Bitcoin Surges to $118,000 Today — Will BTC Make History This “Uptober”?

Jakarta, Pintu News – Bitcoin’s price surge in early October has once again sparked market enthusiasm for a potential sustained rally. The question is, will this October really go down as a historic “Uptober”?

This phenomenon has also revived attention to the “4-year cycle” theory which states that Bitcoin bull and bear markets tend to repeat in predictable patterns, especially in relation to halving events. So, how is Bitcoin’s current price movement?

Bitcoin Price Up 3.51% in 24 Hours

On October 2, 2025, Bitcoin was trading at $118,765, equivalent to IDR 1,970,710,171, marking a 3.51% gain over the past 24 hours. Within the same period, BTC dipped to a low of IDR 1,902,221,942 and climbed to a high of IDR 1,983,834,322.

At the time of writing, Bitcoin’s market capitalization is approximately IDR 39,255 trillion, while its 24-hour trading volume has surged 34% to IDR 1,271 trillion.

Read also: MrBeast and Crypto Whales Pile Into ASTER After 20% Drop – What’s Next?

Looking at Bitcoin’s Historical Patterns

Joao Wedson, CEO of investment analysis firm Alphractal, highlights a key number: 548 days.

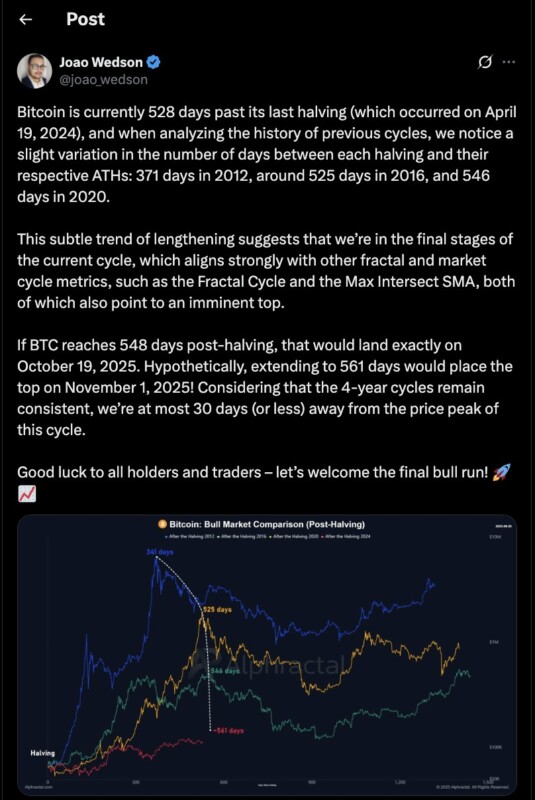

An analysis of previous Bitcoin cycles shows a difference in the number of days between each halving event and the all-time high . In the 2012 cycle, the gap was 371 days, then 525 days in 2016, and 546 days in 2020.

This lengthening trend suggests that the current cycle has entered its final stage. Wedson said this is in line with various other market cycle indicators, such as fractal cycles and Max Intersect SMA.

According to him, the key number for this cycle is 548 days, which is the moment when the price is expected to peak. Currently, Bitcoin has entered its 528th day since the last halving on April 19, 2024.

If the prediction is correct, then the peak price of Bitcoin will occur on the 548th day, October 19, 2025 to be precise. By expanding the hypothesis, the price peak could be pushed back to November 1, 2025.

Read also: 3 Altcoins to Watch in Early October 2025

Wedson added, “Considering the consistency of the 4-year cycle, we are at most only about 30 days (or less) away from the price peak of this cycle.”

Other Estimates: Peak on December 23, 2025

A crypto analyst with the pseudonym ‘seliseli46’ also predicted when the current bull run will end. According to his calculations, each Bitcoin cycle lasts about 152 weeks, or approximately 1,064 days.

He explained through his X account that:

- The first cycle started after the market bottomed out in early 2015 and ended with a price peak in late 2017.

- The second cycle started in late 2018 and peaked in November 2021.

- If it is assumed that the third cycle starts from the market low in November 2022, then by adding 152 weeks, the end of this cycle is estimated to fall on December 23, 2025.

The analyst added that this calculation is in line with Bitcoin’s historical tendency to reach an all-time high about 12 to 18 months after a halving. However, he emphasized that this week’s 152 pattern is still hypothetical and could be affected by various external factors, such as regulation, market sentiment, and technological developments.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Is Bitcoin’s “Uptober” Here? Analysts Look to a 4-Year Cycle. Accessed on October 2, 2025