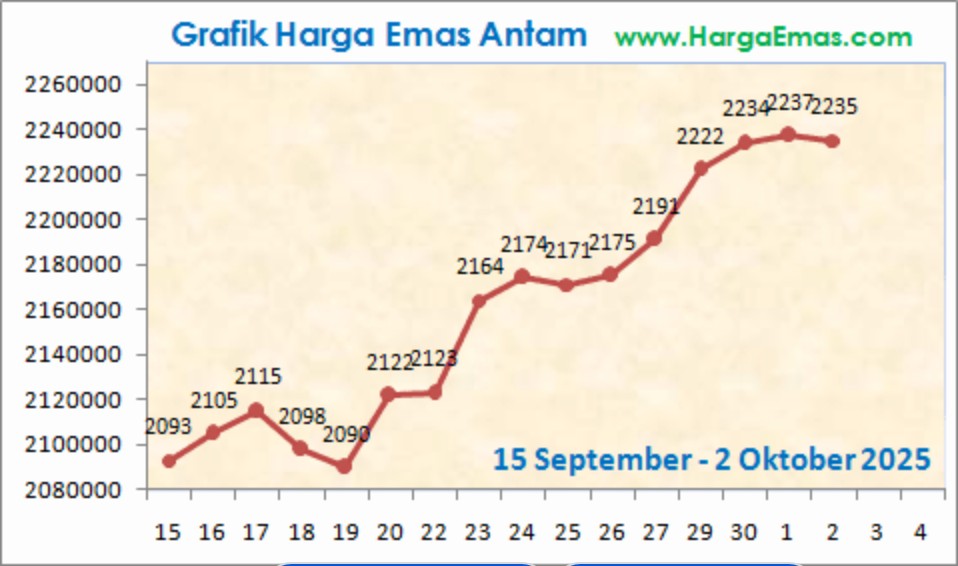

Antam Gold Price Chart Today October 2, 2025: Up or Down?

Jakarta, Pintu News – The price of gold, especially those produced by PT Aneka Tambang Tbk (Antam), is always in the spotlight for investors in Indonesia. In today’s trading, Thursday, October 2, 2025, the price of Antam gold for 1 gram denominations is recorded at an attractive level of around Rp2,237,000, based on data from one of the precious metal trading platforms.

This value is indicative of market dynamics that should be watched closely, as Antam’s gold price has a close relationship with the world spot market price of gold and fluctuations in the Rupiah exchange rate against the United States Dollar (USD). For investors, understanding the factors that drive these price movements is key to making smart and measured investment decisions.

1. World Spot Gold Rise Exceeds $3,860 per Ounce

Gold prices in the global spot market showed a significant positive trend, becoming one of the main drivers of the increase in Antam gold prices in the domestic market. Based on the global commodity price report, spot gold was recorded at a level of around $3,864.20 per troy ounce on Thursday, October 2, 2025. This increase in world gold prices, according to commodity market analysis, is generally influenced by the increasing demand for safe haven assets amid global geopolitical uncertainty.

The increase in gold prices on the international market has a direct impact on the base price of gold bars sold by Antam. For example, when converted to Rupiah at an exchange rate of IDR 16,609 per USD, the value of one ounce of gold reaches approximately IDR 64,288,000. Therefore, price movements on international exchanges, whether caused by economic or non-economic factors, will always be an early indicator for Antam’s domestic prices.

Also Read: 5 Reasons Eric Trump’s IDR16 Billion Bitcoin Prediction Could Be Real

2. Rupiah Exchange Rate Fluctuations Amid US Dollar Pressure

The exchange rate of the Rupiah against the US Dollar (USD) plays a crucial role in determining Antam’s gold price, given that global gold trading is nominated in USD. During this period, the USD/IDR exchange rate showed fluctuations, with the exchange rate hovering around IDR16,634.69 per USD, citing data from currency trading platforms. The weakening of the Rupiah against the Dollar will automatically increase the price of gold denominated in Rupiah, although the global gold price (in USD) remains stable.

It is important to note that Bank Indonesia (BI) continues to monitor and take measures to maintain the stability of the Rupiah exchange rate. Under monetary policy, BI’s intervention in the foreign exchange market aims to mitigate the impact of global currency turmoil that could trigger price inflation of imported commodities. Therefore, investors need to monitor not only global gold prices but also domestic exchange rate policies to project Antam prices.

3. Crypto Market Sentiment and Its Role in Gold

The relationship between digital asset markets, particularly crypto and gold, has increasingly come to the attention of investment analysts. When the prices of major cryptocurrencies such as Bitcoin and Ethereum experience high volatility or sharp declines, some investors tend to shift their funds to safer assets such as gold. Market data shows that Bitcoin (BTC) had a significant increase of 3.96% and Ethereum (ETH) 5.40% on October 2, 2025.

These movements in cryptocurrency assets can affect overall market sentiment, and some market participants see gold as a solid alternative store of value. In the context of investment, while cryptocurrencies such as Ripple are also on the rise, gold still serves as a traditional hedge against inflation and economic uncertainty. Therefore, some investors looking for lower risk may return to Antam as an investment instrument.

4. Antam’s Selling and Buyback Price Differences

One important piece of information that Antam gold investors need to know is the difference between the selling price (LM boutique) and thebuyback price. On October 1, 2025, the price of 1 gram of Antam gold stood at Rp2,237,000, while the buyback price of Antam gold was recorded at Rp2,084,000 per gram, based on a report from Logam Mulia. This price difference, known as the spread, is a factor that affects the short-term profit potential for investors.

According to precious metals investment analysis, the spread reflects the company’s operating costs and the market risk premium. Investors are advised to consider this spread when planning their gold sales. Wise investment decisions need to take into account daily price movements and this buyback spread to ensure optimal returns.

5. Long-Term Price Chart Shows an Average Increase of 45.47%

Looking at price movements over a longer period of time provides a more comprehensive perspective for investors. Based on historical data of global commodities, gold prices have generally recorded substantial gains. On a year-to-date basis, global gold prices as of October 2, 2025 showed an average increase of 45.47%, according to commodity trading reports.

This significant increase shows that gold, including Antam gold, has proven to be a profitable investment over the long term. Although daily prices may fluctuate due to various market sentiments and economic news, this long-term upward trend confirms gold’s position as a strong asset for portfolio diversification. Therefore, a long-term view is key for gold investors looking to maximize returns.

Also Read: 5 Reasons XRP Could Hit IDR66,000 by the End of 2025: ETFs, Fed, & Crypto Market Momentum

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- HargaEmas.com. Gold Price Today. Accessed October 2, 2025.