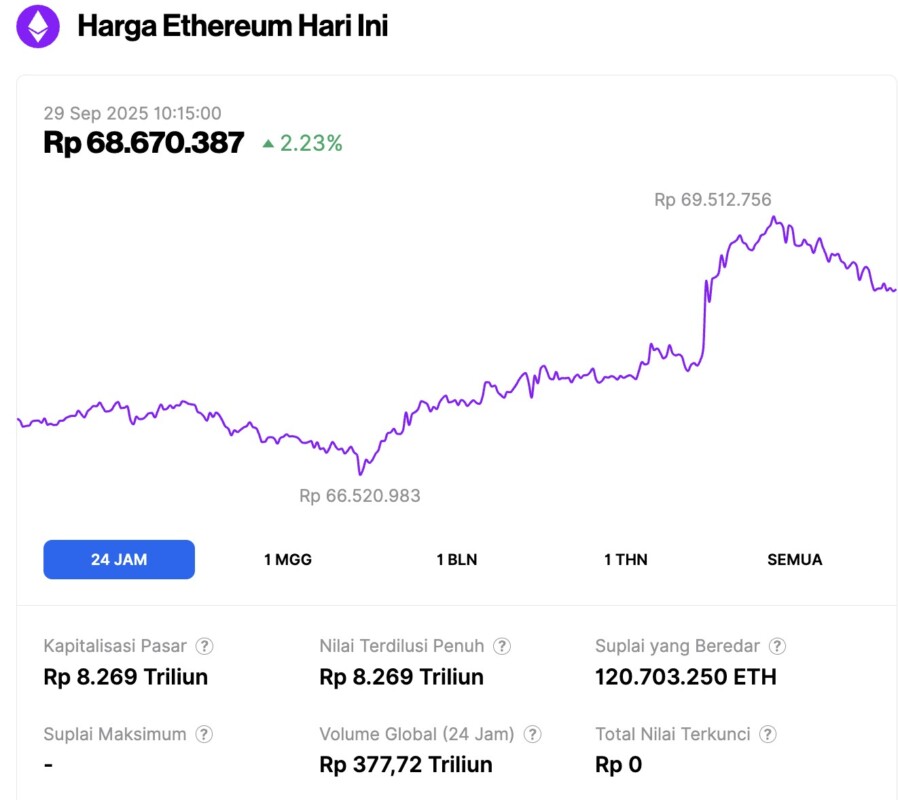

Ethereum Price Up 2.23% in 24 Hours

On September 29, 2025, Ethereum was trading at around $4,107, or approximately IDR 68,670,387, marking a 2.23% gain over the past 24 hours. Within this timeframe, ETH hit a low of IDR 66,520,983 and climbed to a high of IDR 69,512,756.

At the time of writing, Ethereum’s market capitalization is valued at about IDR 8,269 trillion, while its daily trading volume has surged 30% to reach IDR 377.72 trillion in the last 24 hours.

Read also: 5 Crypto Set to Capture Attention by the End of 2025 with Their Technological Breakthroughs

Ethereum Price Reversal on the Horizon as RSI Hits Oversold Area

Popular crypto analyst Lark Davis recently noted that Ethereum’s price fell 20% in the past two weeks, pushing the Relative Strength Index (RSI) to its most oversold level since April. The last time ETH touched similar levels, the price had shot up 134% in just two months.

As the second-largest crypto, ETH bounced off the $3,800-$3,900 range. Davis emphasized that this area is an important support level that must be maintained for the bullish outlook to remain intact.

Market observers also think that if the overall crypto sentiment improves in the fourth quarter, this oversold signal could pave the way for Ethereum to target the $7,000-$8,000 range.

In addition, renowned crypto analyst Michael van de Poppe said that September is historically a weak month for ETH and the crypto market. Even so, he remains optimistic that the fourth quarter will be positive, followed by a strong first quarter of 2026. In a post on X, Poppe wrote:

“The market always corrects in September/October. Historically, Q4 and Q1 are the best periods for altcoins. September is usually bad, and that’s what we saw with $ETH, which dropped almost 10%. Q4 is almost always positive, and Q1 is the best quarter in history.”

Read also: Tom Lee Predicts Bitcoin to Hit $250K and Ethereum $12K Before the End of 2025!

As of September 28, ETH was trading at $4,006. If it fails to hold at this crucial support level, the price could correct further to $3,600. Based on the MVRV price bands indicator, a fall of ETH to $2,750 cannot be ruled out.

ETH Whales Accumulate Over $1.7 Billion from Major Exchanges

Blockchain analytics firm Lookonchain reported that Ethereum whales have amassed 431,018 ETH worth approximately $1.73 billion in just the last three days.

The assets were spread across 16 wallets from major platforms, including Kraken, Galaxy Digital, BitGo, FalconX, and OKX. This suggests that accumulation by whales continues despite the volatile crypto market.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinspeaker. Ethereum Price Drop Triggers Active ETH Whale Buying, Reversal Soon? Accessed on September 29, 2025