Tether Invests $1 Billion to Buy 8,888 Bitcoins, What’s the Strategy?

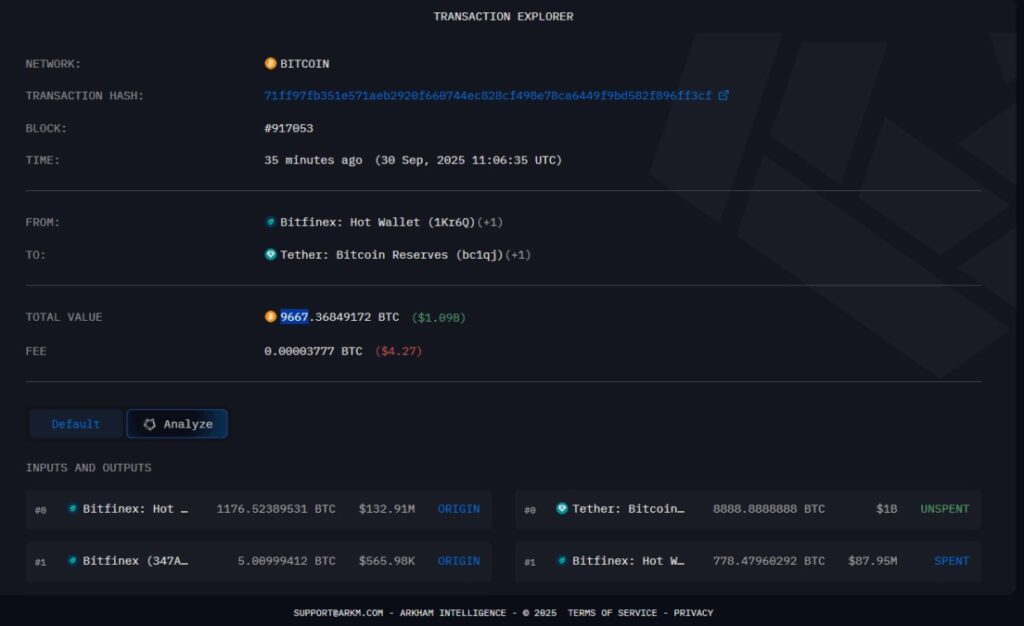

Jakarta, Pintu News – Tether, the issuer of the world’s largest stablecoin, Tether , recently made a large purchase of Bitcoin . By acquiring 8,888 Bitcoins, valued at approximately $1 billion, Tether demonstrated its commitment to strengthening its financial position in the crypto market.

This transaction was carried out directly through the Bitcoin blockchain, where the coins were moved from the Bitfinex exchange wallet to Tether’s publicly announced backup address.

The move reflects Tether’s strategy of increasing their Bitcoin holdings, in line with growing institutional interest in the cryptocurrency as a store of value.

Tether’s Asset Diversification Strategy

With this latest purchase, Tether has not only increased the volume of Bitcoin in their reserves but also emphasized their asset diversification strategy. According to the last attestation report, the composition of Tether’s reserves previously included several crypto and non-crypto assets.

This $1 billion Bitcoin purchase is expected to increase the proportion of Bitcoin in Tether’s next quarterly financial report. This purchase also demonstrates Tether’s approach to managing inflation risk while still maintaining the majority of their reserves in highly liquid and stable assets such as US Government Securities.

Also read: Stablecoins a mainstay, Visa launches instant international payments pilot!

Market Reaction and Long-Term Implications

Despite this massive buying, the Bitcoin market has remained stable with no immediately noticeable price impact. This stability suggests that the market may have anticipated or absorbed this news without significant surprises.

Tether’s decision to increase investment in Bitcoin could also be seen as a signal of confidence in Bitcoin as a long-term investment asset. In addition, this move might affect investors’ perception of Tether and USDT.

With more diverse and significant reserves in Bitcoin, Tether may strengthen its position as a reliable stablecoin issuer in the eyes of investors and users.

Conclusion

This purchase marks a new chapter in Tether’s financial strategy, where they are increasingly integrating Bitcoin into their reserve structure. This not only demonstrates Tether’s adaptation to changing market dynamics, but also their commitment to maintaining user trust by stabilizing the value of USDT. Going forward, it will be interesting to see how this decision affects the interaction between the stablecoin and cryptocurrency markets more broadly.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto Times. Tether Buys 8888 Bitcoin Worth $1 Billion for Reserves. Accessed on October 1, 2025

- Featured Image: Unchained Crypto